OSS Data Analytics

Overview

The 2024 China Open-Source Annual Report is centered on comprehensive and in-depth data insights, presenting the flourishing development of China’s open-source ecosystem across nine key chapters.

- Chapter 1: Macro Insights – Examines China’s unique position and influence in the global open-source ecosystem through key metrics such as major events, active repositories, active users, and programming languages.

- Chapter 2: OpenRank Rankings – Provides authoritative and systematic OpenRank metrics, ranking open-source projects, enterprises, foundations, developers, and collaboration bots across China and globally, establishing a key benchmark for measuring open-source contributions.

- Chapters 3 & 4: Enterprise & Foundation Insights – Leverages dynamic evolution charts and trend analysis to offer a deep dive into the strategic layout and development trajectories of enterprises and foundations in the open-source domain, both in China and worldwide.

- Chapter 5: Technology Insights – Focuses on Top 10 rankings and project trends in various fields, capturing cutting-edge technological advancements and innovation trends.

- Chapter 6: Open-Source Project Insights – Explores the diversity of project types, domains, and topics, showcasing the vibrancy and innovative potential of the open-source ecosystem.

- Chapter 7: Developer Insights – Analyzes developer demographics, work patterns, regional distribution, and the use of automation tools, offering a comprehensive profile of the developer community.

- Chapter 8: Commercial Open-Source Insights – Investigates the development landscape of commercial open-source enterprises and projects in China and globally, uncovering their growth paths and success factors.

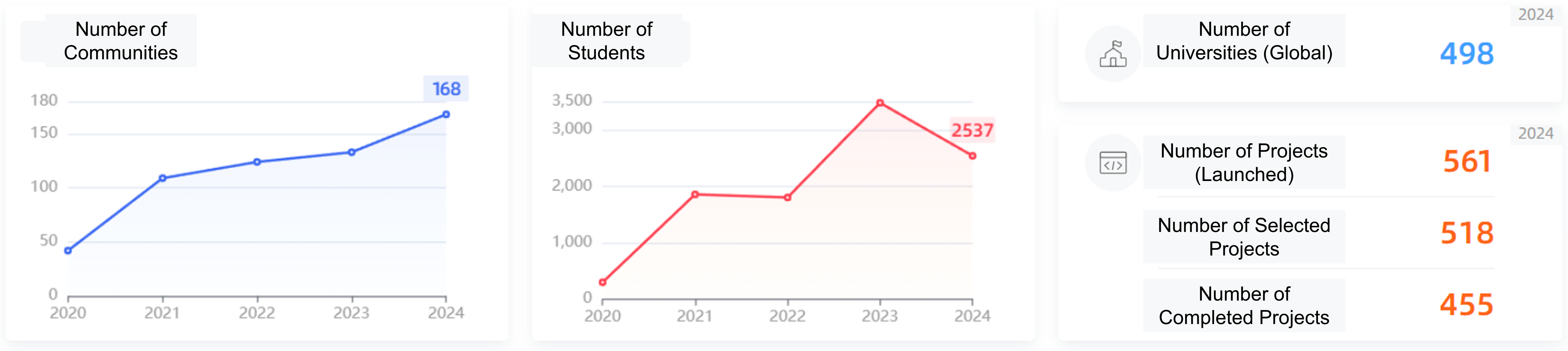

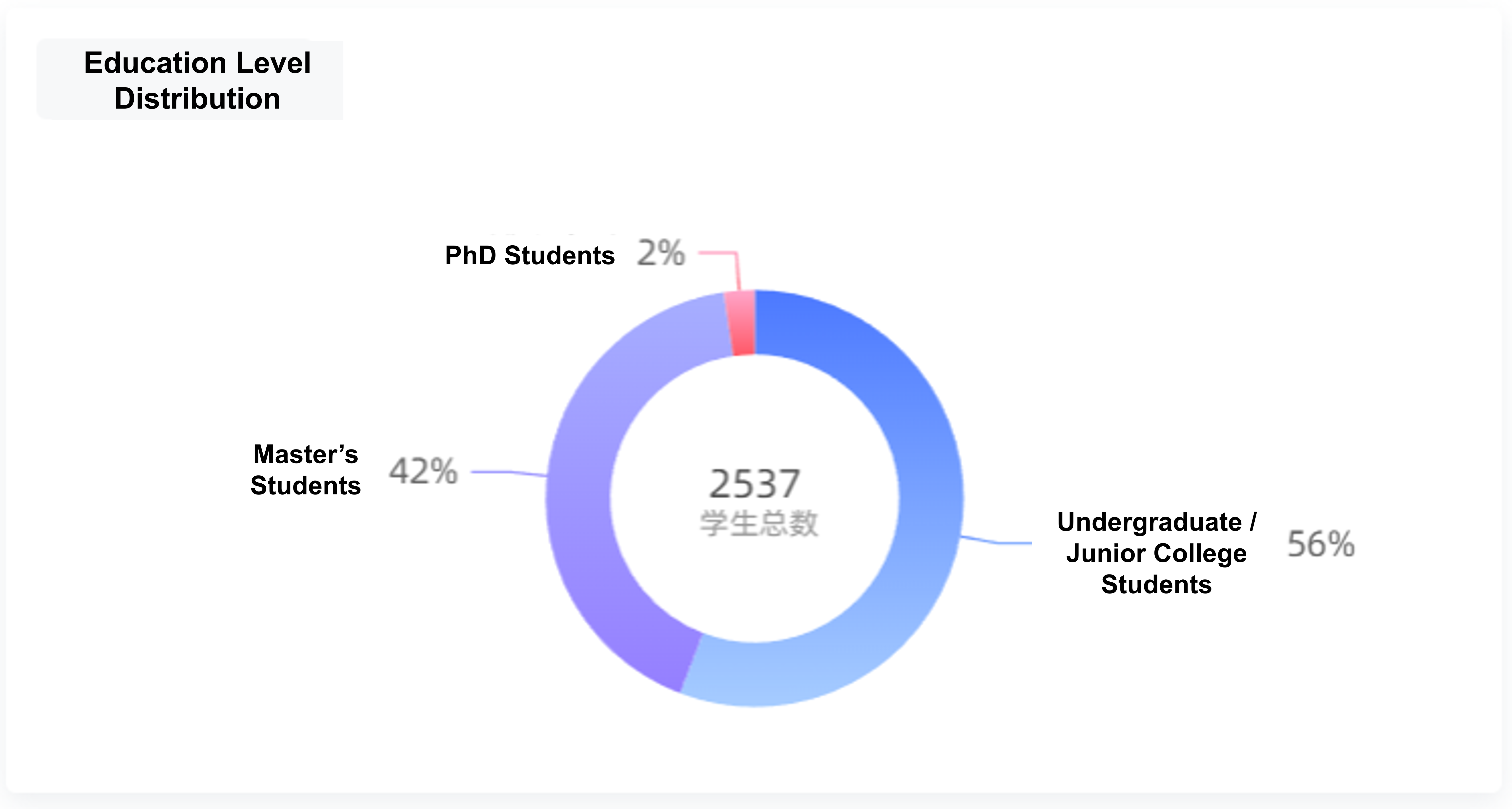

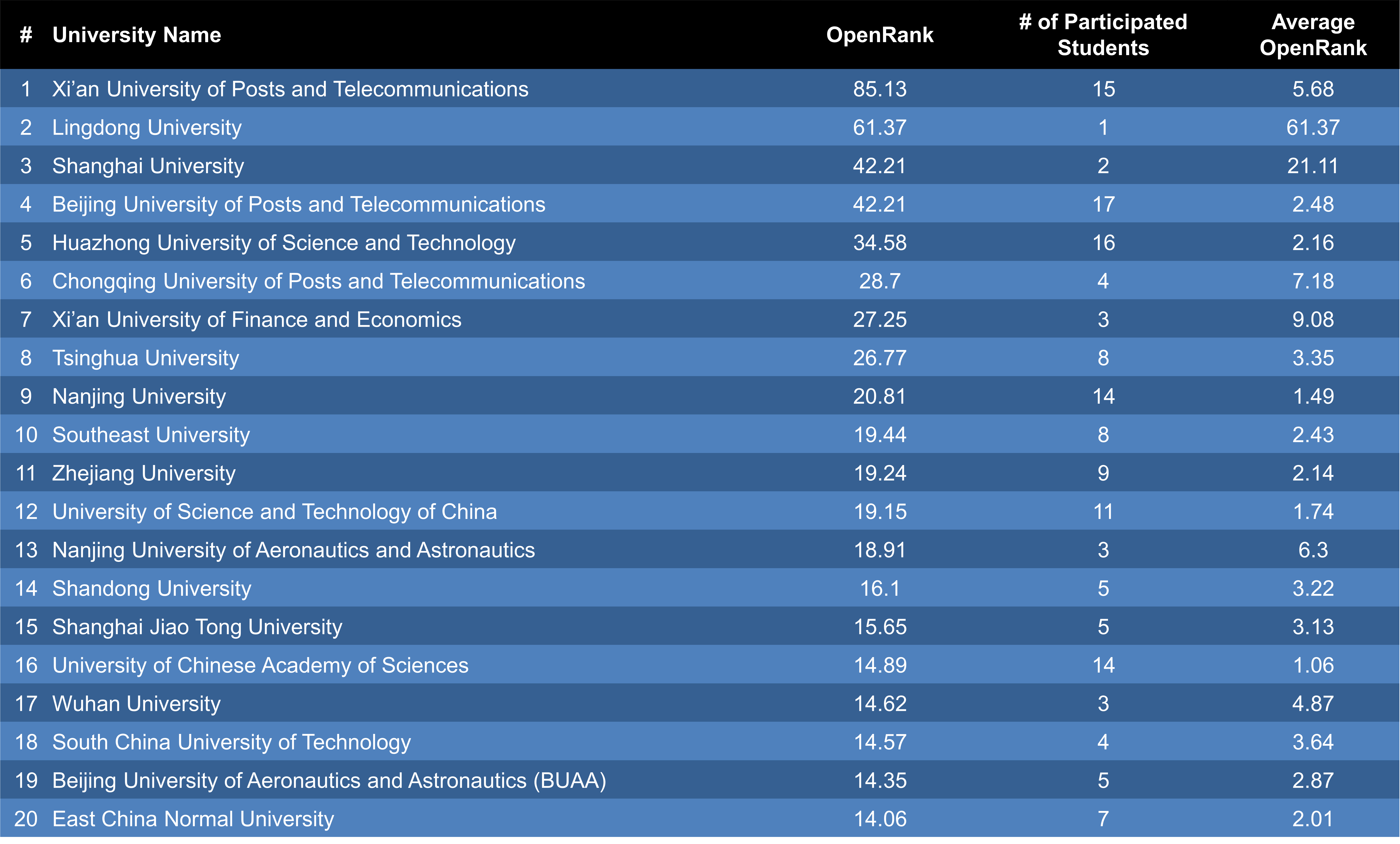

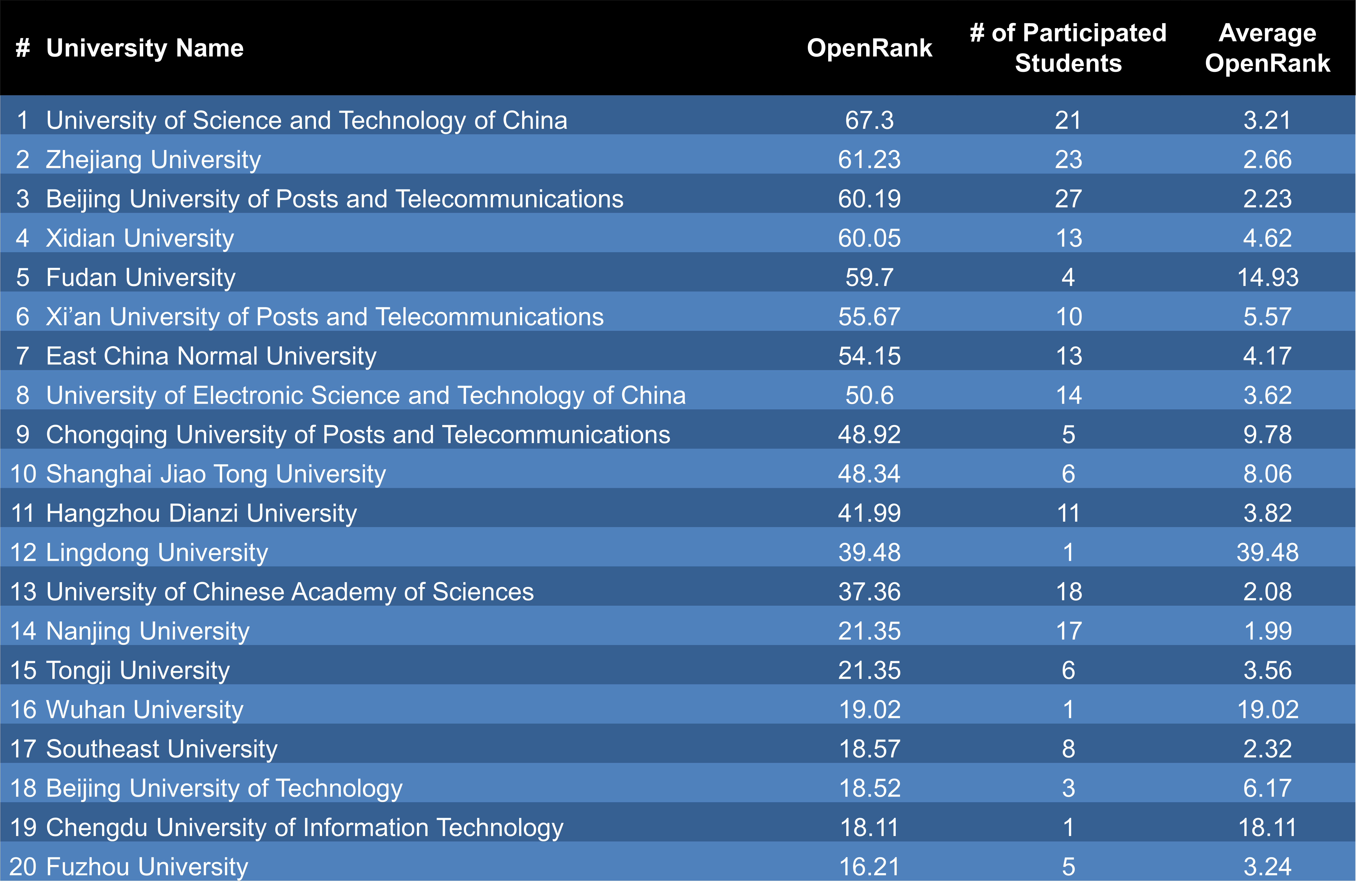

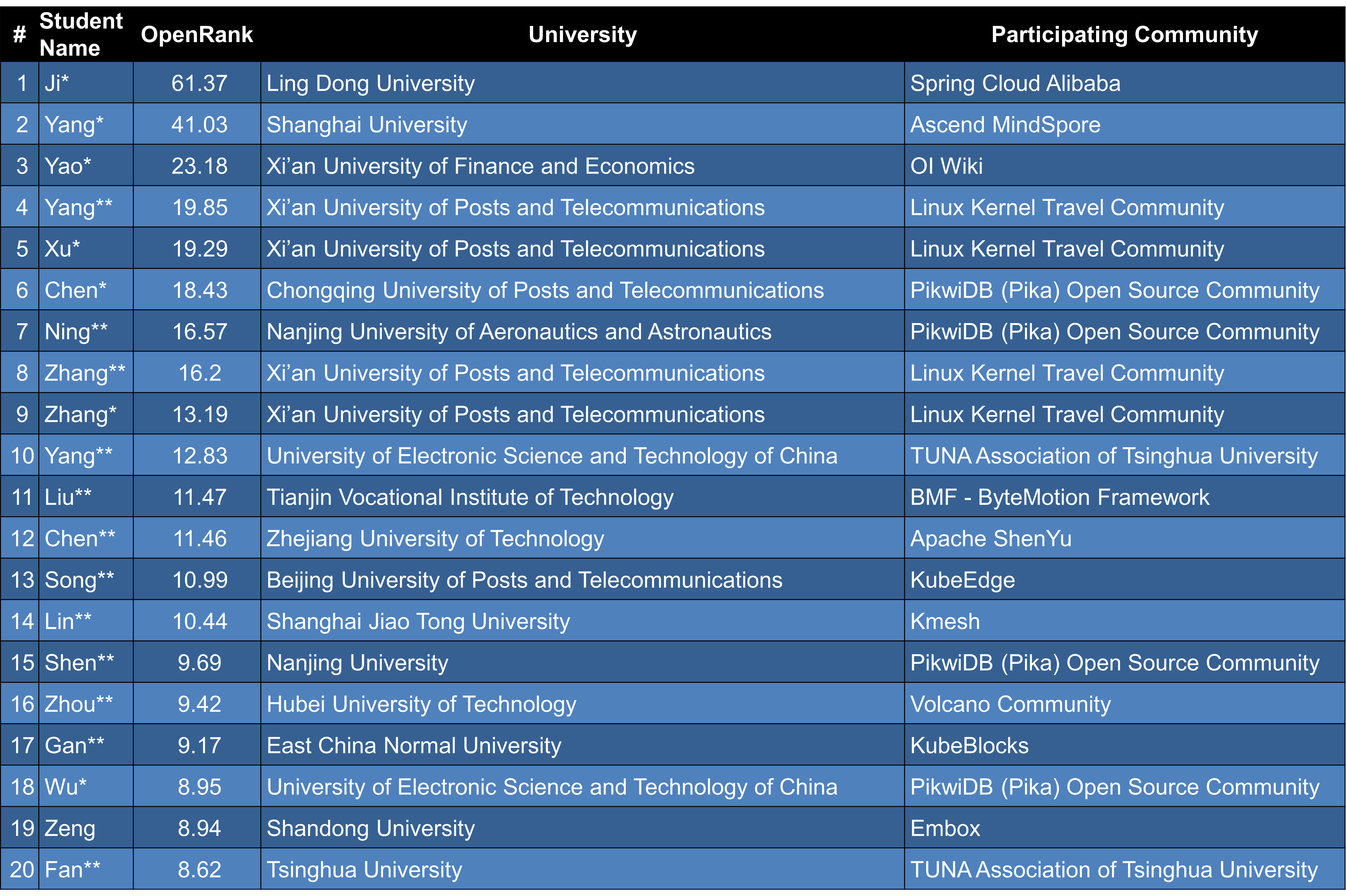

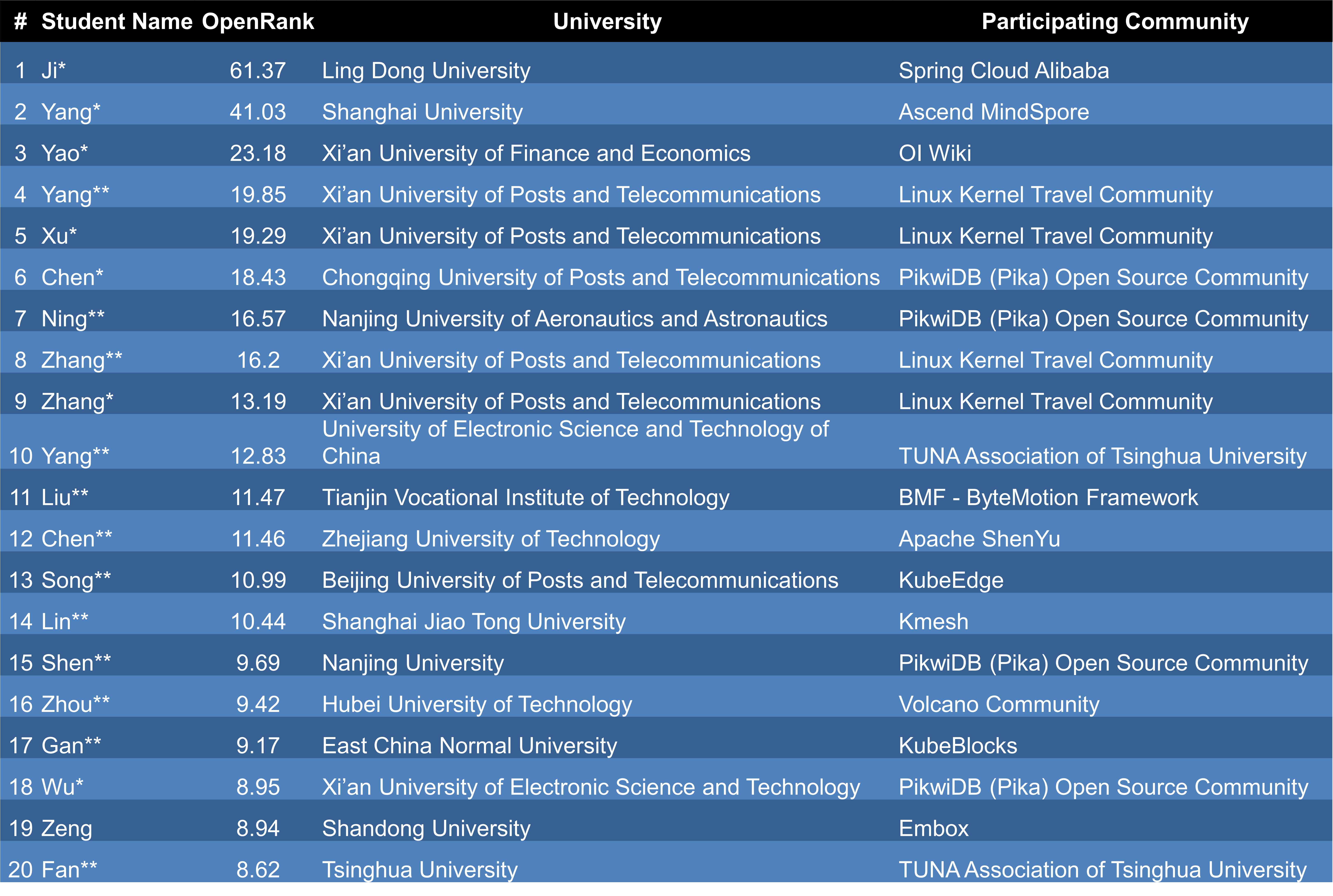

- Chapter 9: University Open-Source Insights – Highlights student participation in open-source through OSPP (Open Source Promotion Plan) and OpenRank community algorithms, revealing emerging trends in open-source talent cultivation.

Overall, this data-driven report, with its rich analytical perspectives and multidimensional insights, paints a comprehensive picture of China’s open-source landscape in 2024, offering valuable references and strategic insights for the industry.

Metrics Introduction

Influence/Contribution (OpenRank)

The OpenRank metric, developed by X-lab Open Laboratory, is built upon the developer-project collaboration network and features multi-dimensional evaluation capabilities. For projects, OpenRank focuses on influence to comprehensively assess their overall development status and community engagement;For developers, it emphasizes contribution as a key indicator, accurately reflecting their collaborative value and activity level within the open-source ecosystem. Additionally, OpenRank can aggregate evaluation targets at higher levels—such as enterprises, organizations, and foundations—revealing their strategic positioning and pivotal role in the open-source collaboration network. Currently, OpenRank has gained broad recognition in both industry and academia, and has been incorporated into several authoritative standards and practices, including: The Open Source Governance Standards by the China National Institute of Standardization, The Open Source Governance Whitepaper by the China Academy of Information and Communications Technology (CAICT), The Global Open Source Dashboard by the OpenAtom Foundation, and The Governance Toolkit for enterprise open-source offices. As a result, OpenRank has become an authoritative benchmark for measuring the health of the open-source ecosystem and its collaborative value.

OpenRank References:

[2] Shengyu Zhao: How to Evaluate an Open Source Project (III) — Value Flow Network, 2021 (in Chinese)

[3] China Electronics Standardization Institute, Ministry of Industry and Information Technology: Information Technology — Open Source Governance — Part 3: Community Governance and Operation [T/CESA 1270.3-2023], Information Technology — Open Source Governance — Part 5: Open Source Contributor Evaluation Model [T/CESA 1270.5-2023], 2023 (in Chinese)

Activity

Activity is one of the core metrics developed by X-lab, designed to quantitatively evaluate the level of activeness of projects or developers. Developer activity is calculated through a weighted assessment of their key behaviors in the open-source ecosystem (such as submitting Issues, creating PRs, conducting code Reviews, etc.), accurately reflecting their engagement and contribution intensity. Project activity, on the other hand, is derived from the aggregated activity of all developers within a project and standardized to provide a comprehensive measure of the project’s overall activity and community participation level. This metric offers a scientific and quantifiable basis for assessing the health of the open-source ecosystem.

Activity References:

[2] Shengyu Zhao: How to Evaluate an Open Source Project (I) — Activity, 2021 (in Chinese)

1. Overall Macro Insights

1.1 Base Event

Basic events are the core data source of open source ecological analysis, referring to event log data generated by developer activity behavior on global open source collaboration platforms (such as GitHub, Gitee, etc.). Through statistical analysis of these events, we can have a macro-in-one insight into the development trend of the global open source ecosystem. This report covers data from two major platforms, GitHub and Gitee.

1.1.1 GitHub Holistic Event Trends

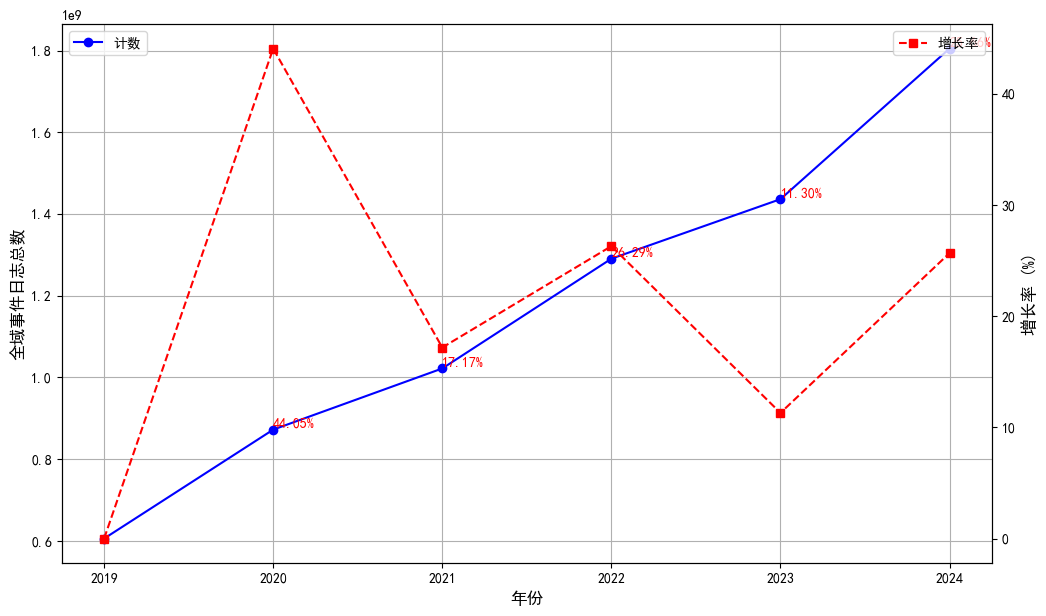

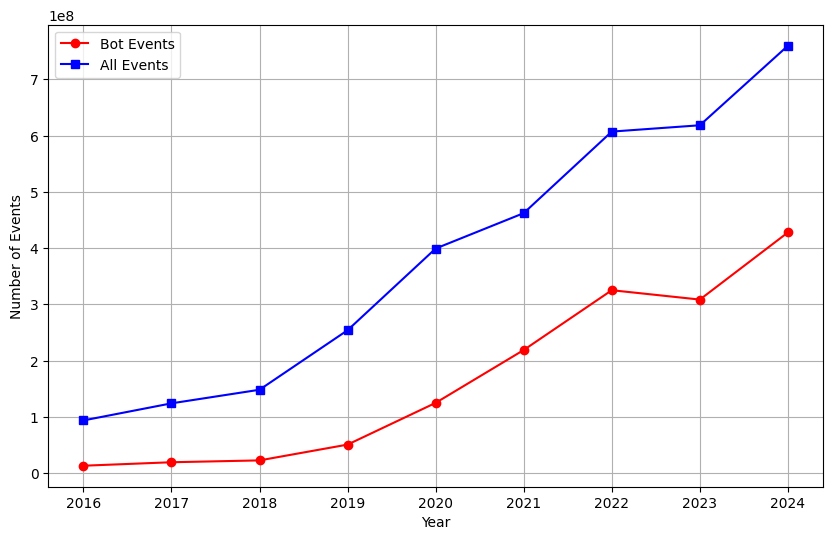

In 2024, the total number of GitHub's global event logs reached 1.75 billion, an increase of about 10% on the same period last year. Although the growth rate slowed down from the high-speed growth period from 2018 to 2023, the 10% growth rate still indicates the key position of open source in global digital transformation. The main factors driving this growth include:

- Popularity of AI tools such as GitHub Copilot: Since the beginning of 2023, the widespread use of AI-assisted programming tools has attracted more developers, especially developers in the Southern Hemisphere.

- Growth of developers: The increase in the number of developers around the world directly drives the rise in event logs.

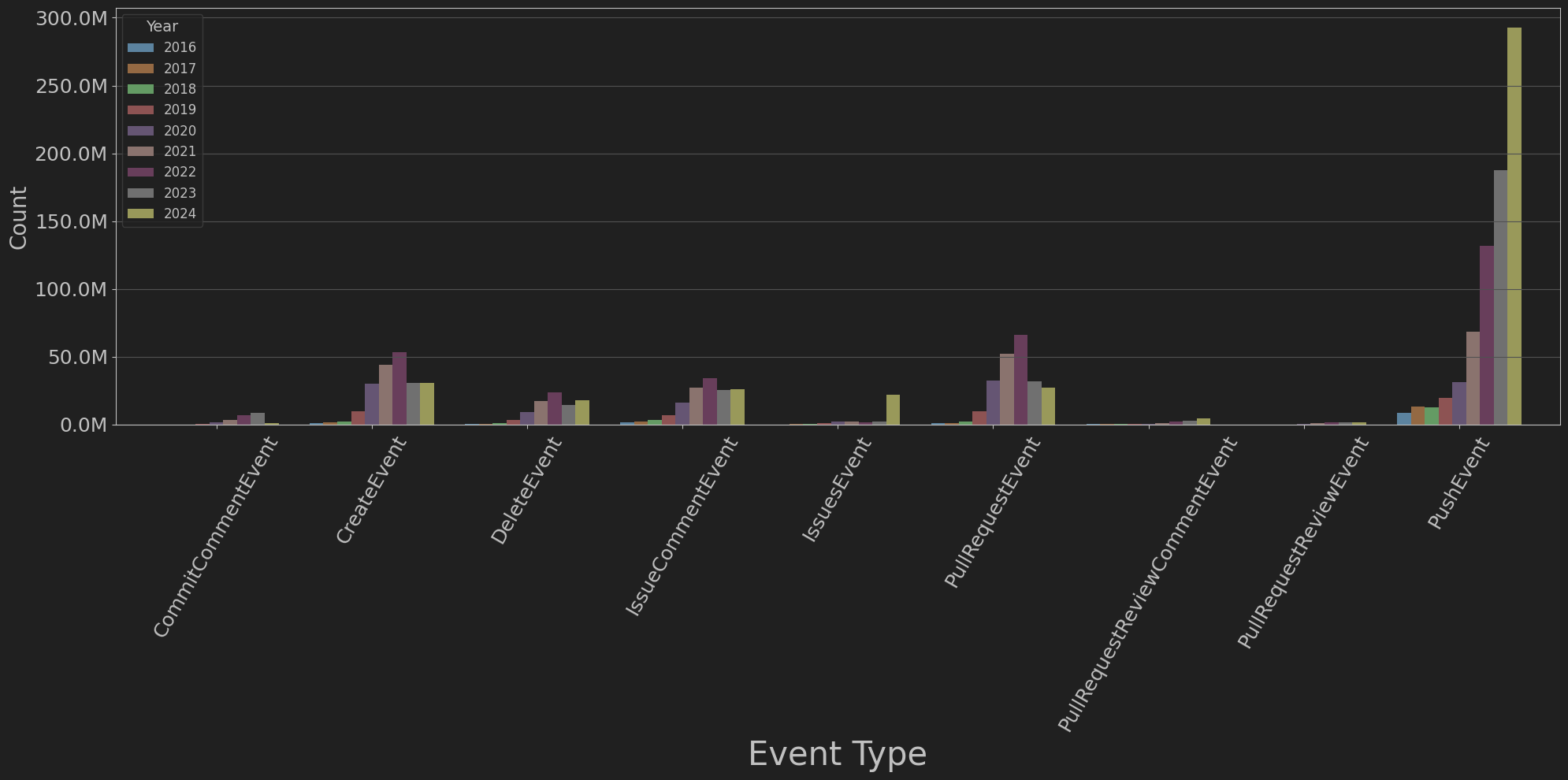

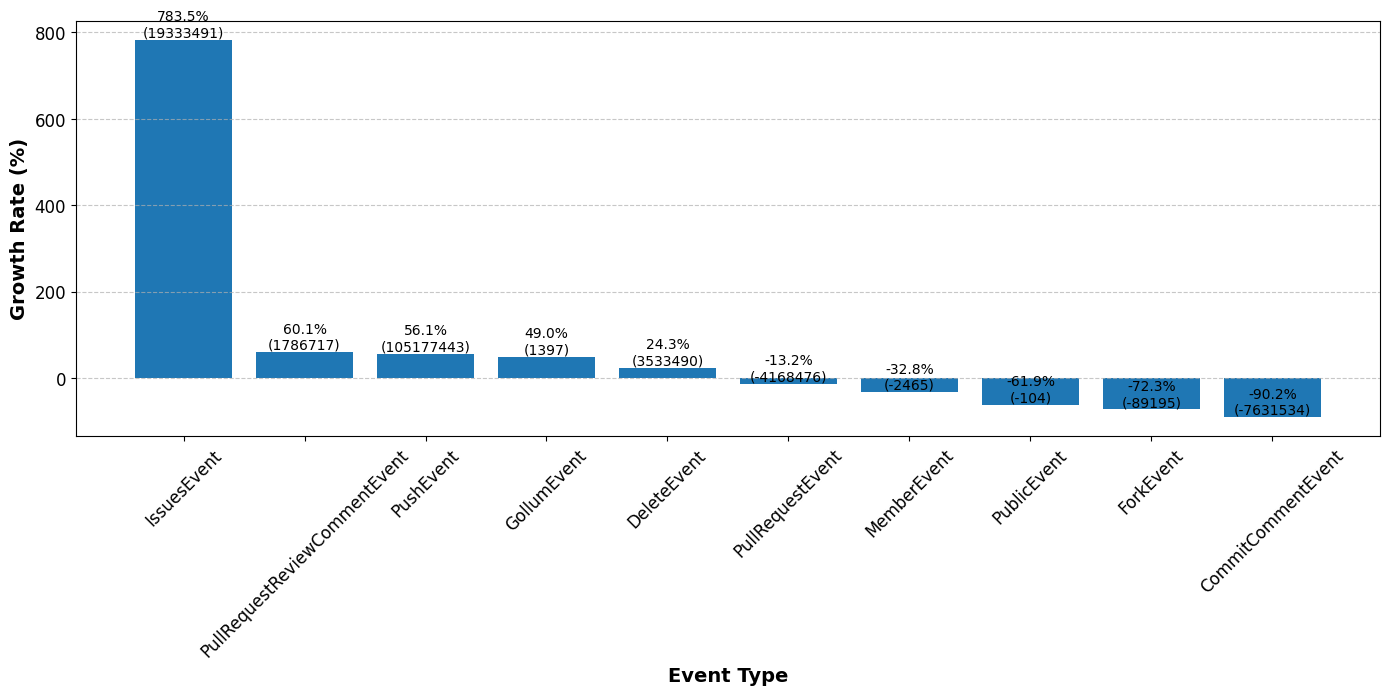

Figure 1.1 shows the growth trend of GitHub's annual event count, highlighting the continued activity of the open source ecosystem.

1.1.2 Trend Comparison of GitHub and Gitee Event Counts

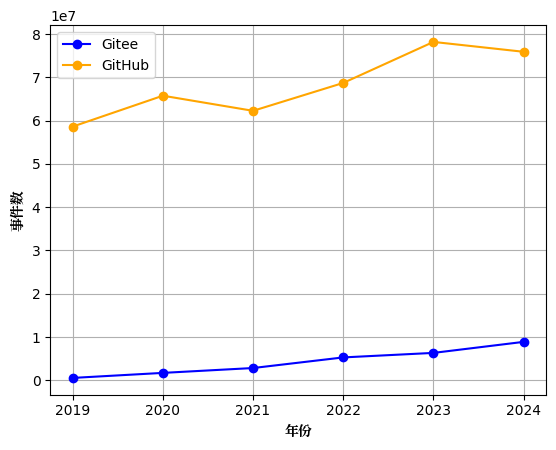

For comparison, we selected the top 30,000 active repositories on each platform of GitHub and Gitee, and focused on eight types of events closely related to open source participation (such as CommitCommentEvent, PullRequestEvent, etc.). The analysis results show:

- GitHub: The number of events continues to grow, but the volatility is large, reflecting the diversity and activity of its global platform.

- Gitee: The number of events has steadily increased, showing the steady development and standardization trend of domestic open source communities.

Although the number of events on GitHub is still much higher than Gitee, Gitee's stable growth shows that domestic developers' enthusiasm and contribution to open source are constantly increasing. Figure 1.2 shows the comparison of event trends between the two major platforms.

1.1.3 Segmented Event Type Analysis

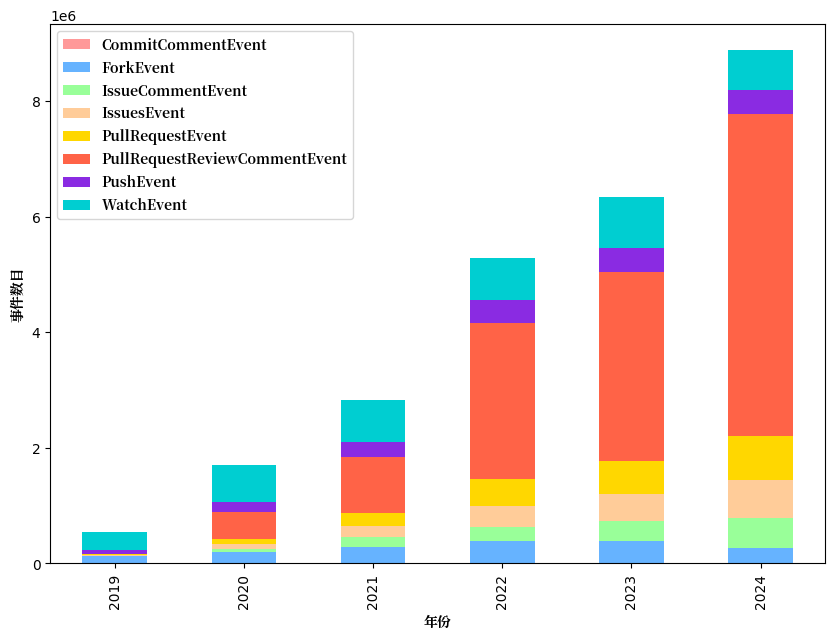

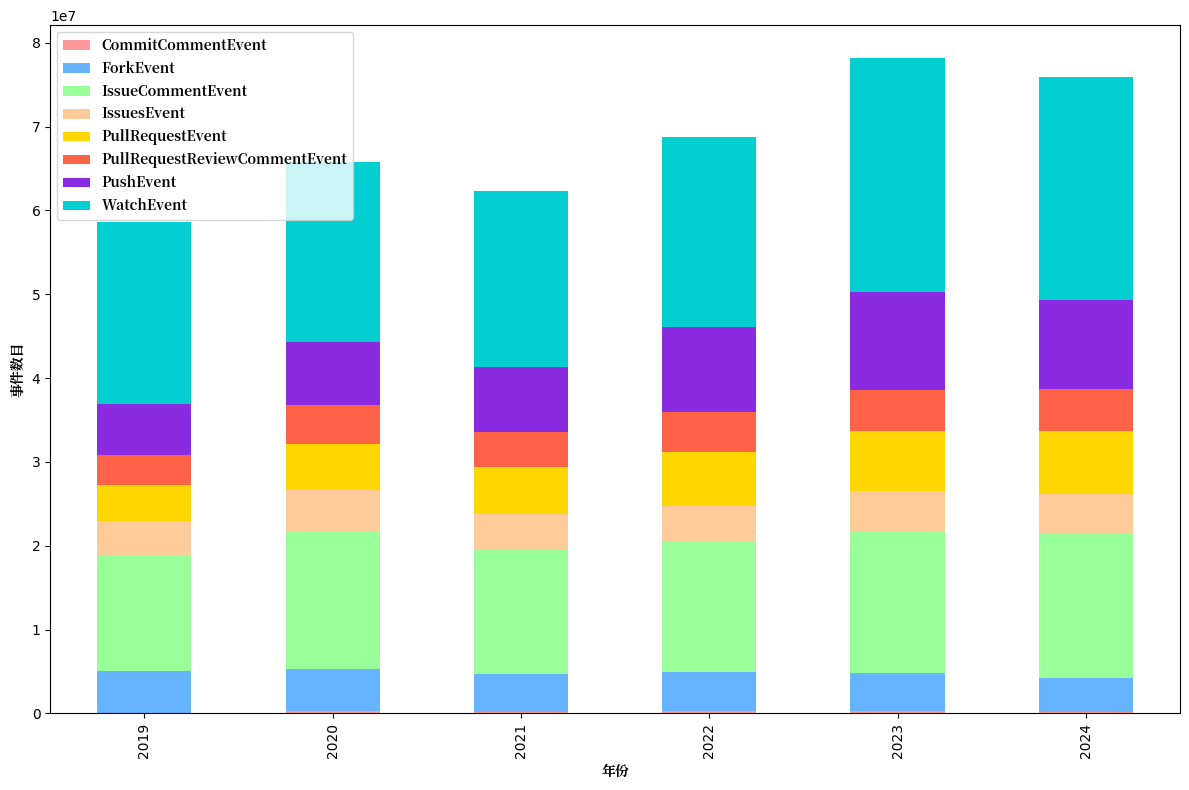

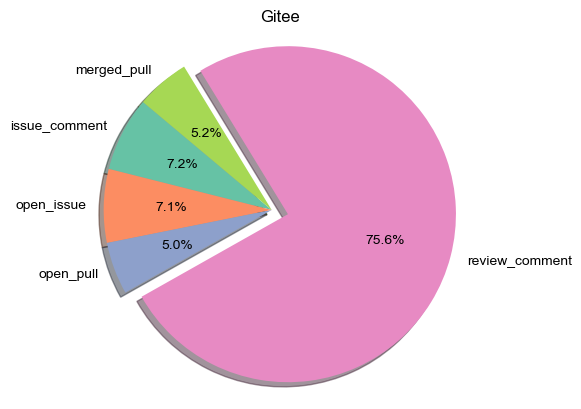

Further analyze the distribution of event types (Figure 1.3 and Figure 1.4):

- GitHub:Watch events (i.e. Star behavior) account for the highest proportion, reflecting users' attention and recognition of the project. Pull Request and Issue Comment events follow, indicating the activity of code collaboration and problem discussion.

- Gitee:Pull Request Review Comment events account for the highest proportion, mainly due to the automated audit mechanism of the platform CI characteristics. This trend reflects the transformation of domestic developers from "follower" to "contributor" roles.

1.2 Active Repositories

1.2.1 GitHub Active Repository Trends

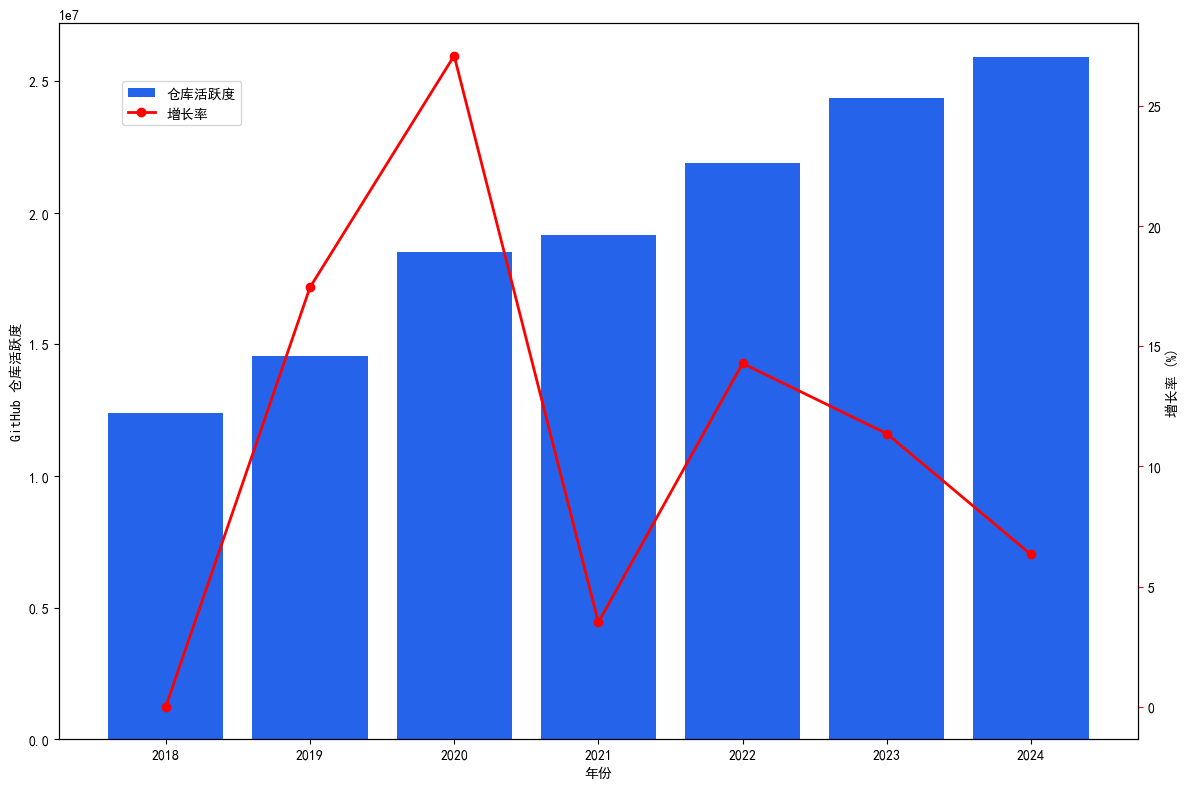

The number of active GitHub warehouses continues to grow, but the growth rate slows down year by year (Figure 1.5). Remote work and digital transformation during the epidemic in 2020 have driven a surge in the number of warehouses, while the slowdown in growth after 2022 is related to the maturity of the market and the development of competitive platforms (such as Gitee and GitLab).

Figure 1.6 shows the general trend in GitHub repository activity, which is near an all-time high in 2024.

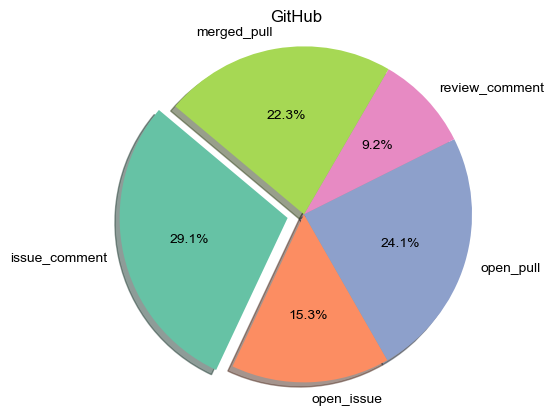

Issue-related events (such as Issue Comment) and Pull Request events (such as PR creation and merge) are the main drivers of GitHub repository activity (Figure 1.7). Specifically:

- Issue comment events account for 29.1%, which is the largest component of active events, indicating that users are highly active in problem solving and improvement discussions.

- Pull Request events (including PR creation and merger) account for 46.4% of the total active events, highlighting GitHub’s core role in code collaboration and contribution.

Figure 1.7 shows the detailed composition of GitHub warehouse activity, further confirming the key position of Issue and PR events in promoting the development of open source projects.

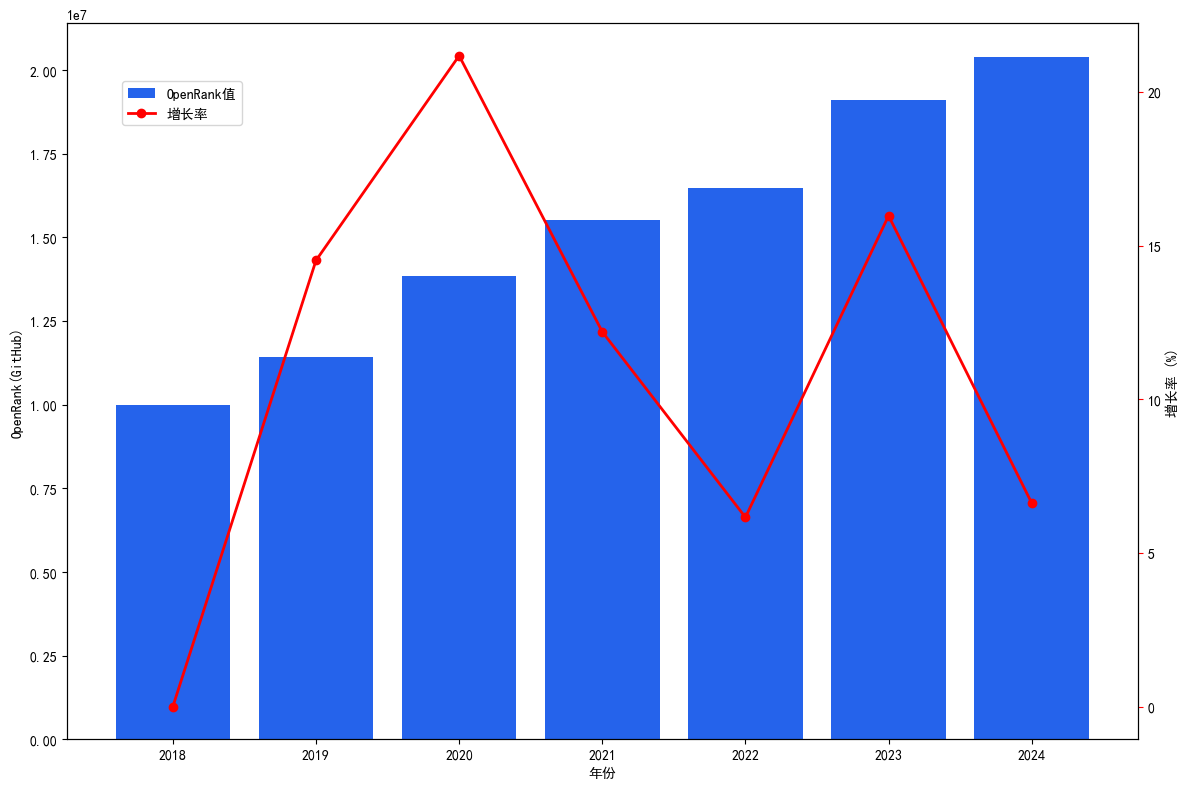

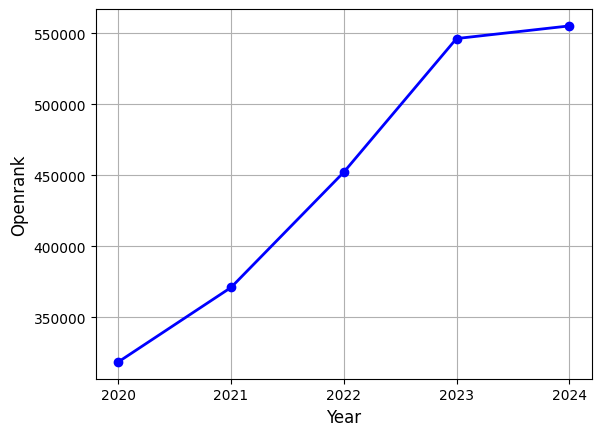

The OpenRank value of GitHub repository experienced a period of rapid growth from 2018 to 2020, and the growth rate reached its peak in 2020, reflecting the dual explosion of GitHub user expansion and open source project activity during this period. From 2021 to 2022, the growth rate gradually slowed down and entered a period of slowness. However, since 2023, the growth rate has rebounded. Although there has been a slight decline in 2024, the overall growth has remained stable, indicating the continued vitality and attractiveness of GitHub as the world's leading open source platform.

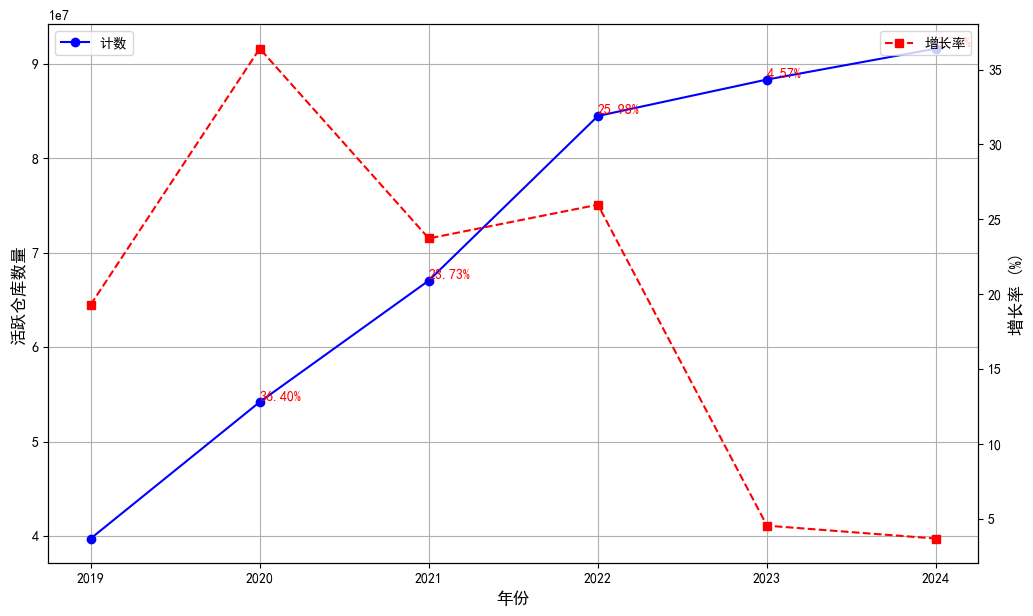

1.2.2 Gitee Active Repository Trends

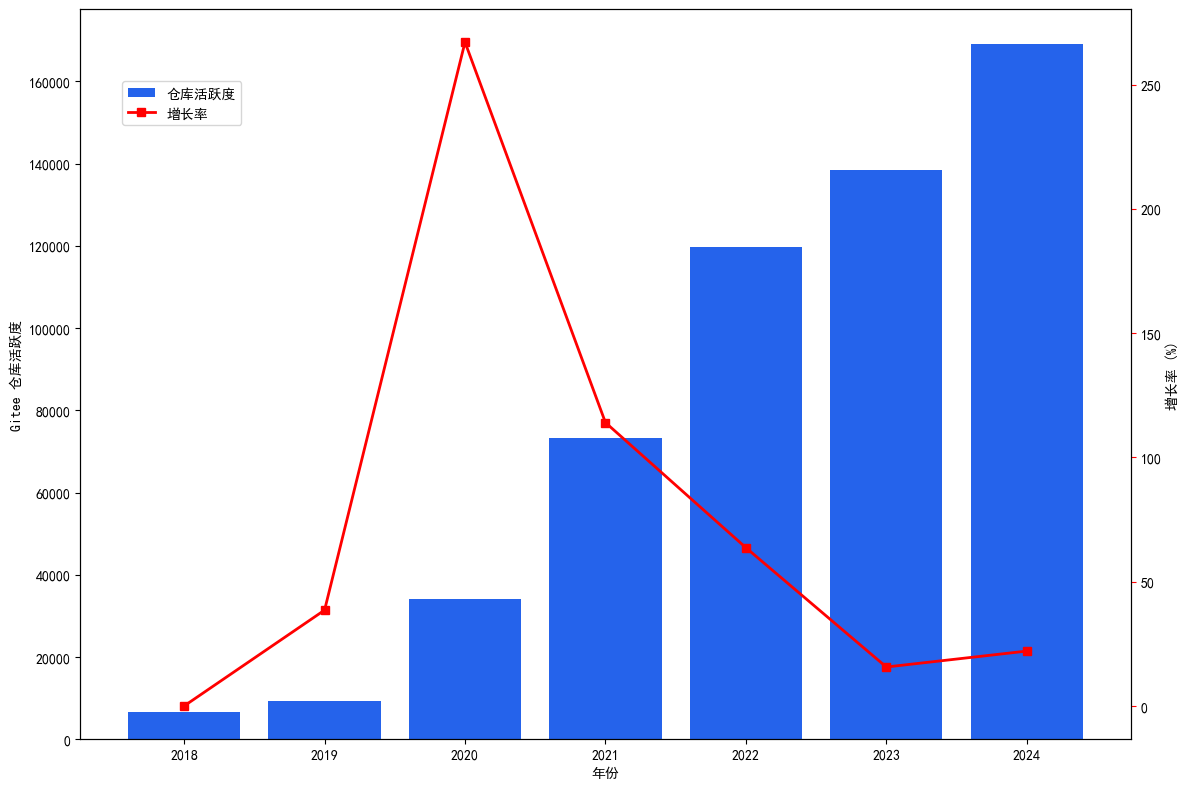

Repository activity on Gitee grew rapidly from 2018 to 2020, reaching its peak in 2020, primarily benefiting from domestic open-source policy support and the establishment of the OpenAtom Open Source Foundation. After 2021, growth slowed down, but still reached a new peak in 2024 (Figure 1.9).

On the Gitee platform, Review Comment events dominate absolutely, accounting for 75.6% of total active events, far higher than other event types (such as Open Issue, Issue Comment, Merged Pull, etc., which account for about 7%; Open Pull events account for only 5%). This distribution indicates that Gitee developers focus more on the code review stage, while being slightly less active in code submission and issue discussion compared to GitHub, reflecting the platform users' high attention to code quality and the gradual maturation of standardized processes (Figure 1.10).

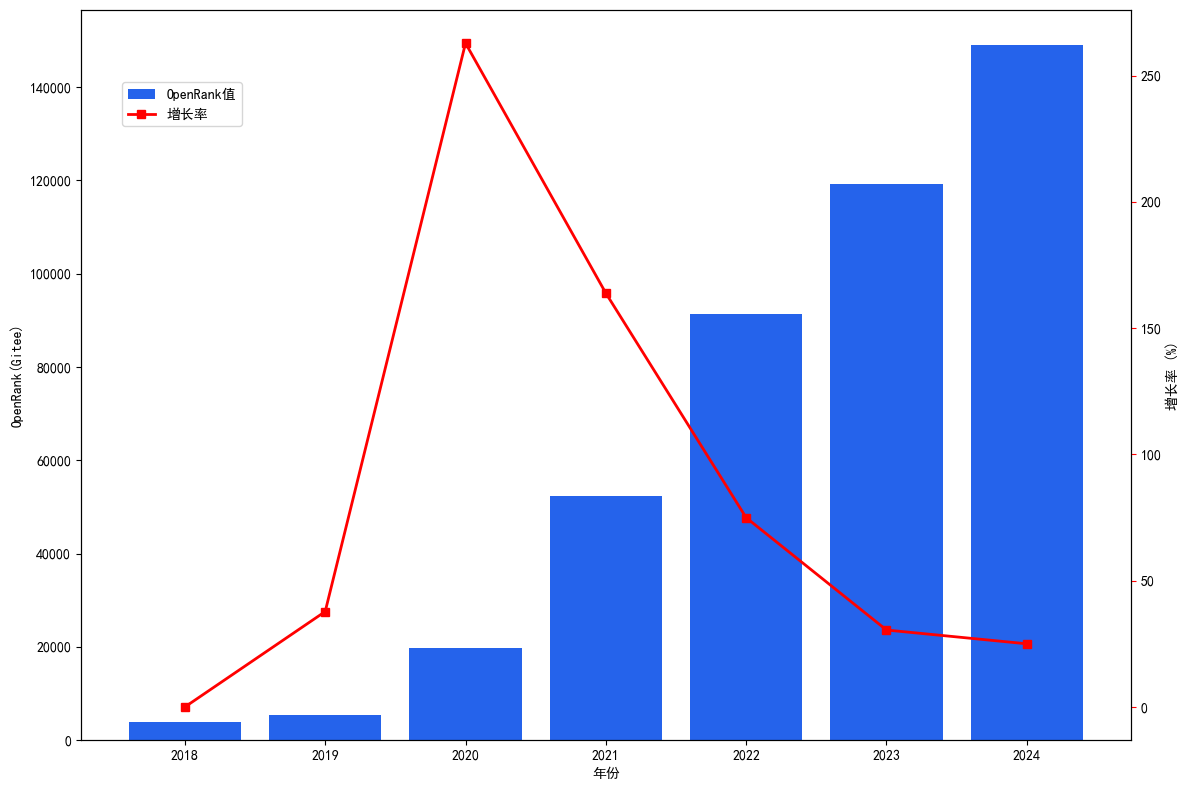

Gitee's OpenRank value achieved significant growth from 2018 to 2024, especially with a substantial increase between 2019-2020, mainly benefiting from domestic open-source ecosystem policy support and developers' active participation in the localized platform. Although the growth rate slowed down after 2021, Gitee's comprehensive activity still maintains a steady upward trend, confirming its continuously rising status among domestic open-source platforms, as well as sustained growth in community contributions and activity.

1.3 Active Developers

1.3.1 GitHub Overall Active User Trends

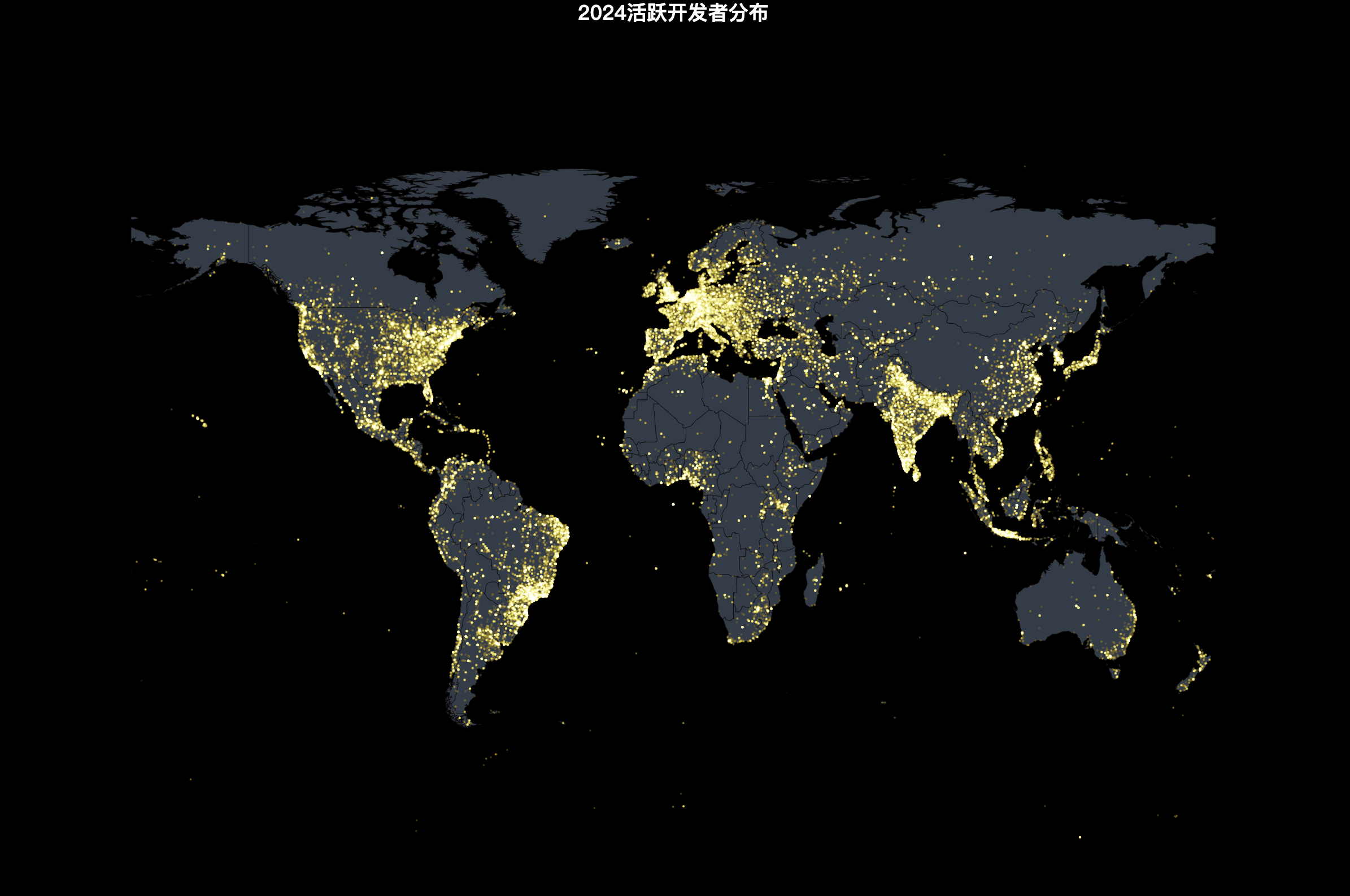

The analysis in 2024 continues previous research methodologies, based on richer and more refined data sources. This study covers a sample of 12 million active developers on GitHub, of which approximately 2.55 million developers provided accurate geographic location information, representing 2% of GitHub's total registered users (approximately 120 million). Although the sample represents only a small portion of all users, the improved data quality provides a more representative perspective for analyzing global developer geographic distribution and regional collaboration patterns.

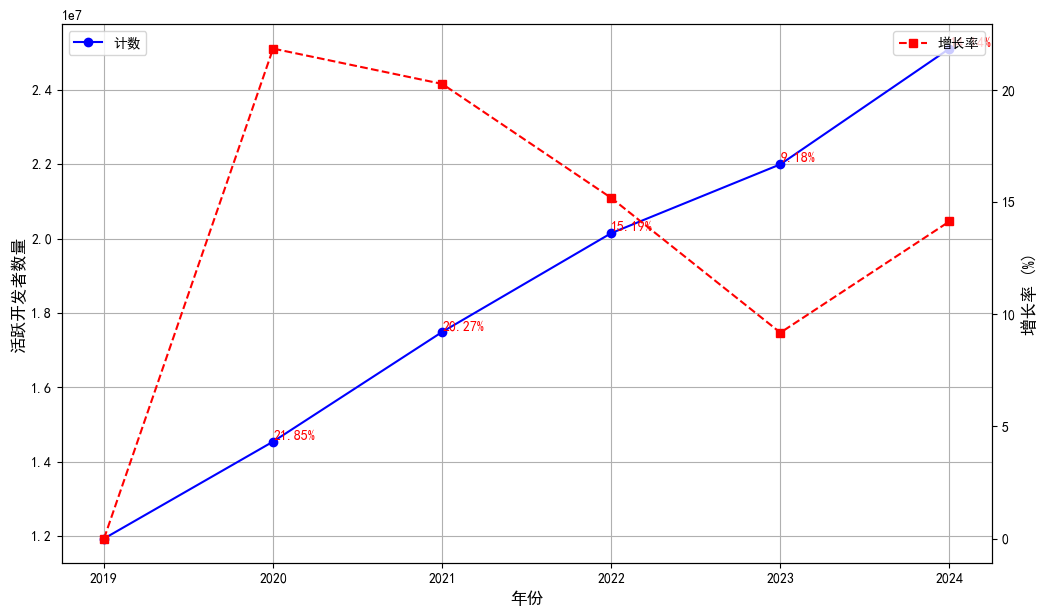

Figure 1.12 shows the growth trend of annual active developers on GitHub. The number of active developers has generally increased from 14.54 million in 2020 to 25.11 million in 2024. Specifically:

- 2019-2021: Rapid growth, mainly benefiting from the pandemic-driven transition to remote work and accelerated global digital transformation.

- 2022-2023: Growth rate slowed, possibly related to market maturation and base effect.

- 2024: Growth rate rebounded to 14.1%, with approximately 3.11 million new developers, reflecting the driving force of new technology waves (such as AI, Web3, etc.) on the developer ecosystem.

Compared to repository growth, developer growth is more stable, indicating that GitHub's user base continues to expand. Even during periods of slowed growth, a large number of new developers join each year. The rebound in 2024 further demonstrates GitHub's strong attraction as the world's leading open-source platform.

1.3.2 Geographical Distribution of Developers

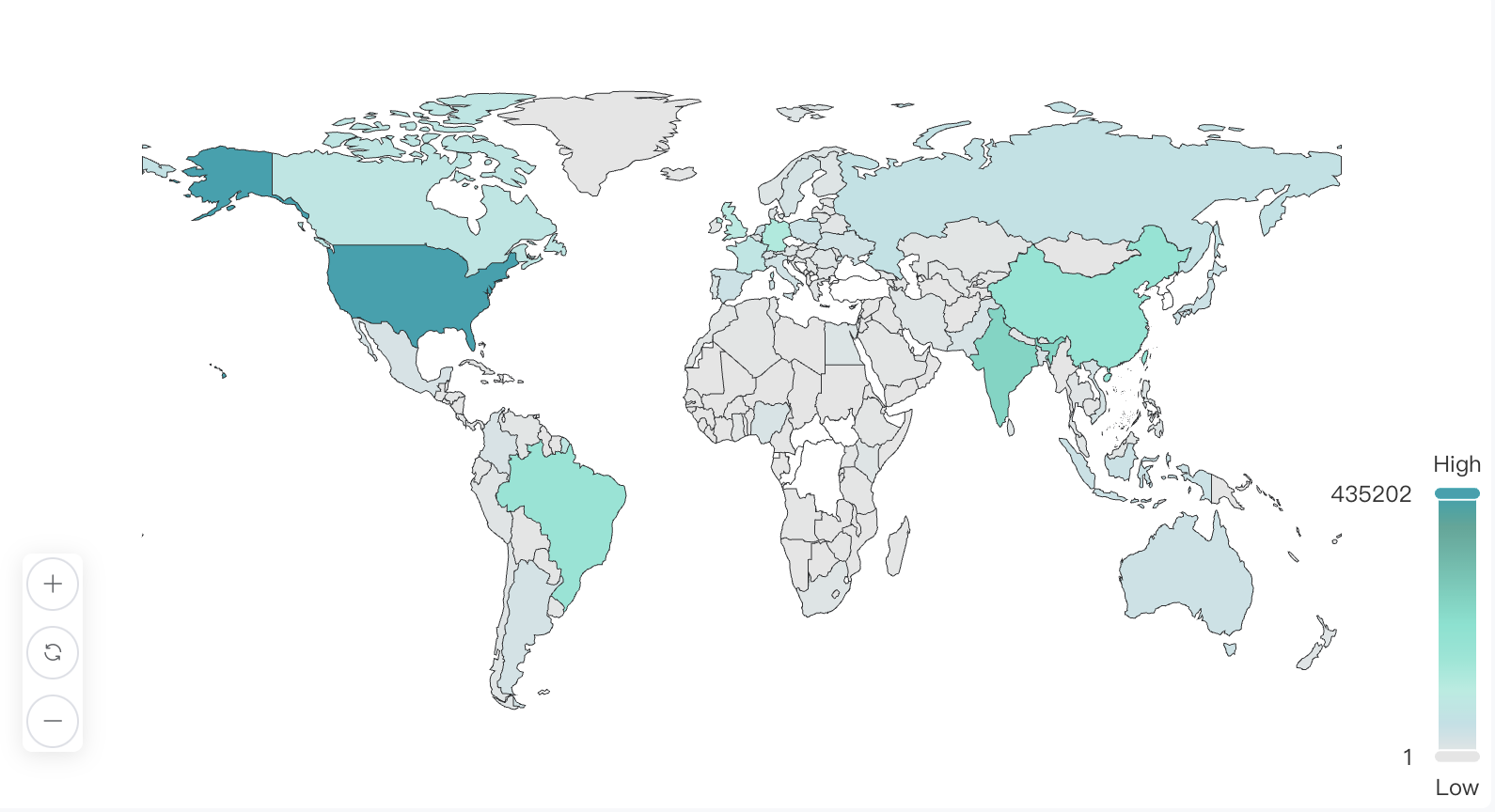

1. Global Developer Geographic Distribution

According to statistics, the geographic distribution of global developers shows highly concentrated characteristics, with the top 10 countries accounting for 60% of the total global developers, as shown in the table below:

| Rank | Country | Total Number | Percentage | Developer Activity |

|---|---|---|---|---|

| 1 | United States | 435,202 | 17.11% | 4,301,051.55 |

| 2 | India | 252,054 | 9.91% | 1,099,659.73 |

| 3 | China | 184,085 | 7.23% | 1,097,116.82 |

| 4 | Brazil | 174,811 | 6.87% | 683,186.08 |

| 5 | Germany | 126,397 | 4.96% | 1,492,317.89 |

| 6 | United Kingdom | 103,061 | 4.05% | 1,140,839.73 |

| 7 | Canada | 82,627 | 3.24% | 821,240.65 |

| 8 | France | 78,288 | 3.07% | 833,038.24 |

| 9 | Russia | 60,735 | 2.38% | 310,555.47 |

| 10 | South Korea | 44,006 | 1.73% | 375,550.82 |

Key Observations:

- The United States leads by a wide margin with 435,000 developers (17.11%), and its activity level (4,301,051.55) also ranks first globally, demonstrating its absolute dominant position in the open-source ecosystem.

- India (9.91%) and China (7.23%) follow closely. Although China has fewer developers than India, the activity levels are almost equal, indicating high participation and contribution density of Chinese developers in open-source projects.

- Germany stands out - despite ranking fifth in developer numbers, its activity level (1,492,317.89) ranks second, indicating higher overall depth of participation among its developers.

- Although Brazil and Russia have relatively large numbers of developers, their per capita activity is relatively low, suggesting room for improvement in the quality of participation in the open-source ecosystem.

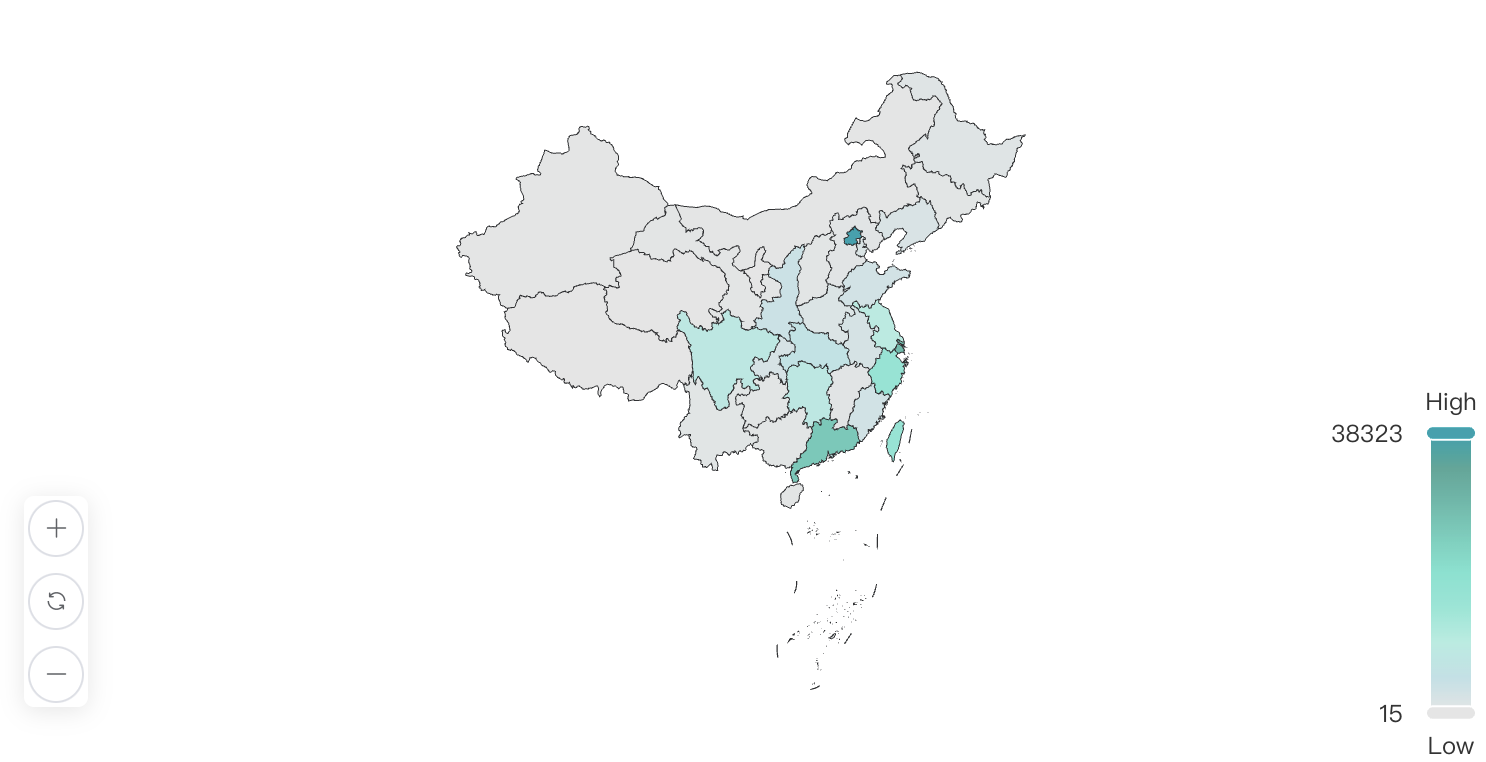

2. Chinese Developer Geographic Distribution

Further analysis of Chinese developers' distribution shows that the total number of Chinese developers is 9,404,966, with the Beijing-Shanghai-Guangzhou-Shenzhen region occupying the major share, demonstrating the strong attraction of economically developed regions to open-source technology.

| Rank | Province | Total Number | National Percentage | Actual Total (10,000) |

|---|---|---|---|---|

| 1 | Beijing | 38,323 | 22.04% | 207.20 |

| 2 | Shanghai | 28,393 | 16.43% | 154.86 |

| 3 | Guangdong | 24,959 | 14.49% | 136.28 |

| 4 | Taiwan | 15,894 | 9.53% | 89.62 |

| 5 | Zhejiang | 15,816 | 8.13% | 76.52 |

| 6 | Jiangsu | 9,369 | 4.90% | 46.10 |

| 7 | Sichuan | 8,186 | 4.69% | 44.03 |

| 8 | Hong Kong | 6,625 | 3.13% | 29.44 |

| 9 | Hubei | 5,732 | 2.95% | 27.75 |

| 10 | Shaanxi | 3,669 | 1.88% | 17.68 |

Key Observations:

- Beijing-Shanghai-Guangzhou dominance: Beijing (22.04%), Shanghai (16.43%), and Guangdong (14.49%) rank as the top three, collectively accounting for over 50%, reflecting the prominent position of these economic and technological centers in the open-source ecosystem. Beijing leads with 38,323 developers (2.072 million people), demonstrating its core advantages in technological innovation and talent concentration.

- Taiwan and Hong Kong: Taiwan (9.53%) and Hong Kong (3.13%) occupy important positions in the open-source ecosystem, with Taiwan attracting a large number of developers through its high-tech industry and open policy environment.

- Yangtze River Delta and Pearl River Delta advantage: The Yangtze River Delta (Shanghai, Zhejiang, Jiangsu) and Pearl River Delta (Guangdong) regions have more than 150,000 developers in total, showing the strong innovation capacity of economically developed regions in eastern coastal areas.

- Rise of central and western regions: Although Sichuan (4.69%), Hubei (2.95%), and Shaanxi (1.88%) have fewer developers than eastern regions, their overall growth is significant, indicating the gradual improvement and increasing attractiveness of the technological innovation ecosystem in central and western regions.

Summary and Perspectives:

- Global perspective: China's position in the global open-source ecosystem is increasingly important, with developer activity and contribution density approaching that of India, showing the rapid maturation of the open-source ecosystem. Countries like Germany and the UK have higher per capita activity levels, offering valuable lessons for China regarding deep participation models.

- Domestic distribution: Beijing, Shanghai, Guangzhou, Shenzhen, and coastal areas remain the core gathering places for Chinese open-source developers, but the technological ecosystems in central and western regions are rising, providing new momentum for the balanced development of China's future open-source ecosystem.

- Development recommendations:

- Strengthen support and resource allocation to developers in central and western regions to promote balanced regional development.

- Learn from the experiences of countries with high participation like Germany to improve developers' community participation and contribution depth.

- Cultivate more highly active, high-contributing developers through policy incentives and technical support to further strengthen China's competitiveness in the global open-source ecosystem.

1.4 Programming Language

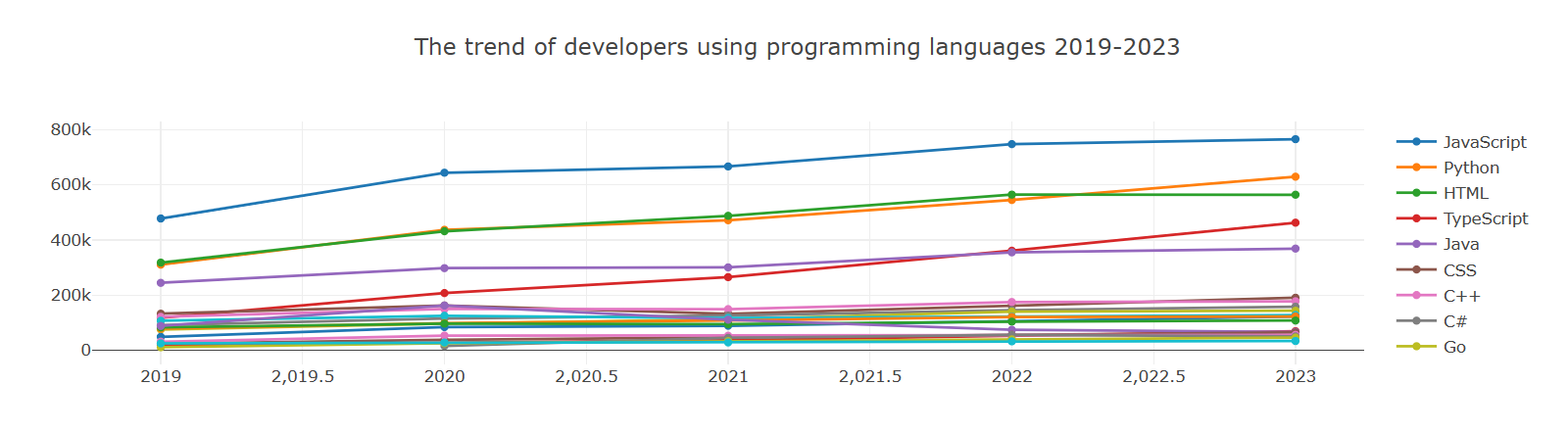

1.4.1 2024 Developer Programming Language Rankings

The popularity of programming languages has always been a focus of developer attention. Below is the ranking of the most popular programming languages among developers in 2024:

| Rank | Programming Language | Number of Developers Using This Language | Number of Repositories Using This Language |

|---|---|---|---|

| 1 | JavaScript | 591,223 | 654,037 |

| 2 | Python | 540,751 | 499,644 |

| 3 | TypeScript | 439,954 | 462,496 |

| 4 | HTML | 424,901 | 401,084 |

| 5 | Java | 281,403 | 328,123 |

| 6 | C++ | 143,135 | 106,444 |

| 7 | CSS | 137,566 | 114,166 |

| 8 | C# | 131,549 | 163,796 |

| 9 | Go | 125,521 | 121,209 |

| 10 | Jupyter Notebook | 119,874 | 79,415 |

| 11 | PHP | 100,984 | 108,019 |

| 12 | Shell | 93,726 | 76,276 |

| 13 | C | 84,253 | 60,389 |

| 14 | Rust | 68,199 | 62,969 |

| 15 | Kotlin | 53,503 | 48,013 |

Key Observations:

- JavaScript continues to firmly hold the top position with 590,000 developers and 650,000 repositories. Its wide range of application scenarios and mature ecosystem are key factors in maintaining its lead.

- Python follows closely with 540,000 developers, benefiting from its widespread use in data science, artificial intelligence, and general programming.

- TypeScript ranks third, with the number of developers (439,900) exceeding HTML (424,900), showing its continuously rising status in frontend development.

- HTML and Java rank fourth and fifth, with 424,900 and 281,400 developers respectively. However, starting from the 6th-ranked C++, the number of developers decreases by nearly half, demonstrating a significant concentration effect among top programming languages.

- Languages ranked 6th to 15th (such as C++, Rust, Kotlin), though having smaller user bases, still have significant influence in specific domains (such as system development, mobile development, etc.).

Overall, the application domains of mainstream programming languages have basically solidified, with little change in rankings by number of users in recent years, indicating that developers' choices for these languages have high stability.

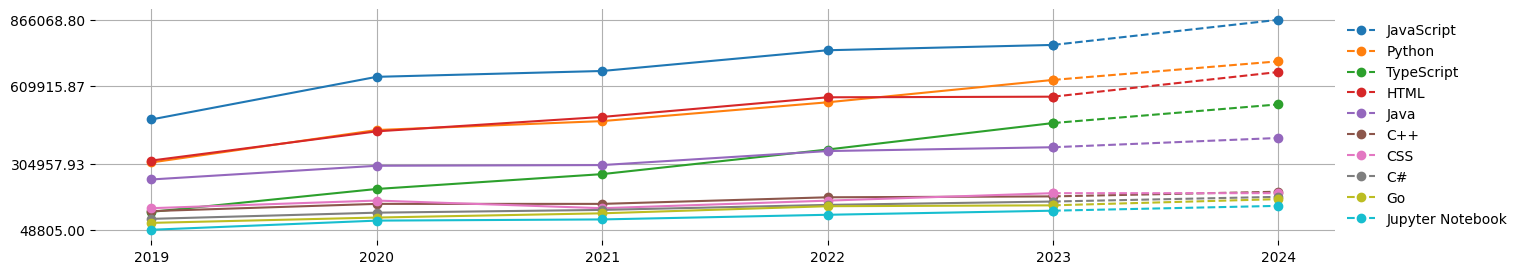

1.4.2 Developer Programming Language Usage Trends 2019-2024

Below is the statistical analysis of developer programming language usage trends from 2019 to 2024:

Data Notes: Due to the data source no longer providing repository metadata, the relevant data for October, November, and December 2024 is missing. Therefore, combining data from 2019-2023, a prediction model was used to estimate the data for 2024, with the dashed lines representing the prediction results.

Key Observations:

- JavaScript, Python, HTML, TypeScript, and Java are currently the main programming languages and have maintained leading positions for a long time.

- Rapid growth of HTML language: Predictions show that the growth rate of HTML will accelerate in 2024, significantly narrowing the gap with Python. This trend may be related to developers' emphasis on project aesthetics and convenience. HTML will continue to maintain an important position in frontend development and content display in the future.

- Continuous leap of TypeScript: Over the past 5 years, the number of TypeScript users has grown rapidly. By 2021, it had already created a clear gap with the programming languages ranked below it, becoming one of the core choices for developers. The 2024 prediction data shows that its developer usage will rank fourth. TypeScript's success is due to its introduction of static type checking based on JavaScript, strong community support, and adaptability to large projects.

- Steady growth of JavaScript and Python: Both consistently rank in the top two, with relatively stable growth curves, indicating their irreplaceability in general development.

1.5 Summary & Trending Insights

- The head effect is significant: JavaScript and Python have been firmly in the top two for a long time, and the rapid rise of TypeScript further consolidates its position in front-end development. At the same time, the growth of HTML also reflects developers' demand for more intuitive and easy-to-use technologies.

- Domain-driven trend: Although languages such as C++ and Rust have a small user base, their influence in specific fields such as system programming and high-performance computing cannot be ignored, and may continue to be key technologies in vertical fields in the future.

- Community and ecology have a clear role: TypeScript's success once again proves the importance of communities and ecosystems in programming language promotion. The combination of the technical advantages of the language itself, combined with a strong support system, can significantly drive its user growth.

- Development Suggestions:

- In view of the development trends of emerging programming languages (such as Rust and Kotlin), we actively improve supporting tools and ecology to attract more developers.

- Encourage developers to try more HTML and TypeScript in projects to improve front-end development efficiency and display effect.

- Support the deepening application of vertical programming languages (such as C++ and Go) in the industry and promote the implementation of innovative technologies.

2. OpenRank Rankings

In the open source field, rankings are not only an important tool to measure the influence and activity of projects, but also a window to showcase the global open source ecosystem dynamics. The 2024 China Open Source Annual Report passed the OpenRank rankings, presenting the activity and influence of key players in the open source community from a unique perspective, including projects, regions, enterprises, foundations and emerging projects. The report integrates the data of two major domestic and foreign platforms, GitHub and Gitee, covering China's open source ecosystem, and providing a global analysis. Through these rankings, we hope to further promote the popularization of open source culture and the application of open source technology, while encouraging enterprises and individuals to participate more actively in open source projects.

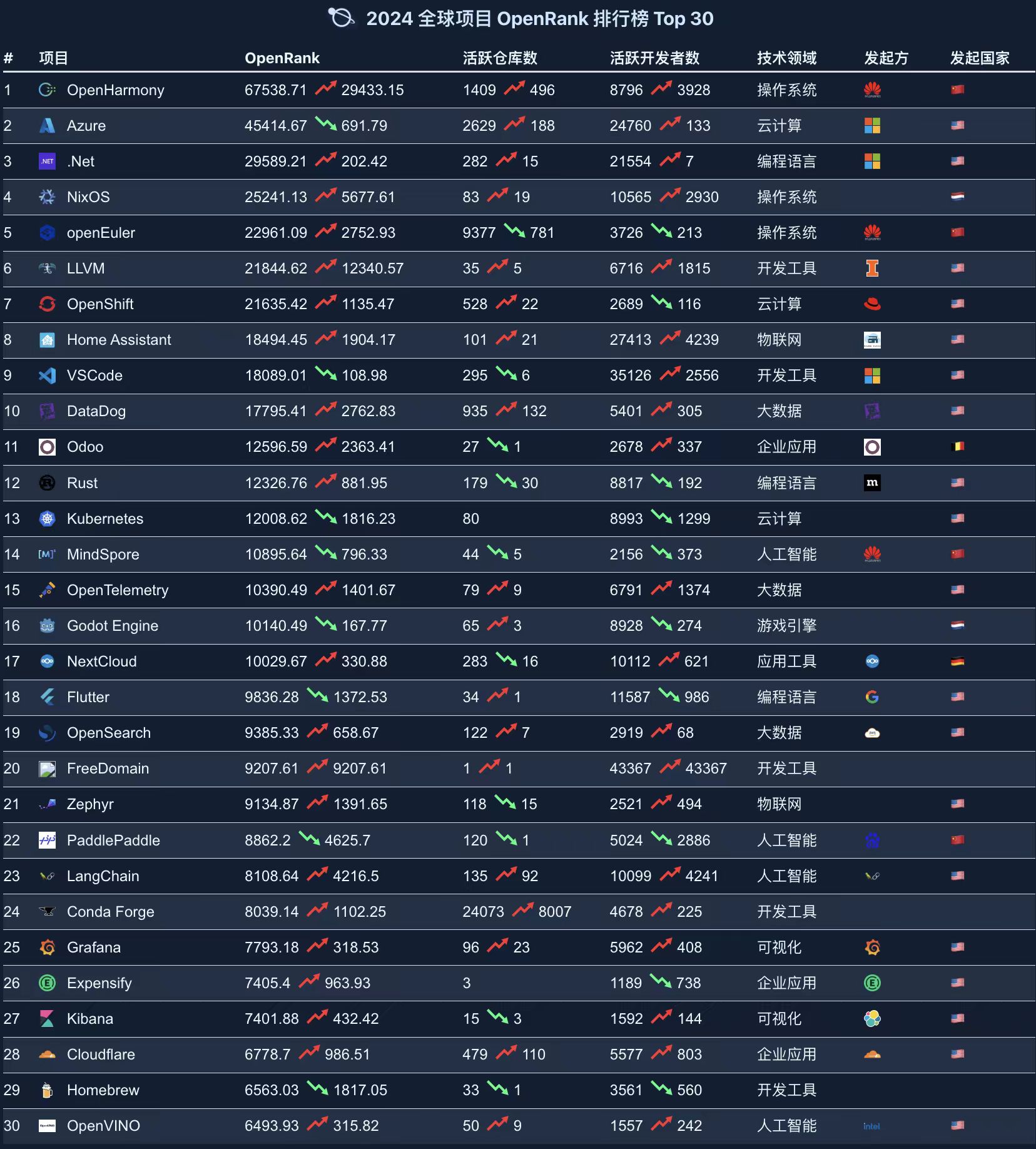

2.1 Ranking of Global Projects

According to the 2024 Global Project OpenRank Rankings Top 30, the Chinese open-source project OpenHarmony ranks first with an OpenRank value of 67538.71, demonstrating its exceptional activity and global influence in the open-source community. Azure and .Net rank second and third respectively. Notably, the OpenRank scores of OpenHarmony and LLVM have grown significantly over the past year, indicating their enormous growth potential and community influence in specific technology domains or technology stacks.

Rankings Overview:

- Covers multiple domains, including Operating Systems, Cloud Computing, Programming Languages, Internet of Things, Big Data, Artificial Intelligence, Game Engines, and Visualization Tools.

- Demonstrates the breadth and diversity of open-source projects, while reflecting the key focus areas and trending directions in the technology field.

2.2 Ranking of China Projects

The 2024 China Project OpenRank Rankings cover multiple technology domains, including Operating Systems (such as OpenHarmony), Artificial Intelligence (such as MindSpore), Databases (such as openGauss, TiDB), and Big Data Processing (such as Apache Flink). This indicates that the diversity and technical strength of Chinese open-source projects continue to grow.

Key Observations:

- Huawei occupies multiple positions in the rankings (such as OpenHarmony, openEuler), demonstrating its leading position and outstanding contribution in the Chinese open-source community.

- Artificial intelligence projects show impressive performance: MindSpore and PaddlePaddle rank third and fourth respectively, reflecting China's rapid development in the AI field.

- Rise of privacy computing projects: SecretFlow makes the list as a representative in the privacy computing field, indicating that emerging technology domains are gaining widespread attention.

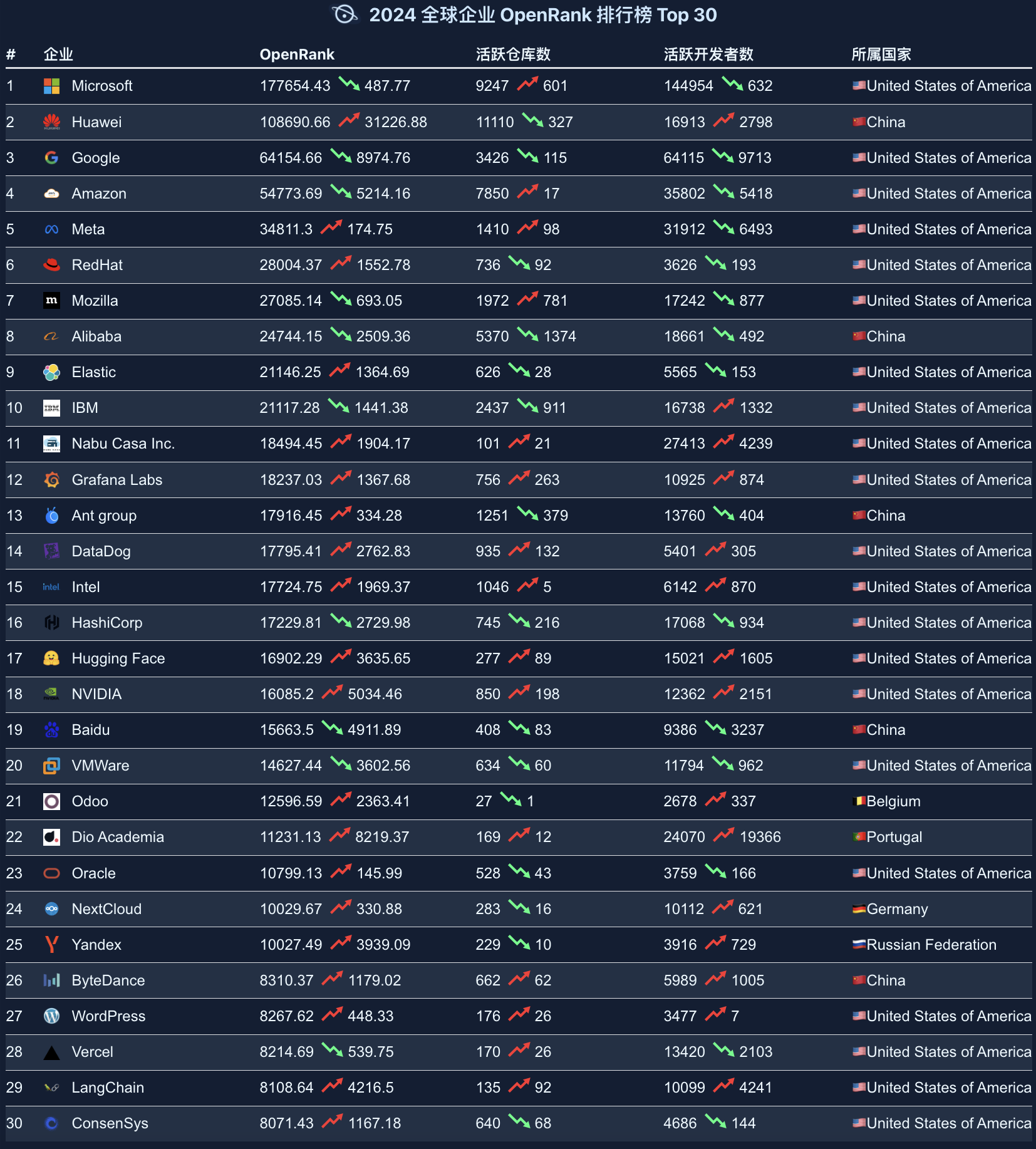

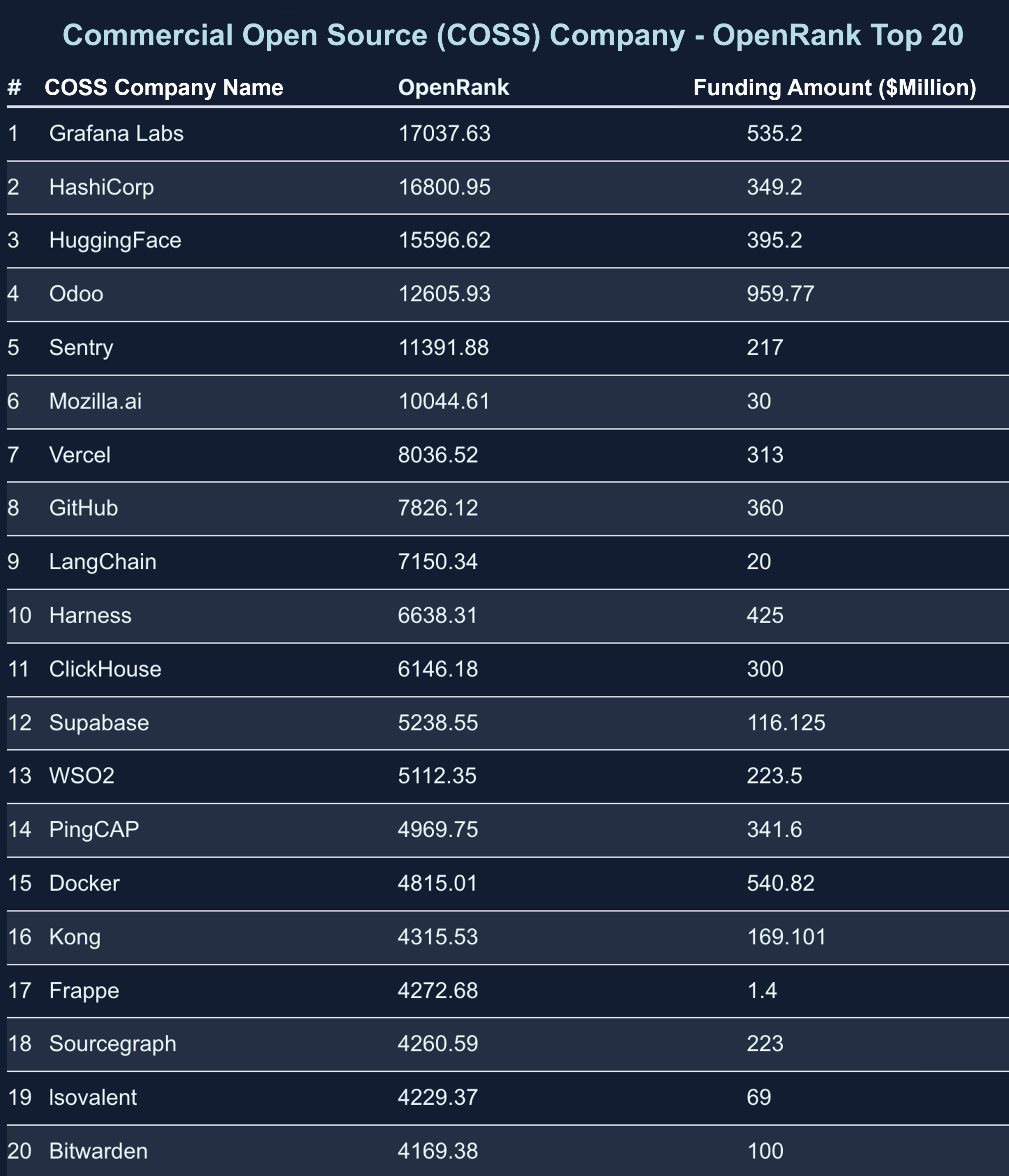

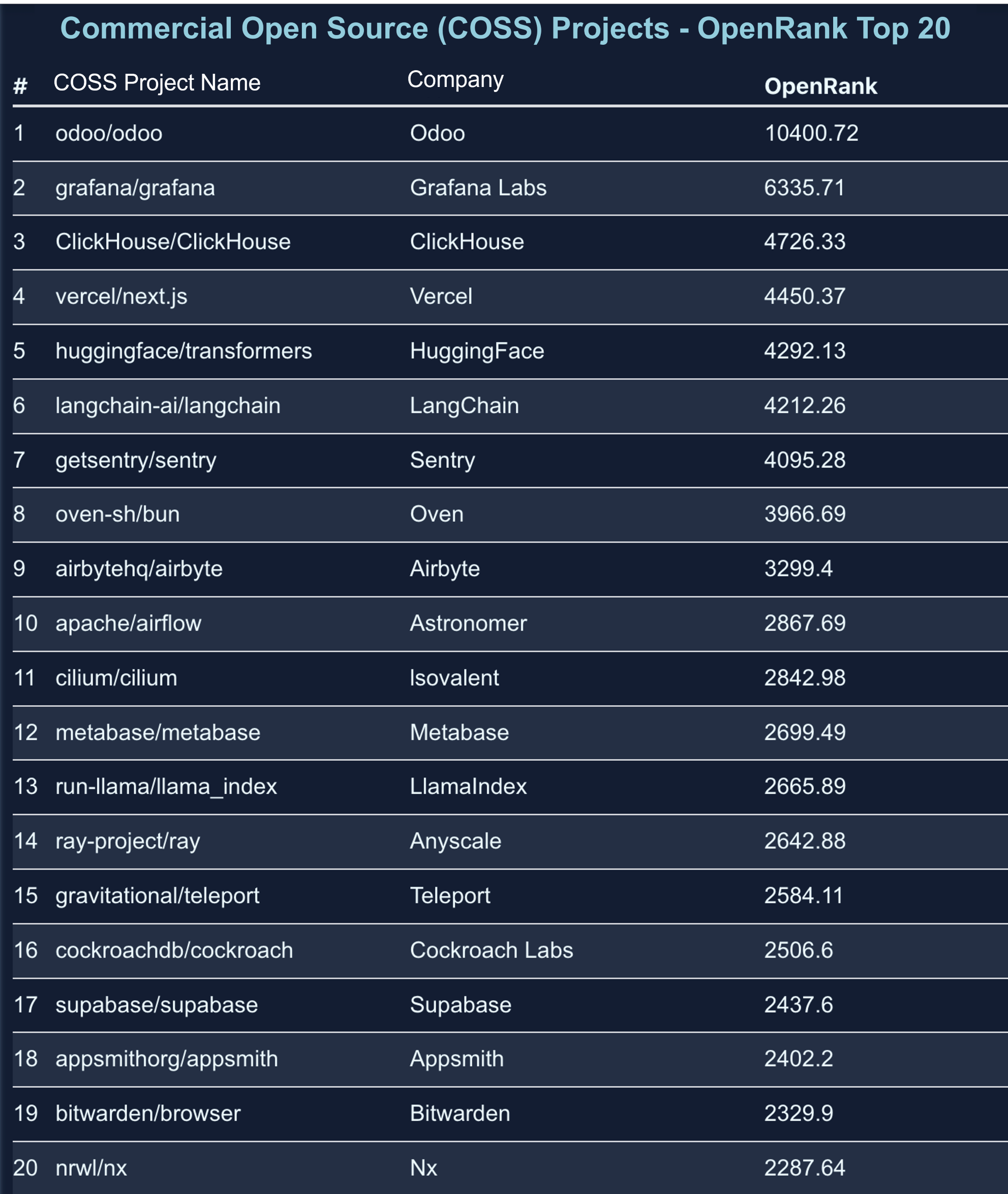

2.3 Ranking of Global Compies

The Global Enterprise OpenRank Rankings showcase the international and global characteristics of open-source projects, with American enterprises maintaining an absolute dominant position. Tech giants such as Microsoft, Google, and Amazon lead by a significant margin in OpenRank scores, demonstrating their leadership in the global open-source field.

Highlights:

- Rise of Chinese enterprises: Huawei and Alibaba rank second and eighth respectively, reflecting the continuously strengthening influence of Chinese enterprises in the global open-source ecosystem.

- Emergence of new enterprises: Emerging companies such as HashiCorp, Hugging Face, Vercel, and LangChain have also entered the rankings, indicating that innovation vitality in the open-source field continues to be released.

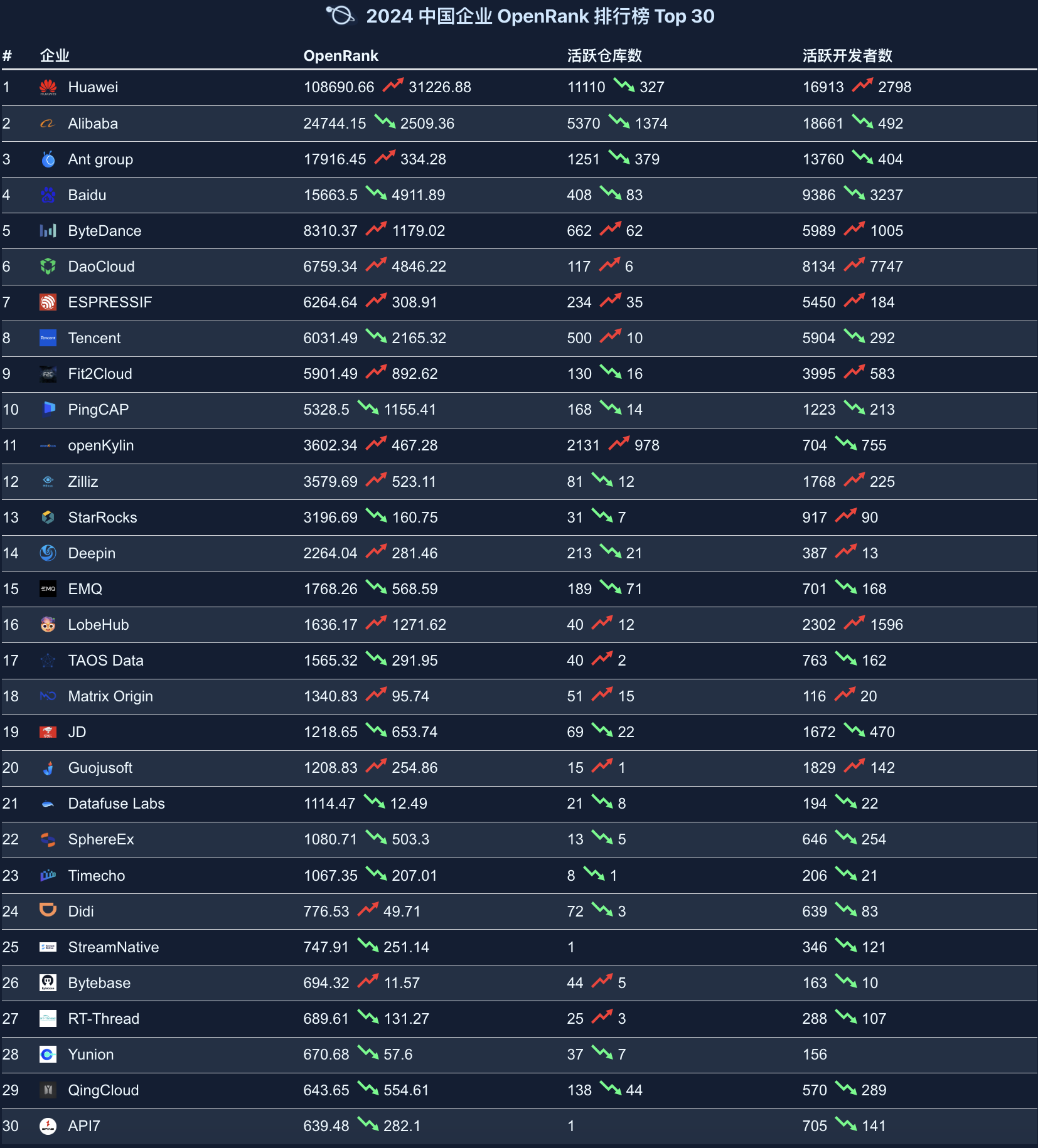

2.4 Chinese Enterprise Rankings

The 2024 Chinese Enterprise OpenRank Rankings are dominated by large enterprises, demonstrating the important role of Chinese companies in driving the development of the open-source ecosystem.

Key Observations:

- Huawei, Alibaba, Ant Group, Baidu, and other companies top the list, showcasing their positions as core driving forces in the open-source ecosystem.

- Companies like Tencent, Baidu, and Alibaba not only perform remarkably domestically but also have significant influence in global open-source projects.

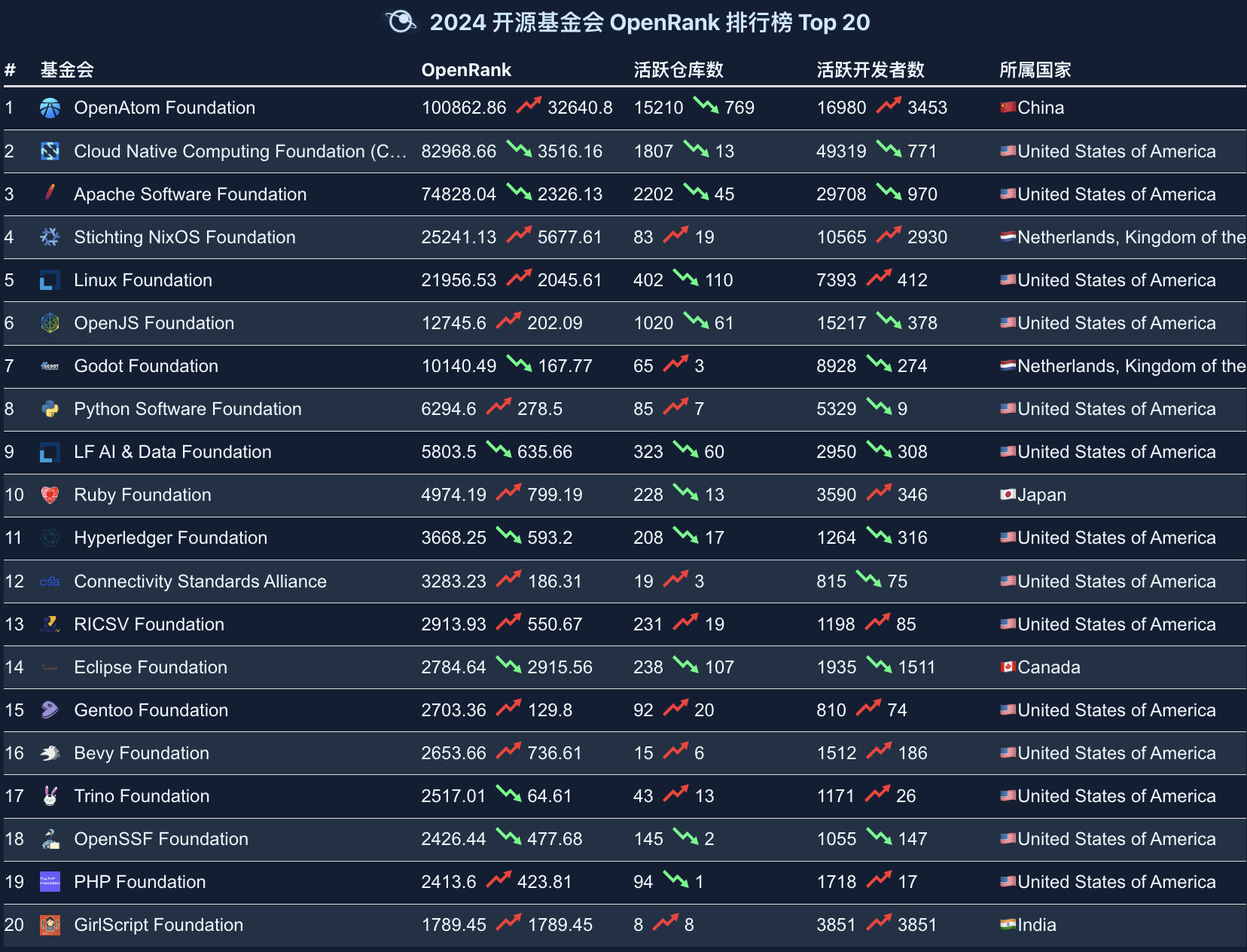

2.5 Ranking of Open Source Foundations

In the 2024 Open Source Foundation OpenRank Rankings, the OpenAtom Foundation ranks first, indicating that China has achieved important accomplishments in promoting large open-source projects.

Highlights:

- Several high-ranking American foundations (such as the Cloud Native Computing Foundation, Apache Software Foundation, and Linux Foundation) continue to maintain strong influence.

- The Netherlands' Stichting NixOS Foundation and Godot Foundation rank fourth and seventh respectively, demonstrating European participation and contribution in open-source projects.

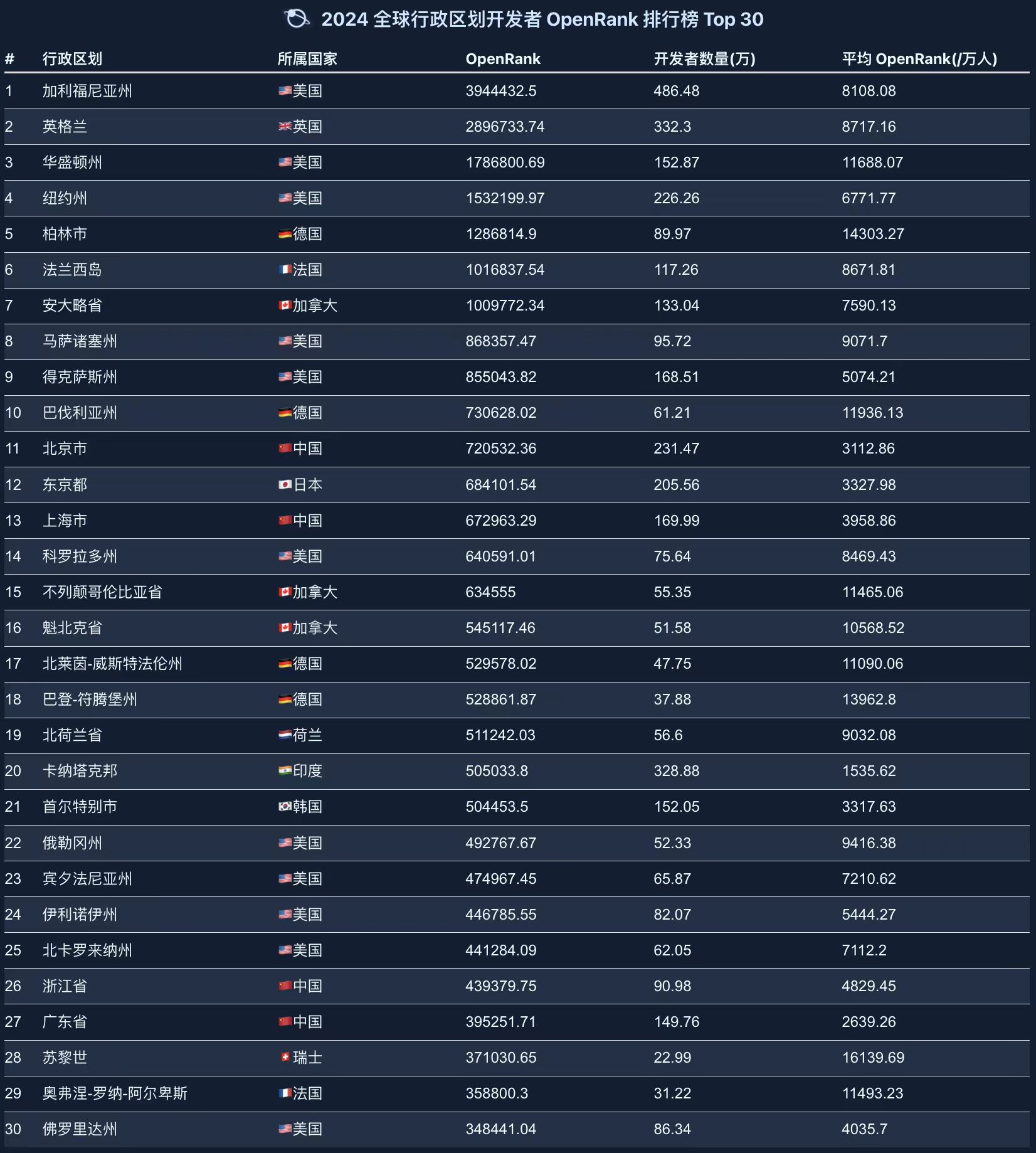

2.6 Global Developer Rankings by Region

The Global Administrative Division Rankings show that economically developed regions have higher levels of open-source development activity. Key Observations:

- United States dominance: Regions such as California (Silicon Valley), Washington State (headquarters of Microsoft and Amazon), and New York State are centers of global open-source activity.

- Cities in China such as Beijing and Shanghai also perform strongly, further consolidating their positions in the global open-source ecosystem.

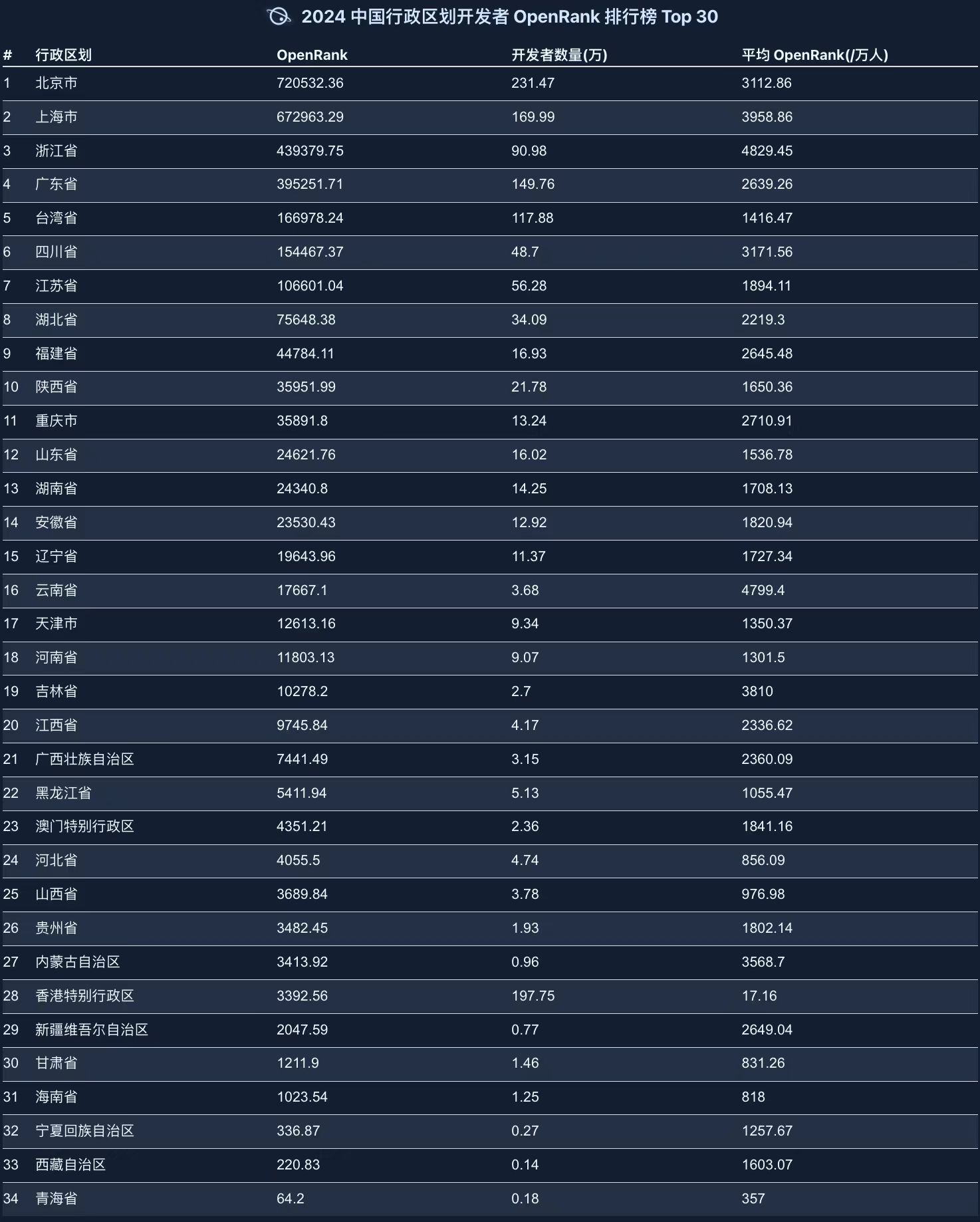

2.7 China Developer Ranking by Region

The Chinese Administrative Division Rankings show that first-tier cities like Beijing and Shanghai continue to dominate in open-source development, while coastal cities and some western regions also demonstrate significant development potential.

2.8 Global Ranking of Fastest Emerging Projects

The Global Emerging Force Project Rankings reflect highly active core projects and development teams, representing future technology trends and innovation directions.

Highlights:

- The UV project ranks first; as a Python package management tool, it has a very high number of active developers and tight collaboration.

- The Valkey project (fourth place): Forked from Redis, it is a high-performance key-value data storage project currently hosted by the Linux Foundation and supported by giants including AWS, Google Cloud, and Alibaba.

- Redot Engine (ninth place): A community-driven open-source game development engine, forked from the Godot engine, using the MIT license.

- The KWDB project (tenth place): As the only Chinese emerging force project on the list, KWDB is China's first open-source distributed multi-modal database, incubated by the OpenAtom Foundation, reflecting China's technological innovation and open-source contribution in the database field.

2.9 Summary and Trend Insights:

- Rise of China's open-source ecosystem: The global leading position of projects like OpenHarmony and the outstanding performance of companies like Huawei demonstrate China's rapid rise in the open-source field.

- Globalization and diversity: The rankings cover multiple technology domains and regions, fully reflecting the internationalization and technological breadth of the open-source ecosystem.

- Emerging technology drivers: Emerging fields such as privacy computing, distributed databases, and community-driven game engines are becoming hotspots in global open-source technology.

- Development recommendations:

- Support the incubation and development of emerging projects, especially the international promotion of Chinese projects.

- Strengthen support for open-source foundations and communities, promoting cooperation and innovation in the global open-source ecosystem.

- Guide more developers to participate in open-source projects, enhancing technological influence and global competitiveness.

3. Enterprise Insights

The role and performance of enterprises in the open source ecosystem are increasingly becoming a key dimension for measuring their technological innovation capabilities and industry influence. From global technology competition to localized industry applications, open source has become an important engine driving enterprise digital transformation and technological breakthroughs. With the continuous expansion of the open source ecosystem, the activity, contribution and influence of enterprises in the open source field have gradually become an important indicator for evaluating their comprehensive strength.

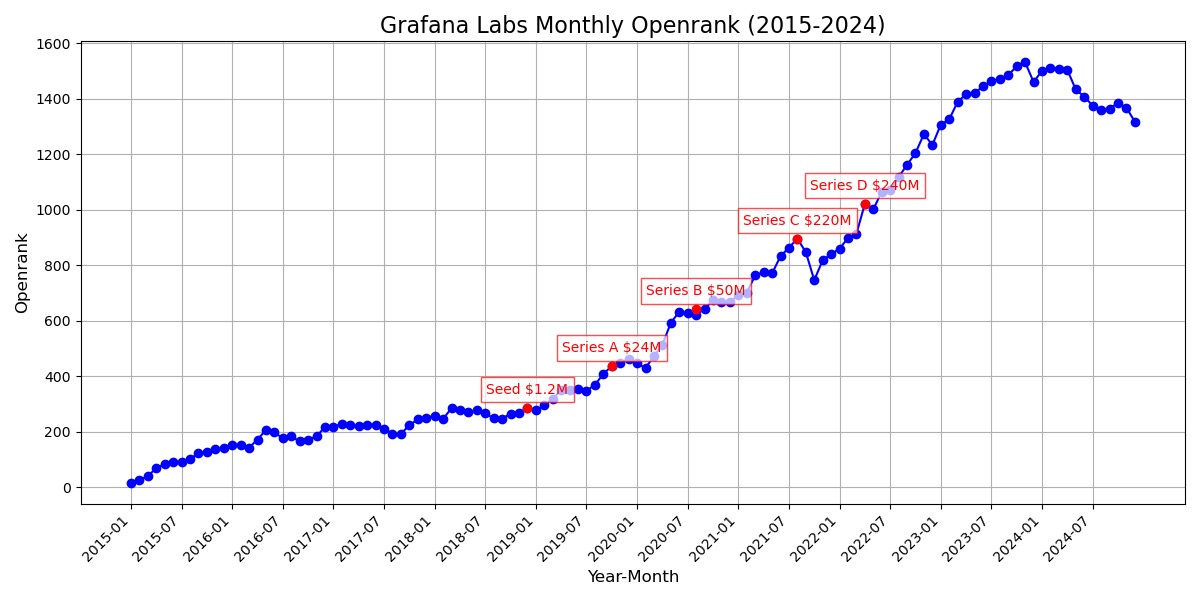

This section will analyze the evolution trends of OpenRank in global and Chinese companies over the past decade, and combine the activity level and OpenRank rankings in 2024 to deeply explore the performance of enterprises in the open source field and their role in promoting the industry ecosystem. Especially for DaoCloud, a dark horse among Chinese companies this year, will fully demonstrate its rapid rise and strategic layout in the field of cloud-native technology through data visualization, analysis of core project ecological collaboration networks and community collaboration networks, providing new references and inspirations for the industry.

3.1 Global Enterprise OpenRank Evolution Over the Past 10 Years

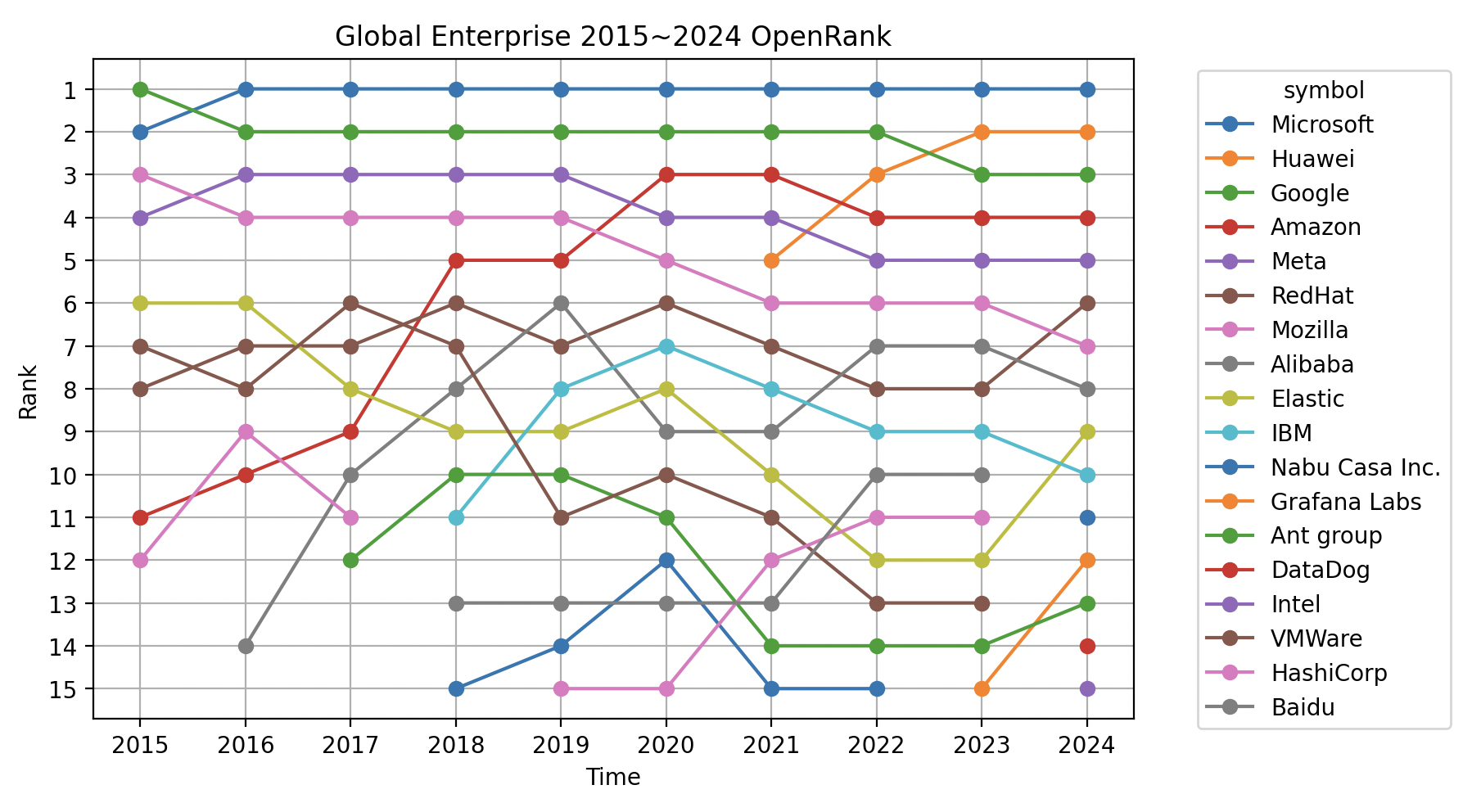

Observations on the influence of global enterprises in the open-source field:

- Microsoft: Since starting its open-source strategy in 2008, Microsoft reached the top of global open-source influence in 2016, and no one has shaken its position since.

- Huawei: After facing US sanctions in 2019, Huawei made open-source a key strategic direction. Its open-source influence has continued to soar, successfully surpassing Google and Amazon in 2023, achieving a major breakthrough.

- Alibaba: The leader of domestic open-source in China before 2021, currently holding a steady position at global eighth place.

- Ant Group: Outstanding performance in the past three years, entering the global top 15 for the first time in 2023, now ranking 13th, showing strong momentum in open-source development.

- Baidu: As the fourth largest giant in domestic open-source, due to the rapidly changing open-source landscape in China, it currently ranks 12th globally.

- Nabu Casa Inc: The global dark horse of 2023, entering the global Top 15 for the first time, currently ranked 11th, it is the world's largest open-source home automation platform.

- Intel: Entered the global Top 15 for the first time this year, ranking 15th, showing its gradual positioning and efforts in the open-source field.

- DataDog: Another newcomer to the Top 15, ranking 14th, this is a leading company providing cloud application monitoring and data analytics services, demonstrating its potential in the open-source field.

3.2 Chinese Enterprise OpenRank Evolution Over the Past 10 Years

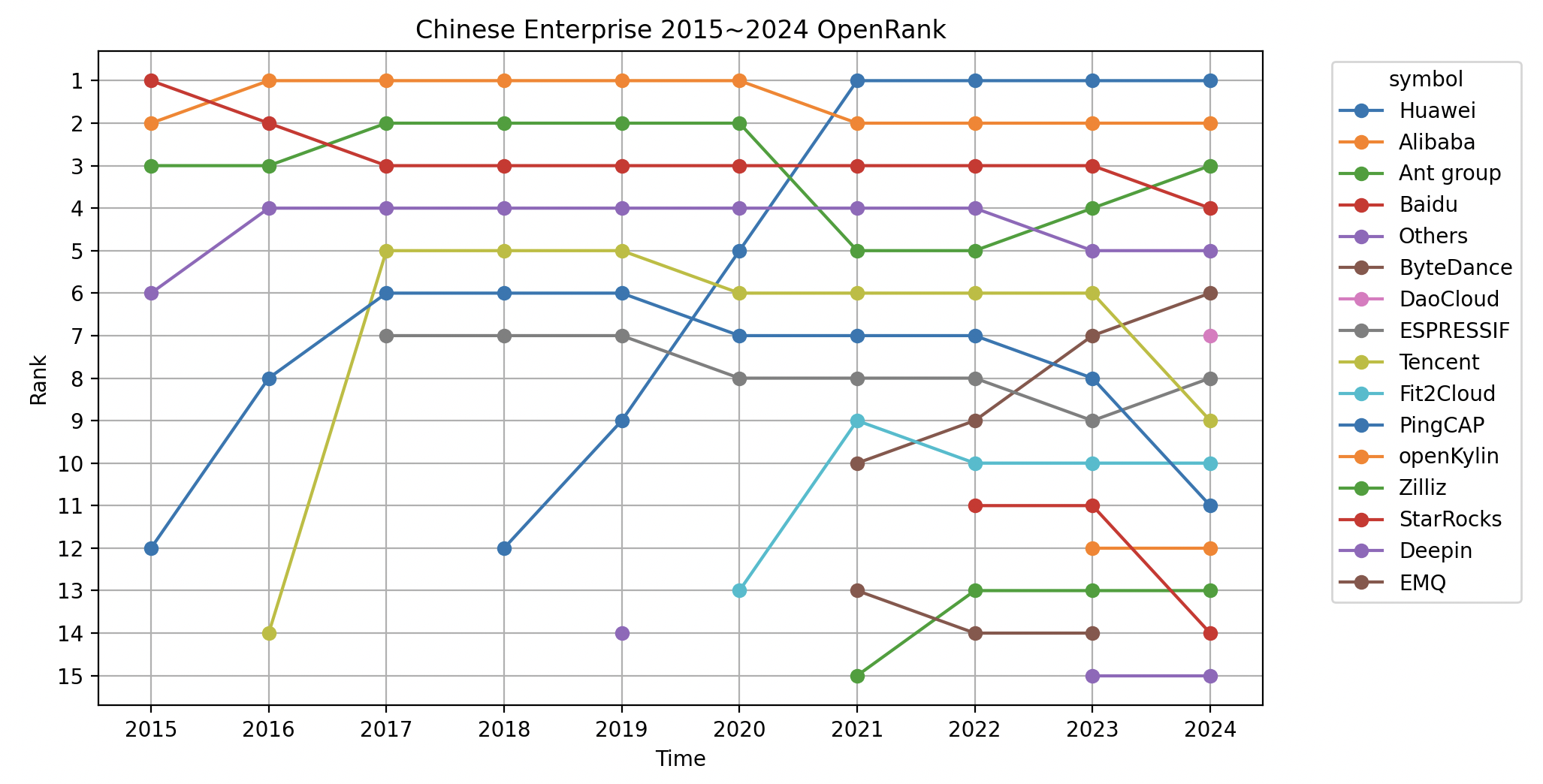

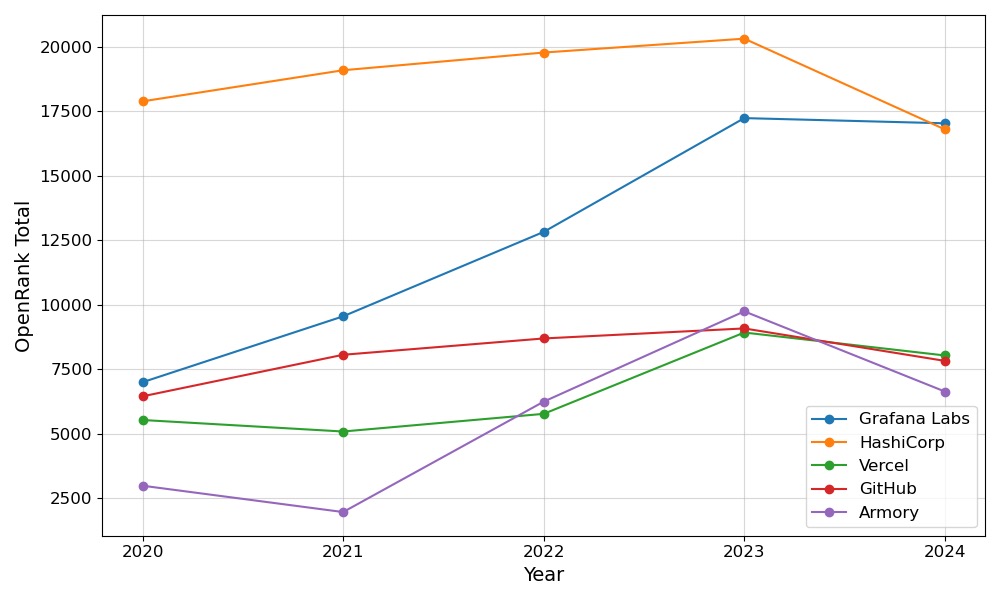

This figure clearly shows the strategic layout and changing trends of domestic enterprises in open-source:

- Huawei: Starting to exert effort in 2018, it took only two years to leap to first place in domestic open-source, and climbed to second place globally in 2023, demonstrating strong execution of its open-source strategy.

- Alibaba and Ant: As veteran leaders in the domestic open-source field, the two companies have maintained stable performance and continued to maintain leading positions.

- Baidu: Affected by the fierce competition from the top three companies, its ranking has slipped to fourth place domestically, but it still maintains high industry influence.

- ByteDance: Rapid progress in the open-source field in recent years, becoming an important emerging force in the domestic open-source ecosystem.

- Espressif: A low-key but powerful semiconductor open-source champion, occupying a place in the open-source world with solid technical contributions.

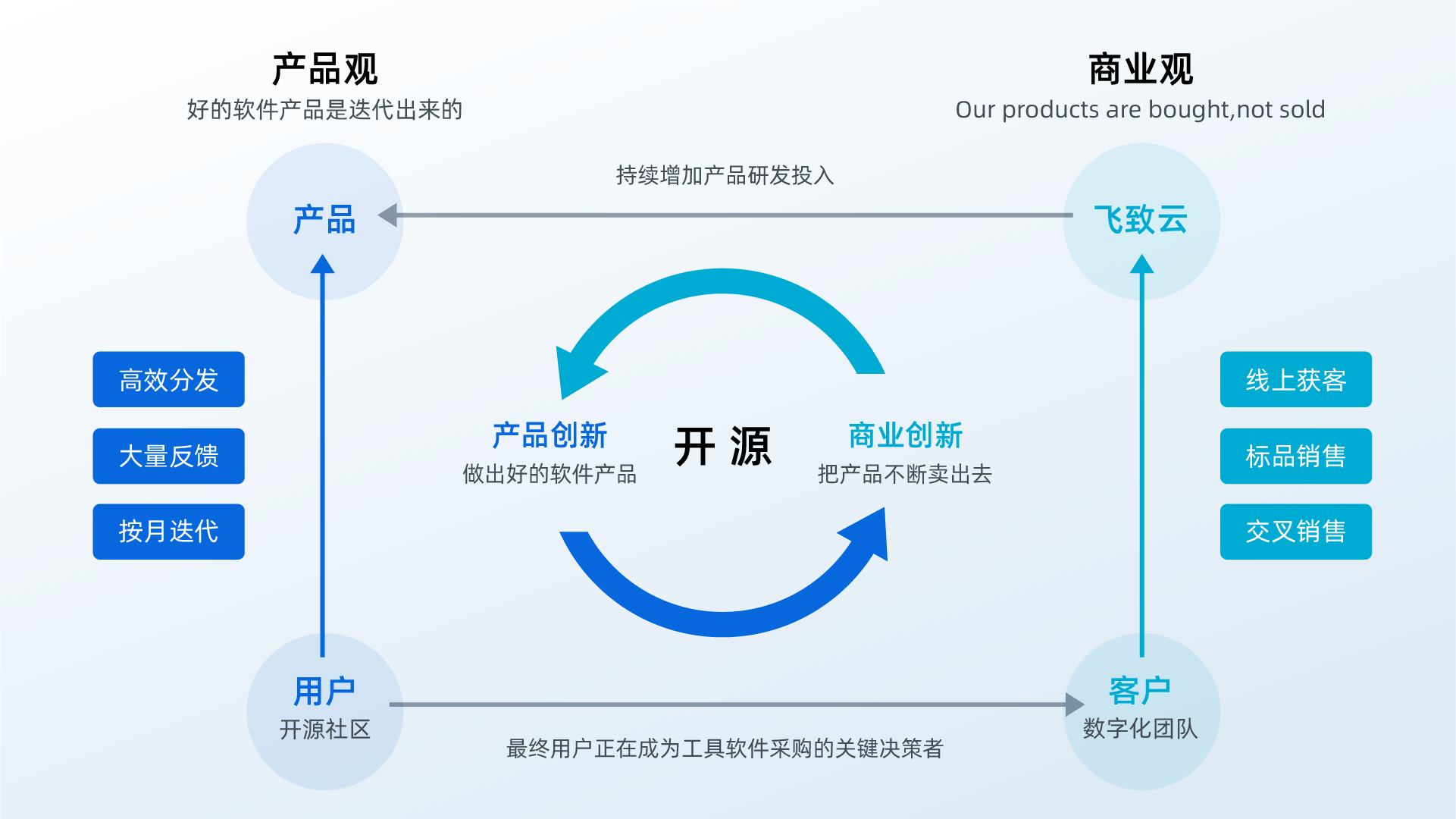

- Fit2Cloud: Another low-key and pragmatic open-source enterprise, whose multiple open-source software products are favored by developers, demonstrating strong practicality and influence.

- Emerging forces: In recent years, emerging enterprises such as Fit2Cloud, PingCAP, and StarRocks have rapidly risen, active in cloud computing, big data, AI, and infrastructure fields. The rapid development of these enterprises reflects that the technological trends of the domestic open-source ecosystem are gradually tilting towards cloud-native and big data.

Overall, these trends demonstrate the diversity and competitiveness of the domestic open-source field, as well as the direction of continued efforts in key technology areas.

3.3 Global Enterprise OpenRank Changes in 2024

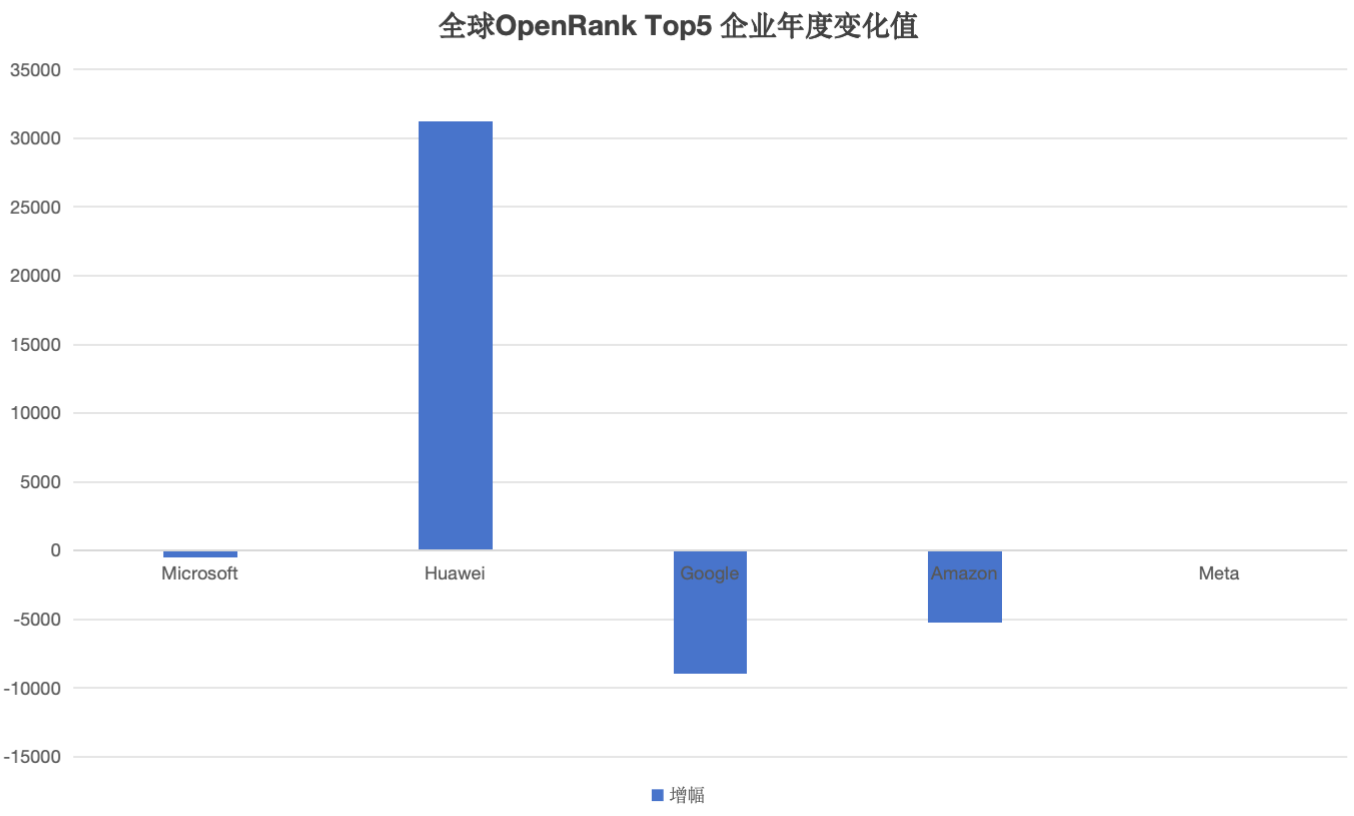

- Among the global Top 5 enterprises, Huawei and Meta are the only companies that achieved growth in 2024, with Huawei showing an extremely significant increase (+31,226.88), while Meta's growth was (+174.75).

- The OpenRank values of Microsoft, Google, and Amazon all declined, with Amazon experiencing the largest decrease (-8,974.76).

- After successfully surpassing Google and Amazon in 2023, Huawei continued to maintain strong growth momentum in 2024, with the increase again setting a new high. This not only suggests that Huawei may challenge Microsoft's global first position in the future, but also further indicates that Chinese enterprises are accelerating their layout in the global open-source community, gradually enhancing their influence in the international open-source ecosystem.

3.4 Chinese Enterprise OpenRank Changes in 2024

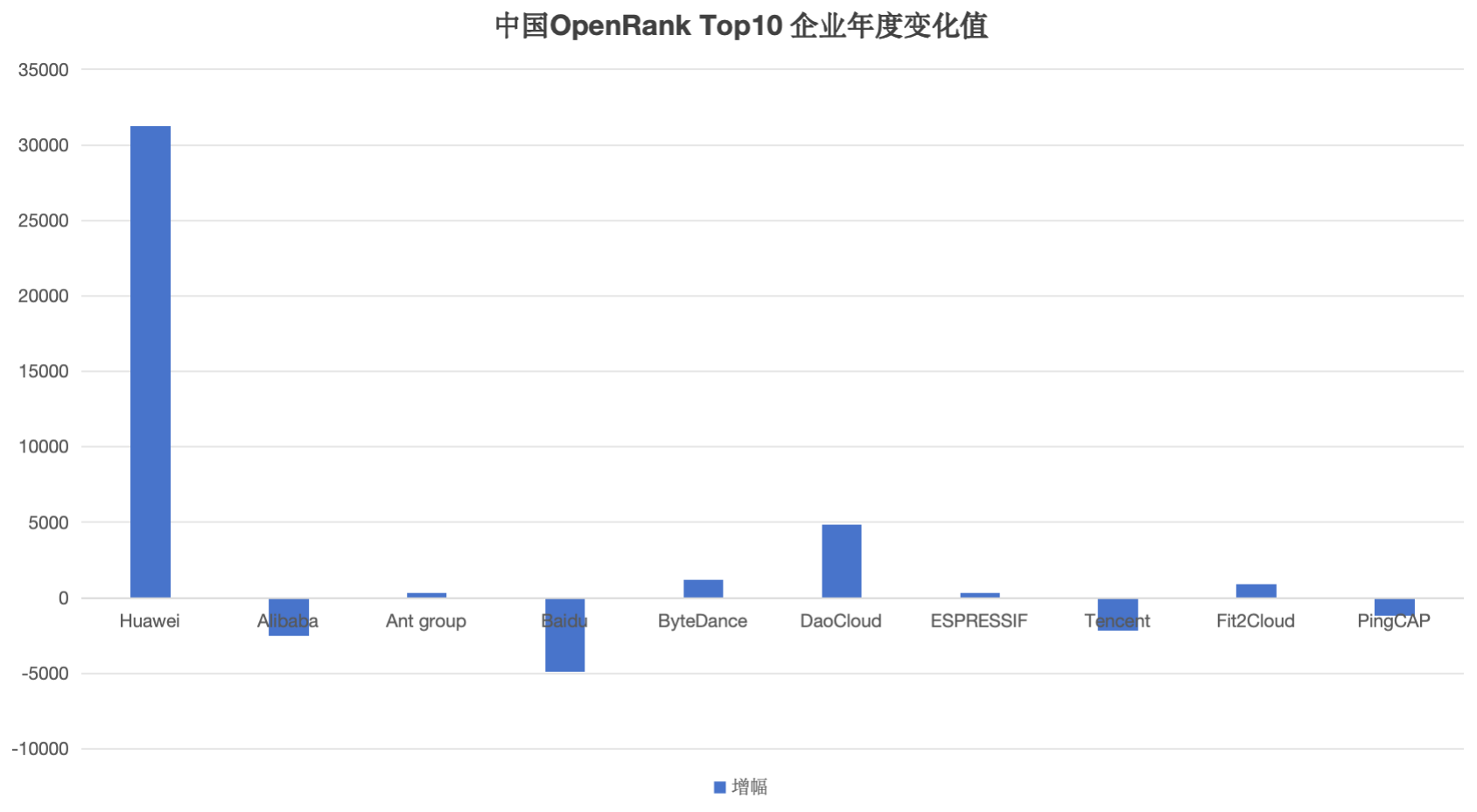

- Among the Chinese Top 10 enterprises, Huawei, Ant Group, ByteDance, DaoCloud, ESPRESSIF, and Fit2Cloud all achieved growth in 2024, with Huawei's growth being particularly significant (+31,226.88).

- DaoCloud was rated as the domestic annual growth dark horse, with a growth value of 4,846.22, and a total OpenRank value climbing to 6,759.34. Its domestic ranking jumped 9 places, successfully entering the national top 6. This performance made DaoCloud one of the most noticed enterprises in 2024, and a detailed analysis will be conducted on it later.

- Baidu experienced a significant decline in 2024, with an annual decrease as high as 4,911.89, becoming the company with the largest decline among Chinese enterprises. In the global enterprise rankings, Baidu fell 9 places, slipping to 19th globally. This performance is closely related to Baidu's judgment of open-source value and strategic layout, reflecting that its investment and influence in the open-source field have not maintained continuous growth.

3.5 An interpretation at DaoCloud, the Chinese company that rose to prominence in 2024

In the 2024 Chinese Enterprise OpenRank and activity rankings, DaoCloud successfully entered the top ten with outstanding performance. Its OpenRank ranking improved significantly by 9 positions from last year to 6th nationwide, while its activity ranking rose by 10 positions to 5th nationwide, making it the undisputed "dark horse" of the year.

Notably, in June 2024, when various university Docker mirror sites were blocked, many developers turned to DaoCloud, accelerating its rapid rise.

DaoCloud's rise is not only due to its long-term investment in the open-source field and technological innovation but also stems from its deep cultivation and promotion in the container cloud and microservice architecture domains. Meanwhile, DaoCloud actively participates in the research and development of mainstream open-source projects domestically and internationally, including the Kubernetes ecosystem, container orchestration tools, and cloud-native development frameworks. These efforts have significantly enhanced its status and influence in the open-source community.

DaoCloud's success not only demonstrates the exploration and practical achievements of Chinese technology companies in open-source technology development but also provides valuable reference paths for other small and medium-sized enterprises. Through technological innovation and community participation, DaoCloud has not only enhanced its own industry influence but also promoted the further prosperity of China's open-source ecosystem.

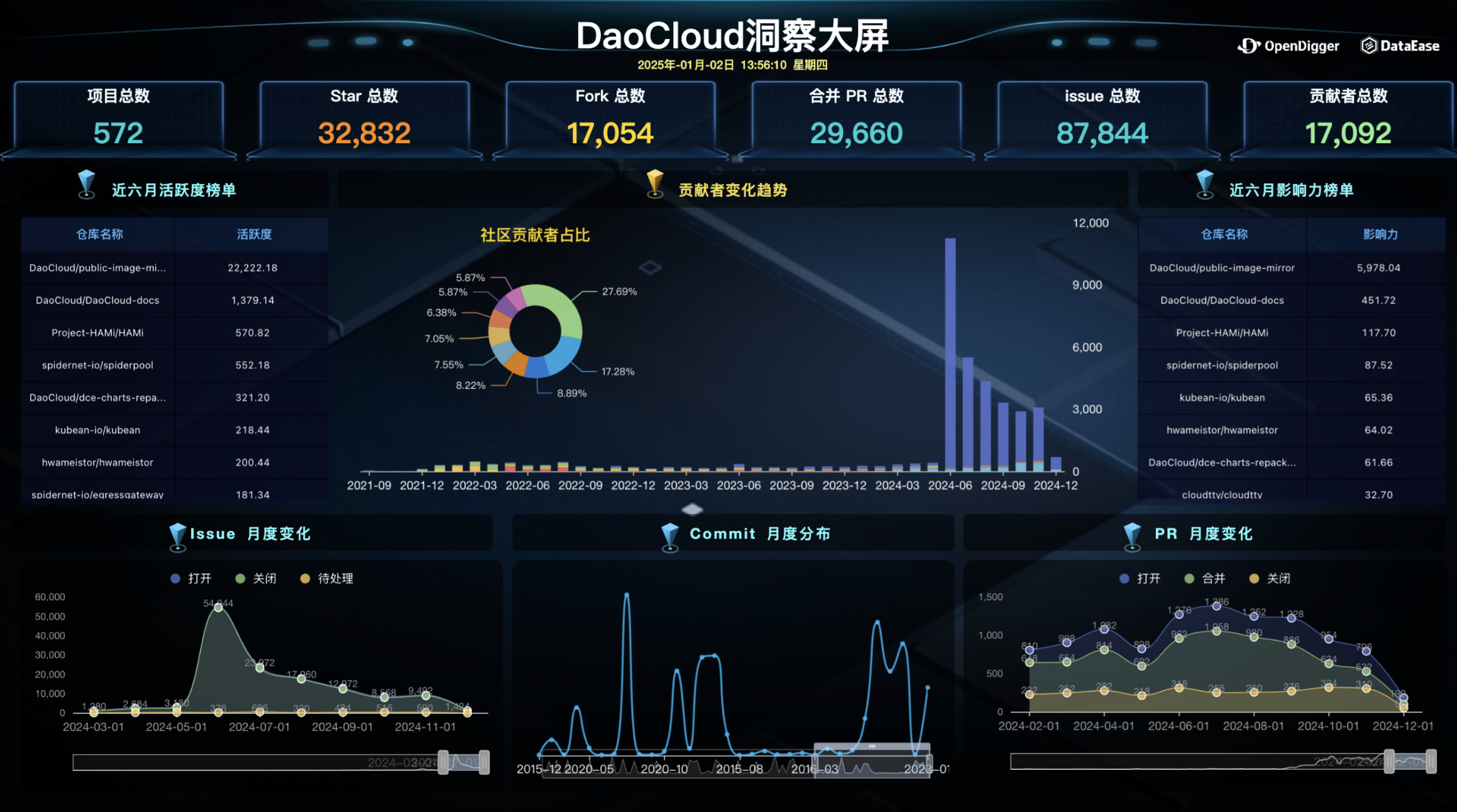

3.5.1 DaoCloud Enterprise Insight Dashboard

This figure displays the DaoCloud Insight Dashboard, comprehensively presenting DaoCloud's overall contribution situation, active project rankings, contributor distribution, and some key open-source activity metrics (such as trends in Issues, Commits, and PRs). These data provide important basis for analyzing community dynamics and development.

In terms of activity trends, DaoCloud's performance is particularly outstanding. First, the number of Issues peaked in May 2024 (exceeding 60,000), which might be closely related to new version releases or community discussions triggered by major events. Subsequently, the community's efficient response to issue closure and processing fully demonstrates its ability to quickly resolve problems. Additionally, the community's Commit activity has shown significant fluctuations historically, with two peaks occurring in 2020 and 2023 respectively, possibly related to important version releases or feature updates. The most recent peak appeared at the end of 2024, with a significant increase in Commit numbers, indicating the community's continued rise in activity. In terms of PR (Pull Request) performance, the number of opened, merged, and closed PRs in 2024 remained stable overall, reflecting efficient and orderly community development activities.

From an overall performance perspective, the DaoCloud community has demonstrated a healthy and continuously growing ecosystem. Its core projects public-image-mirror (public image service) and DaoCloud-docs (related documentation collaboration) have contributed major activity and influence in the community. Among them, public-image-mirror is dedicated to providing efficient and stable image support for developers, not only promoting the development of the DaoCloud community but also providing important support for domestic and international open-source users. As a documentation collaboration project, DaoCloud-docs significantly lowers the learning threshold for new developers by providing comprehensive technical documentation and development guides, and enhances user experience and technical dissemination capabilities through continuous optimization of document content.

In conclusion, the DaoCloud community has performed exceptionally well in multiple dimensions. The efficient handling of PRs and Issues highlights the close collaboration within the community, while the growth in the number of contributors, Commit activity, and PR activity indicates that the community is still developing rapidly and has the ability to attract more developers. The diverse contributor structure, stable development activities, and active project management further consolidate DaoCloud's important position in the open-source ecosystem. Through the successful operation of core projects, DaoCloud has not only enhanced its own industry influence but also provided valuable experience for the construction of other open-source communities.

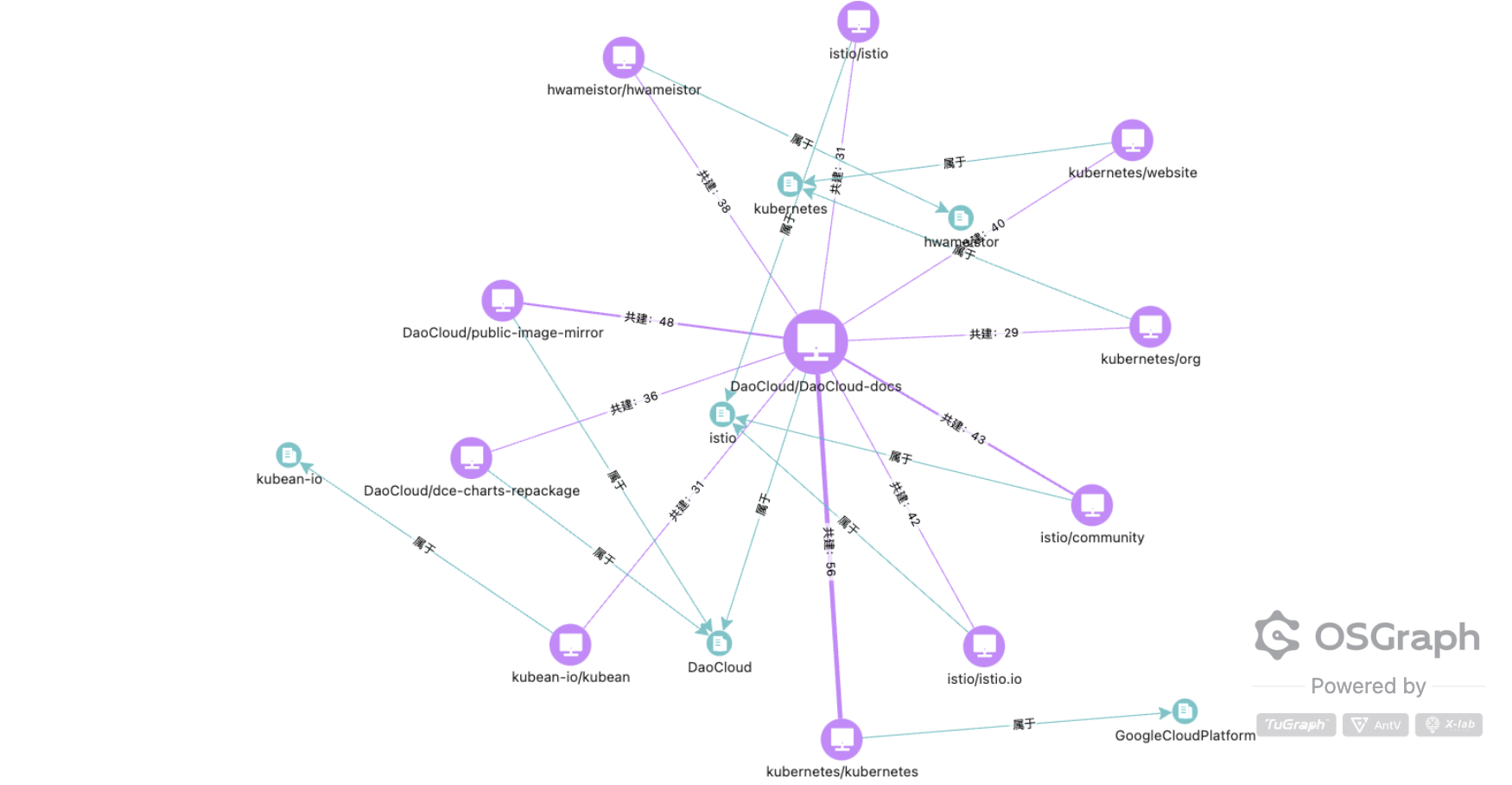

3.5.2 Ecosystem Collaboration Network of DaoCloud's Core Project DaoCloud-docs

This figure is the ecosystem network of the DaoCloud-docs project in the DaoCloud community, aimed at showcasing the interconnections between the project and other projects and organizations, as well as their development activities and cooperative relationships.

Key findings:

- Strong connection with Kubernetes: DaoCloud-docs has strong connections with multiple Kubernetes-related projects (such as kubernetes/kubernetes, kubernetes/website), indicating that it plays an important role in the Kubernetes ecosystem. This connection may come from DaoCloud's deep use, extension, or contribution to Kubernetes.

- Collaboration with Istio: DaoCloud-docs also has significant associations with the Istio project (such as istio/istio, istio/istio.io), indicating its synergistic role in service mesh technology.

- Other partners: In addition to Kubernetes and Istio, DaoCloud-docs also has connections with multiple projects such as GoogleCloudPlatform and Kubean-io, showing its activity in multi-cloud and container technologies.

3.5.3 Community Collaboration Network of DaoCloud's Core Project DaoCloud-docs

This figure shows the Project Community Network of the DaoCloud-docs project, analyzing the distribution and composition of the project community through development activities and organizational associations.

Key findings:

- Core strength of the community: Chinese developers and organizations are the core strength of this project community, with the main contributors and associated organizations coming from China. Developers windsonsea and samzong are the individuals who have contributed the most, and the number of PRs they submitted indicates their leading role in the project. This year, windsonsea also received the annual "Best Technical Documentation Award" Top Documentarian from the CNCF community (https://mp.weixin.qq.com/s/tdO2QhvE800TKy5RY7FCWw).

- International influence: Although the core of the community is concentrated in China, the project has also attracted attention from developers in other countries and regions, such as the United States and South Korea, indicating that the DaoCloud-docs project has a certain international influence.

- Organizational collaboration: The participation of different organizations such as EMC and @DaoCloud shows the characteristics of cross-organizational collaboration, which helps enhance the diversity and influence of the project.

The DaoCloud-docs project community has shown significant localization characteristics, with Chinese developers and organizations as the main contributing force, while also having international potential.

3.5.4 Ecosystem Collaboration Network of DaoCloud's Core Project public-image-mirror

Strongly connected projects:

- kubesre/docker-registry-mirrors (connection strength: 161) and DigitalPlatDev/FreeDomain (connection strength: 176) are the two projects most closely linked to the public-image-mirror project, possibly as a result of joint development, resource sharing, or technical integration.

- kubernetes/kubernetes (71) and alibaba/nacos (52) also have significant associations with it, indicating that they may use or depend on this image project.

- Collaboration with multiple tools and image services: The project has more interaction with image tools such as imdingtalk/image-mirror and langenius/dify, suggesting that the public-image-mirror project may provide infrastructure support for these tools.

- Collaboration with other core projects: DaoCloud/DaoCloud-docs is another core project belonging to DaoCloud that is closely related to it, possibly collaborating on documentation and configuration-related development.

3.5.5 Community Collaboration Network of DaoCloud's Core Project public-image-mirror

Main contributors:

- wzshiming submitted a large number of PRs (279) and is a core contributor to the project.

- Other contributors such as JaredTan95, yank1, and cuisongliu have also made significant contributions to the project through PRs, Stars, and other forms.

Main sources of contribution:

- China is the main source of community collaboration, showing the localization characteristics of the project.

- The United States and Taiwan have also participated in the collaboration, indicating that the project has certain international influence.

4. Foundation Insights

As a non-profit open source organization, the Foundation plays an indispensable role in promoting the organization, development and collaborative innovation of open source projects and communities. It not only provides a full range of services such as technical support, operation and management, and legal protection for the incubation of open source software, but also provides governance guidance for the construction and operation of the community, becoming a combination of incubator and accelerator, and injecting the power of continuous development into the open source ecology. As an important organizer of the open source ecosystem, foundations play the role of a bridge between developers, enterprises and the community due to their standardized operation mode and resource integration ability. This section analyzes the development of the open source ecology from the dimension of foundations, aiming to reveal the core position and actual contribution of foundations in the open source ecology through data insights.

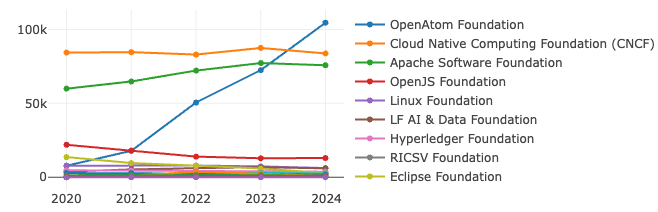

4.1 OpenRank Trend Analysis of Global Foundations

*Note: The Linux Foundation mentioned here does not include its sub-foundations.

- The OpenAtom Foundation has performed particularly prominently, with its influence continuing to rise rapidly, becoming the highlight of 2024. This reflects its strong ecosystem expansion capabilities and project influence.

- In contrast, the growth momentum of CNCF (Cloud Native Computing Foundation) and Apache Software Foundation has significantly slowed. Although they still maintain a high level of influence, their OpenRank saw a slight decline in 2024, which may reflect the maturation of cloud-native technologies and intensified competition.

- Meanwhile, the Linux Foundation continues to develop steadily, demonstrating strong stability. Foundations such as the OpenJS Foundation and Hyperledger Foundation have shown little fluctuation.

The overall trend in 2024 indicates that rapidly growing foundations are gaining market recognition through innovative technologies and robust community ecosystems, while mature foundations need to find new breakthroughs to cope with increasingly fierce competition while maintaining their existing advantages.

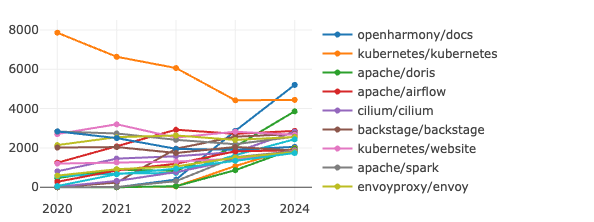

4.2 OpenRank Trend Analysis of Global Foundation Projects

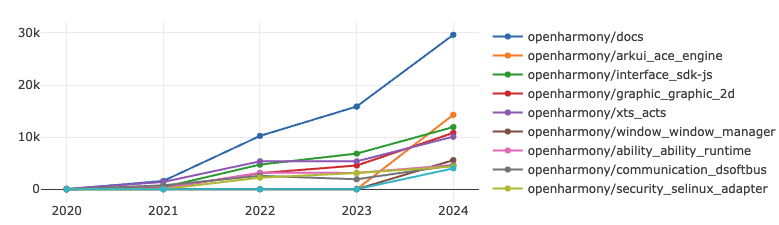

- The influence of the OpenHarmony/docs has risen rapidly, with its OpenRank reaching a historic high in 2024, likely due to the expansion of its ecosystem and the promotion of community activities.

- In contrast, the OpenRank of Kubernetes/kubernetes has been declining since 2020, and its influence further weakened in 2024. This may be closely related to a decrease in community activity or the rise of competitors.

- Apache/doris is another project worth noting, as its OpenRank continued to grow steadily in 2024. This indicates that the project's performance in the field of data processing continues to gain recognition from users and the community.

- Meanwhile, some mature projects, such as Cilium/cilium and Envoyproxy/envoy, showed relatively stable performance in 2024, with minimal fluctuations in OpenRank. This suggests that these projects have entered a stable development phase, maintaining their influence at a certain level.

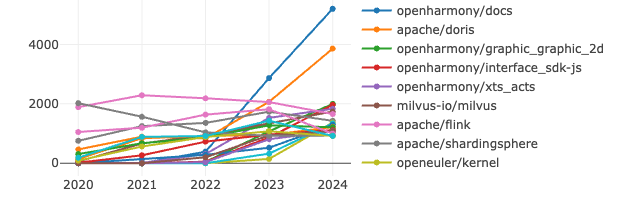

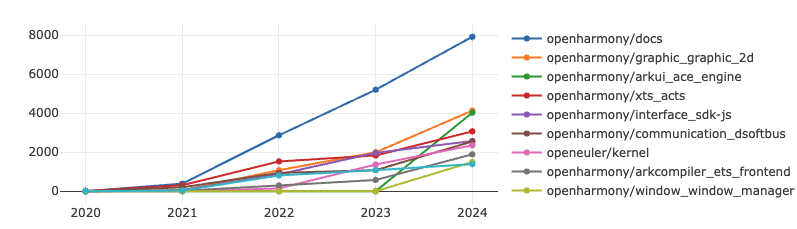

4.3 OpenRank Trend Analysis of the Global Foundation's Chinese Projects

In 2024, among the Chinese projects under foundations, top projects experienced rapid growth, while others developed steadily. Chinese open-source projects demonstrated strong influence and growth potential across various technical fields.

- openharmony/docs ranked first, and other core modules of OpenHarmony (such as graphic_graphic_2d, interface_sdk-js, and xts_acts) also ranked high, reflecting the OpenHarmony community's strong emphasis on promoting ecosystem development. This indicates that OpenHarmony has built a mature and active community ecosystem in the operating system field, with its core components gaining widespread attention and participation from developers.

- Chinese projects have also shown significant influence in the database field. In the field of distributed data processing and storage, apache/doris, as a high-performance analytical database project, ranked second, highlighting its importance in big data and analytics scenarios. Additionally, milvus-io/milvus, focused on vector database development, along with apache/flink and apache/shardingsphere, represents the innovative capabilities of domestic developers in real-time computing and distributed database technologies.

- Furthermore, openeuler/kernel, as a core module of openEuler, is a representative project in the domestic operating system field, reflecting continuous progress in foundational software technologies and the achievements of community collaboration. Meanwhile, openharmony-sig/arkcompiler_runtime_core demonstrates that the domestic operating system ecosystem not only focuses on kernel development but also emphasizes breakthroughs in key technologies such as compilers and runtime systems.

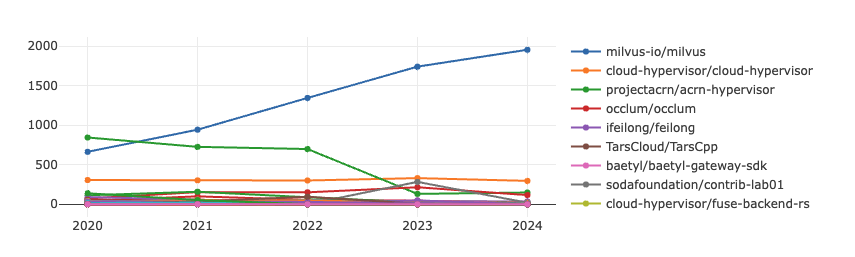

OpenRank Trend Analysis of Chinese Projects Under the Linux Foundation

As a key organization in the global open-source community, the participation and development of Chinese projects within the Linux Foundation reflect China's influence in the global open-source ecosystem.

- The OpenRank of the milvus-io/milvus has grown rapidly. Milvus is an open-source vector database project initiated by Zilliz and contributed to the LF AI & Data Foundation, a sub-foundation of the Linux Foundation. It focuses on the efficient storage and retrieval of unstructured data (such as images, videos, audio, and text), making it particularly suitable for machine learning and artificial intelligence-related scenarios. In 2024, milvus-io/milvus ranked sixth in the Linux Foundation's OpenRank, showcasing China's strong influence in the fields of big data and artificial intelligence.

- Overall, the OpenRank of most projects remains relatively low and shows little change. This disparity provides insights for other Chinese projects: by leveraging technological innovation, market adaptation, and community engagement, projects can enhance their competitiveness and vitality, ensuring long-term influence in the open-source ecosystem.

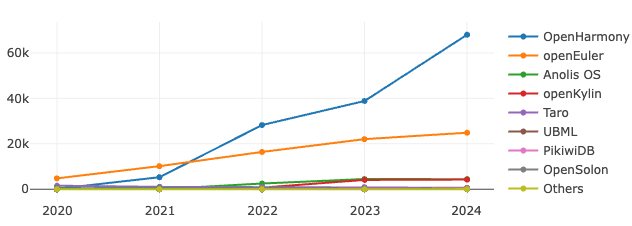

4.4 OpenRank Analysis of Projects Under the OpenAtom Foundation

- OpenHarmony continues to hold the top position, with its OpenRank metric showing significant growth compared to 2023, increasing by nearly 70%. This demonstrates its strong appeal as a core project. Such growth may be attributed to its widespread application in smart devices and operating systems, as well as the continuous investment and support from its community.

- openEuler follows closely behind, maintaining its growth momentum in 2024 with steady increases in OpenRank. This indicates its expanding influence in the field of open-source operating systems and its further adoption in cloud computing and enterprise applications.

- The performance of Anolis OS and openKylin in 2024 has been relatively stable. Although their growth rates are not as pronounced as the top two, they remain competitive in specific domains. Anolis OS focuses on the enterprise Linux market, while openKylin targets domestic operating systems, both maintaining a certain level of recognition within their target user groups.

- Other projects such as Taro, UBML, and PikwiDB have lower OpenRank values, reflecting their limited ecosystem scale or the fact that their application scenarios have not yet been widely adopted.

5. Technology Insights

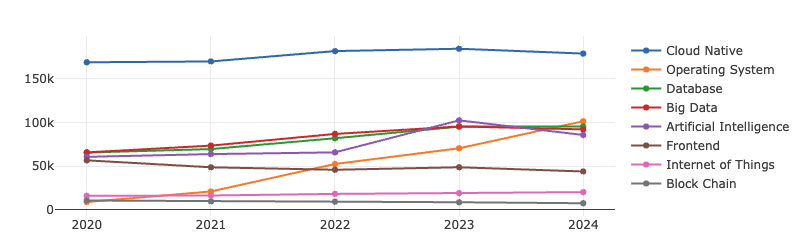

The development of technology plays a pivotal role in the open-source ecosystem, with numerous subdomains demonstrating rapid progress and transformation. Operating Systems: Continuously adapting to new architectures and evolving within the open-source community, showcasing strong ecosystem expansion capabilities. Cloud-Native Technologies: Driving enterprise digital transformation, with an active and rapidly growing open-source project ecosystem, becoming a key driver of technological innovation. Databases: As the core infrastructure for data innovation, the widespread adoption of open-source technologies has facilitated breakthroughs in diverse scenarios. Big Data: Leveraging open-source tools to provide robust support for intelligent decision-making, advancing data-driven applications. Artificial Intelligence: Accelerating automation across industries through open-source frameworks, emerging as a critical force in technological transformation. Front-End Technologies: Enhancing interactive experiences and visual design through open-source projects, improving user experience and development efficiency. These fields, characterized by their openness and innovativeness, have attracted significant attention from developers and investors. This section will provide a data-driven analysis of these technology domains based on two key metrics: influence and activity, revealing their development trends and future potential.

5.1 Trends in the Technical Subfields over the Past 5 years

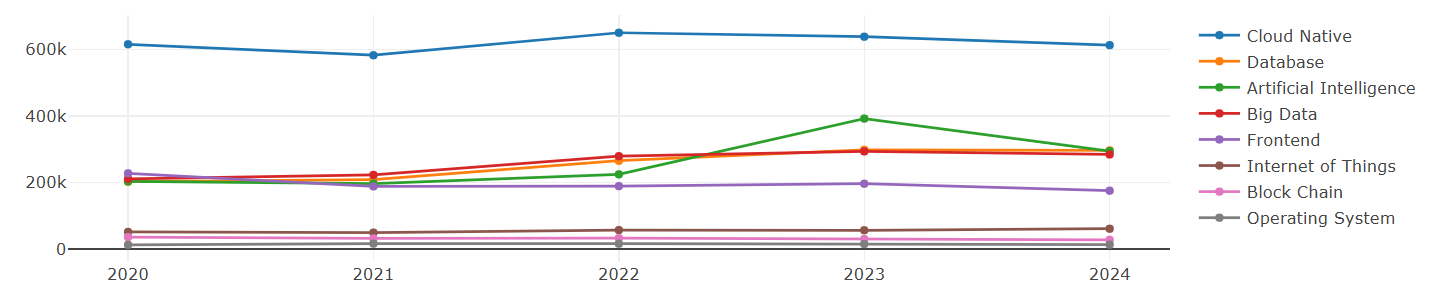

From the trends observed in various categories over the past five years, cloud-native technologies have shown a clear advantage, with a relatively higher number of repositories compared to other areas. AI has experienced significant growth in recent years, reflecting its rapid development. Databases, as critical foundational software, have consistently maintained a strong presence due to their high activity levels. The popularity of big data saw a slight decline in 2024. Although the operating systems field has fewer repositories, its influence has been steadily increasing, highlighting the high value of foundational software. Meanwhile, the influence of front-end technologies has been gradually declining.

5.2 OpenRank of Top 10 Projects in Each Category over the Past 5 Years

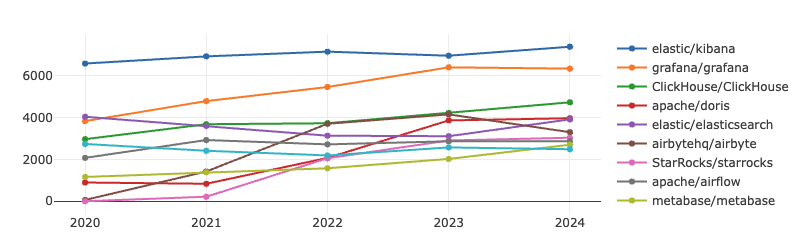

Big Data

In the big data section, the two key metrics have shown an overall upward trend, with Kibana and Grafana consistently ranking in the top two in terms of influence and activity. Notably, the gap between the two narrowed gradually in 2023, but began to widen again in 2024. Additionally, the competition between Clickhouse and Doris in the big data space is becoming increasingly intense.

Kibana is an open-source data visualization and exploration tool that seamlessly integrates with ElasticSearch, supporting querying, analyzing, and visualizing ElasticSearch data.

Grafana, on the other hand, is a powerful open-source data visualization tool widely used in monitoring and reporting scenarios. It supports multiple data sources, including Prometheus, InfluxDB, and Graphite, and can generate various types of charts and dashboards, providing users with flexible data display and analysis capabilities.

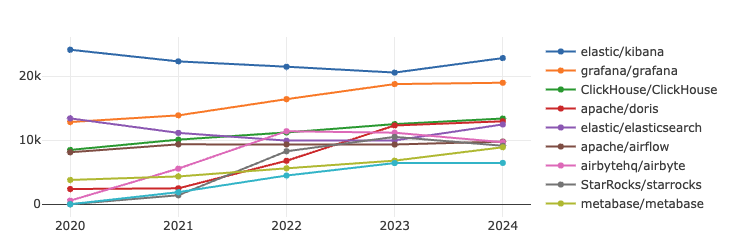

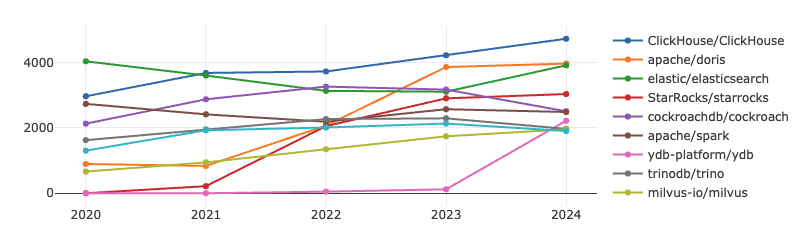

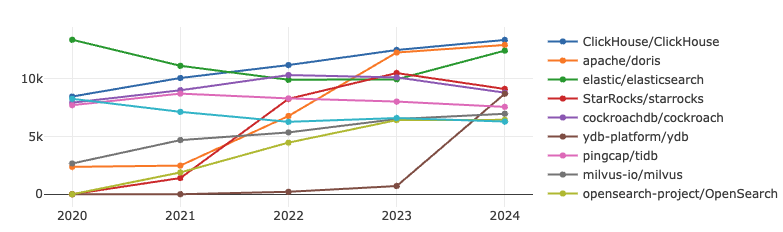

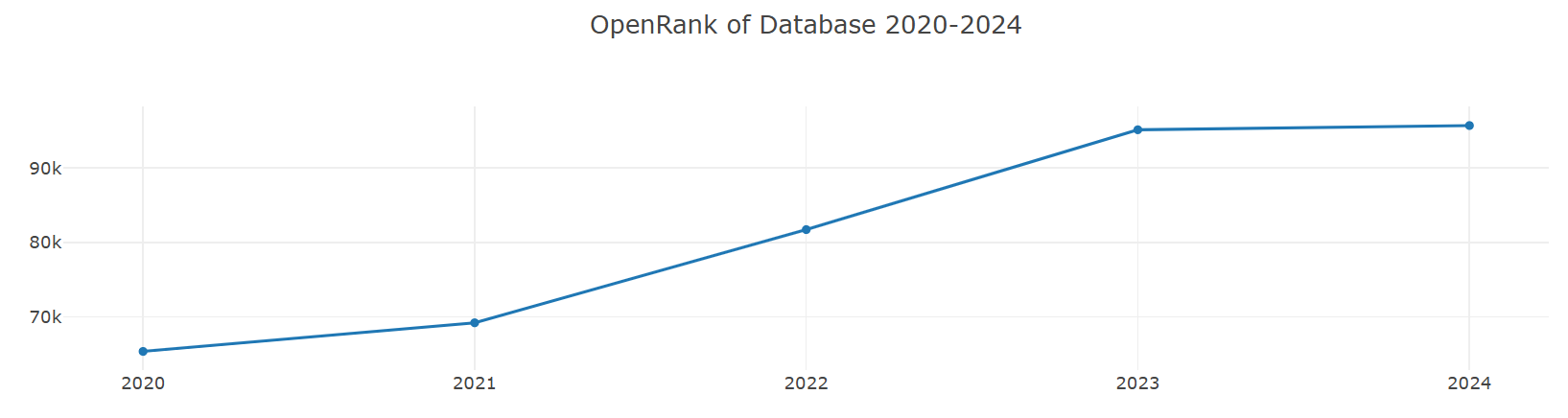

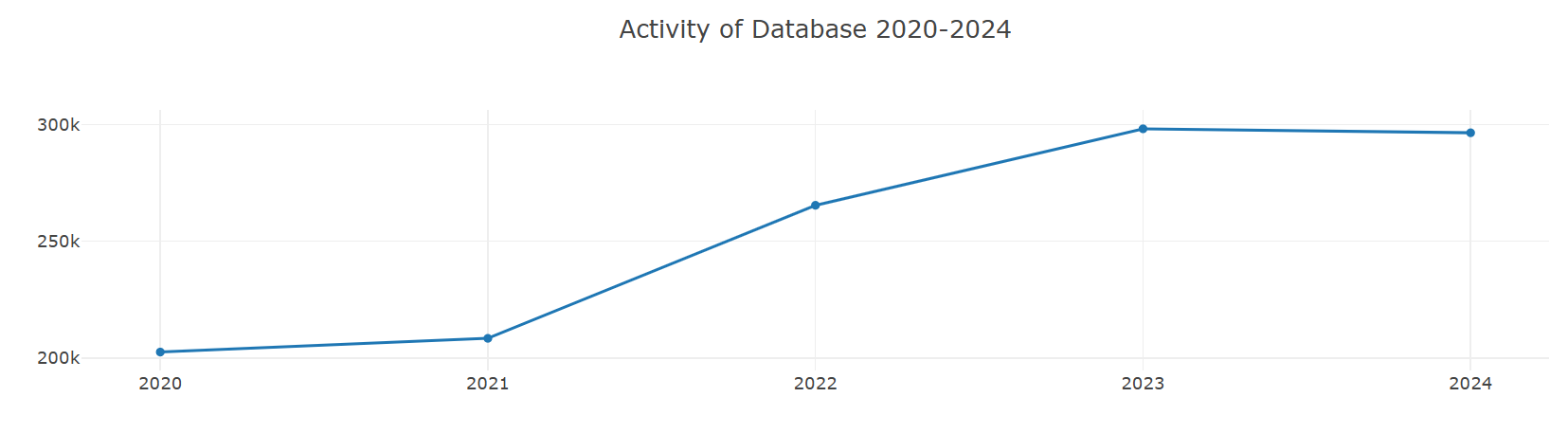

Database

ClickHouse database continues stable growth in both metrics, ElasticSearch returns to the top three, and although Doris' growth rate has slowed, its activity metric is now close to the top. It is expected that its overall ranking may surpass ClickHouse in the future. Additionally, YDB has shown significant growth, successfully entering the top ten rankings in 2024.

ClickHouse is an open-source high-performance analytical engine developed by Russia’s Yandex, based on an MPP (Massively Parallel Processing) architecture. Its vectorized execution engine claims to be 100-1000 times faster than traditional transactional databases while offering rich features and high reliability.

Apache Doris, contributed by Baidu, is an open-source MPP analytical database with a simple distributed architecture that is easy to maintain and is widely used in efficient real-time analytical scenarios.

YDB was released as an open-source project in 2020, designed to provide a high-performance distributed database that supports ACID transactions, making it especially suitable for high-concurrency and distributed application scenarios. Initially developed to address Yandex’s internal technical challenges, YDB has gained increasing attention from developers and enterprises since its open-sourcing and has become a part of the modern distributed database landscape.

Operating System

It can be observed that multiple repositories under the OpenHarmony project are ranked in the top ten. This analysis incorporates data from the Gitee platform, providing a clearer view of the various advantages of domestic operating systems. Additionally, the OpenEuler Kernel project has also demonstrated strong performance.

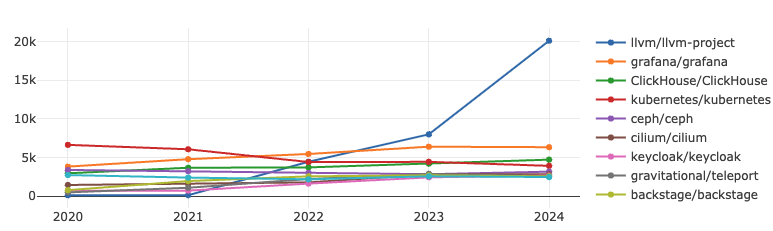

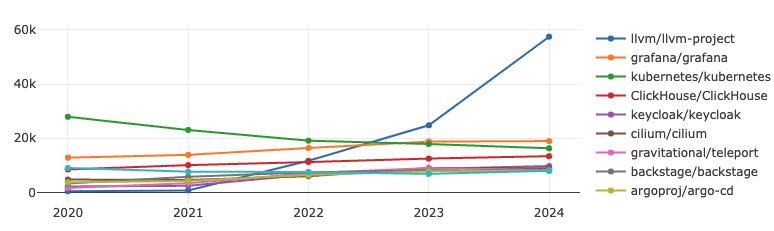

Cloud Native

LLVM-Project has a significant growth rate, ranking first in both indicators; Grafana's growth rate has slowed down, ranking second; Kubernetes's two indicators have declined significantly, and the competition for other projects is fierce.

LLVM is a modular, reusable collection of compiler frameworks and toolchain technologies. It has grown rapidly in activity in the past three years and is deeply loved by developers.

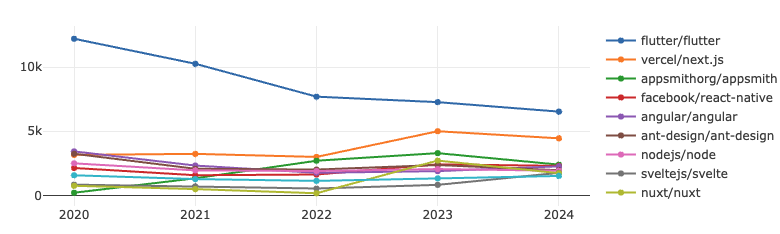

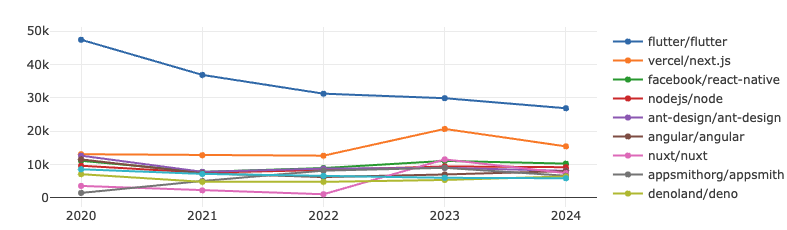

Frontend

Flutter has experienced a gradual decline in both metrics, yet still maintains a clear advantage over Next.js. Next.js, which showed significant growth since 2023, has slightly slowed down in 2024. Meanwhile, projects ranked 3rd to 10th remain highly competitive with narrow differences in rankings.

Flutter: Developed by Google, it enables both front-end and full-stack developers to build cross-platform user interfaces from a single codebase.

Next.js: An open-source framework created by Vercel, based on Node.js and Babel. Designed to complement React, it offers preview mode, fast compilation, and static export features.

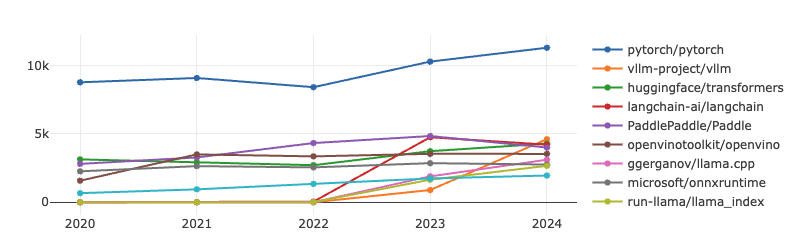

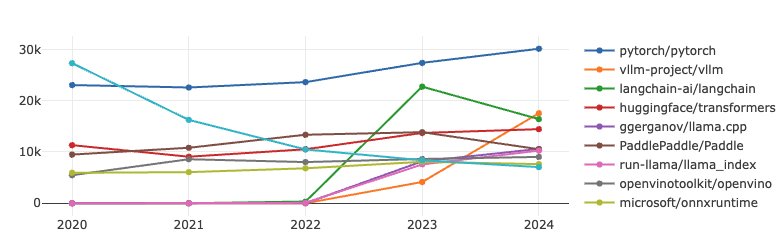

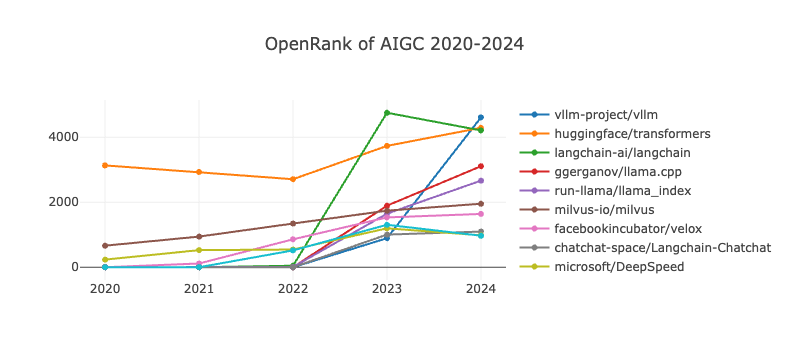

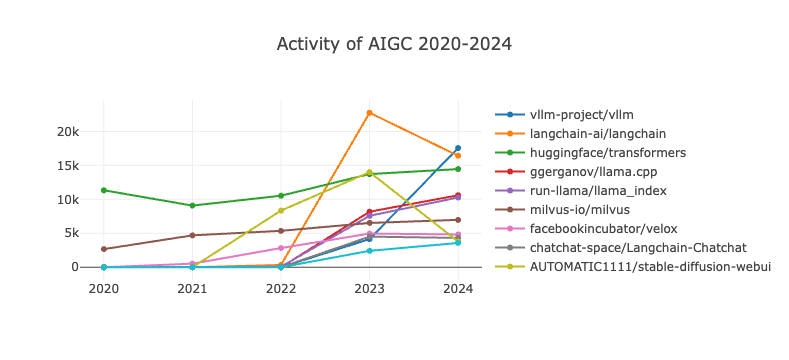

AI

Since 2020, TensorFlow has been on a steady decline, eventually dropping out of the OpenRank Top 10 by 2024. Meanwhile, PyTorch has been steadily growing, further widening the gap with other projects. It is worth mentioning that LangChain has been ranked in the top three in terms of both indicators since it was open sourced in 2022. Although its popularity has slightly declined in 2024, its influence is still significant. At the same time, vllm has grown significantly, surpassing LangChain to rank second, while the Huggingface/Transformers project has maintained a steady growth in both indicators.

LangChain is an open source project launched by Harrison Chase in October 2022 and has become one of the most popular frameworks in LLM development.

vllm-project/vllm is an efficient and scalable distributed reasoning framework designed for efficient reasoning optimization of large-scale language models (LLMs). It has seen a significant increase in activity in the past three years and is deeply loved by developers.

5.3 OpenRank of Top 10 Projects in Each Sub-category

Below is the 2024 OpenRank leaderboard for projects across various categories.

6. Open Source Project Insights

In 2024, open source projects are gradually showing a smooth evolution after the rapid development of AI large models and generative AI, as well as a new vigour after the steady development in the database field. This chapter analyses in-depth multi-dimensional data of the projects from the perspective of open source projects to gain a more comprehensive insight. Statistical analysis of the Topics of open source projects reveals the common points of interest of the global open source community in 2024.

6.1 Project Category

This section selects the top 10,000 active GitHub repositories for analysis.

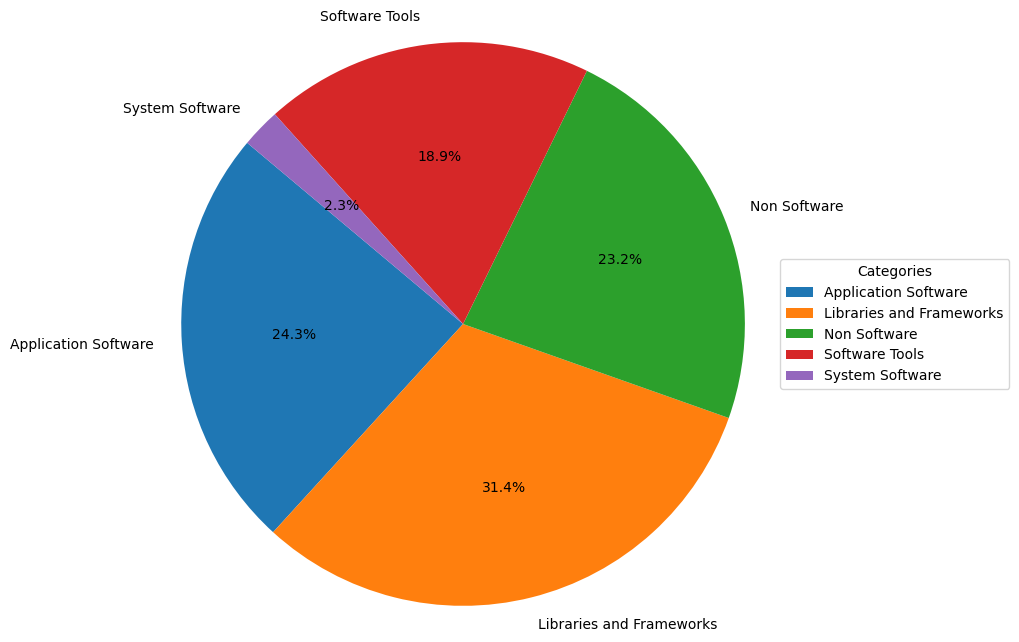

6.1.1 Proportion of Project Categories

- Application Software: Represented in blue, accounting for 24.3% of the pie chart. This indicates that application software holds a significant proportion in the analyzed dataset, reflecting its importance in the software ecosystem.

- Libraries and Frameworks: Represented in orange, making up the largest proportion at 31.4%. This highlights the widespread use of libraries and frameworks in software development, as they provide the infrastructure and tools for building applications.

- Non-Software: Represented in green, accounting for 23.2%. This category may include projects not directly related to software development, such as documentation, design resources, or other non-code assets.

- Software Tools: Represented in red, making up 18.9%. These tools may include compilers, debuggers, version control systems, etc., which are essential auxiliary tools in the software development process.

- System Software: Represented in purple, accounting for the smallest proportion at only 2.3%. This may include operating systems, drivers, etc., which form the foundation of computer system operations but have a relatively small share in this dataset.

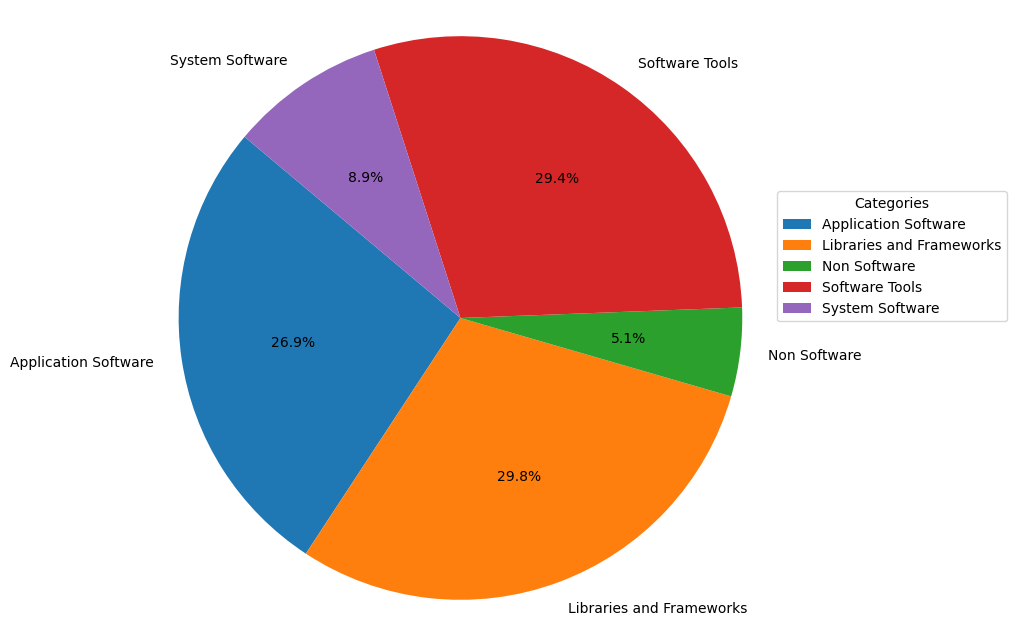

6.1.2 Proportion of OpenRank Totals by Project Categories

From the influence perspective of OpenRank in 2024, the distribution of these categories shows some notable trends:

- The most significant change is that Non-Software projects, despite having a high proportion in terms of active project count, have relatively low influence in 2024.

- System Software projects, although accounting for a small percentage of active projects, have a relatively higher influence in 2024. A similar trend is observed for Software Tools projects.

- Libraries and Frameworks and Application Software categories remain relatively unchanged, both continuing to represent a significant proportion.

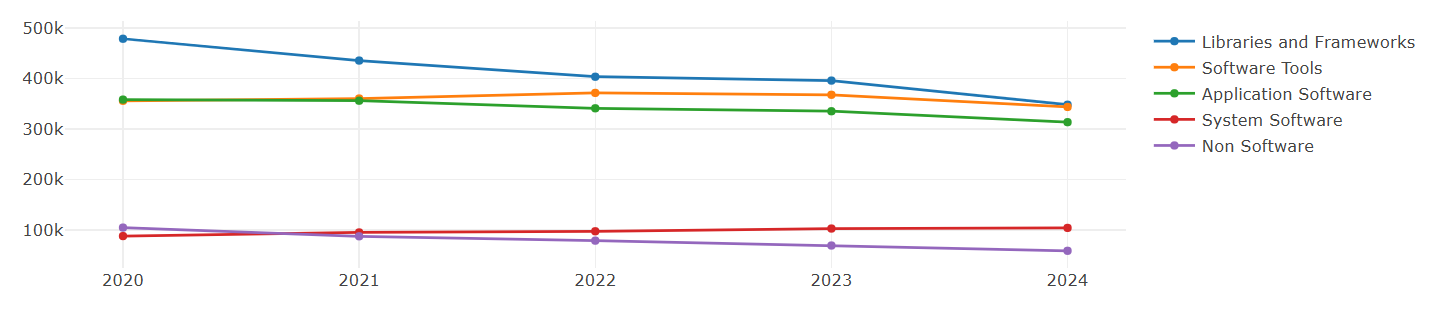

6.1.3 Trends in OpenRank Changes for Different Project Types Over the Past 5 Years

From the five-year OpenRank changes above, it is evident that the influence of System Software has been increasing year by year. The influence of Software Tools has slightly declined this year. Libraries and Frameworks and Application Software show an overall downward trend, while the influence proportion of Non Software projects has been decreasing year by year.

6.2 Project Topic Analysis

This section also selects the top 10,000 repositories ranked by GitHub OpenRank for analysis and explores the Topic tags within these repositories for deeper insights.

6.2.1 Popular Topics

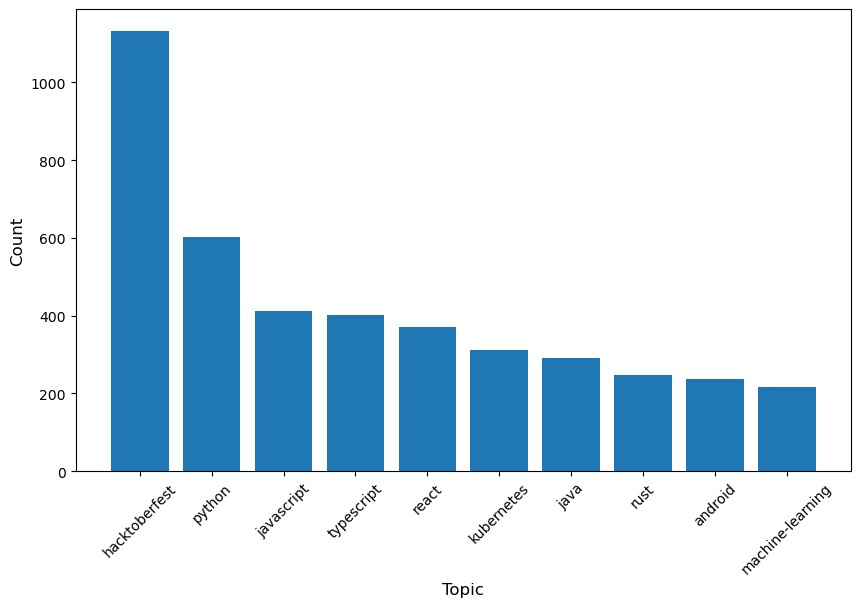

The top 10 topics cover multiple domains, reflecting the diverse interests of the open-source community. Among them, hacktoberfest — a GitHub open-source event that encourages developers to contribute code — leads significantly with 1,132 occurrences, showcasing the welcoming nature of many projects toward contributors. Topics such as Python, JavaScript, TypeScript, Java, and Rust highlight the popularity of these programming languages in open-source software development. Additionally, Kubernetes and machine-learning are among the highly recognized topics, indicating strong community interest in these areas.

6.2.2 The Total OpenRank Trend of Popular Topics' Repositories

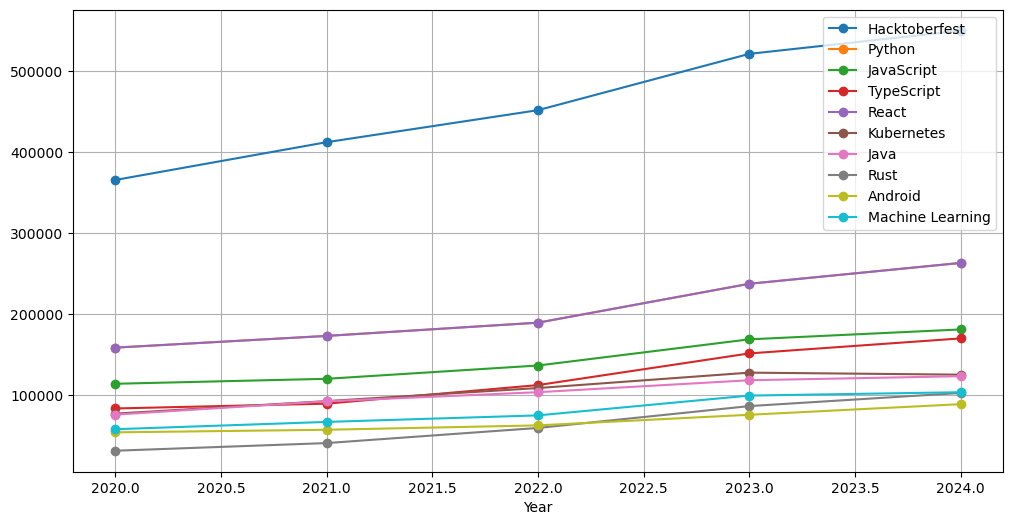

- From 2020 to 2024, Hacktoberfest's OpenRank has shown significant growth. The goal of Hacktoberfest is to encourage more people to participate in open-source projects, reflecting the enthusiasm for open-source initiatives, community engagement, and contributions.

- Python and React have steadily risen, indicating their continued popularity. JavaScript and TypeScript have shown stable growth, highlighting the ongoing demand for front-end and application development.

- The growth of Kubernetes and Machine Learning reflects advancements in the fields of cloud computing and artificial intelligence.

- Other technologies, such as Java, Rust, and Android, have experienced moderate growth, indicating stability in mature technology markets.

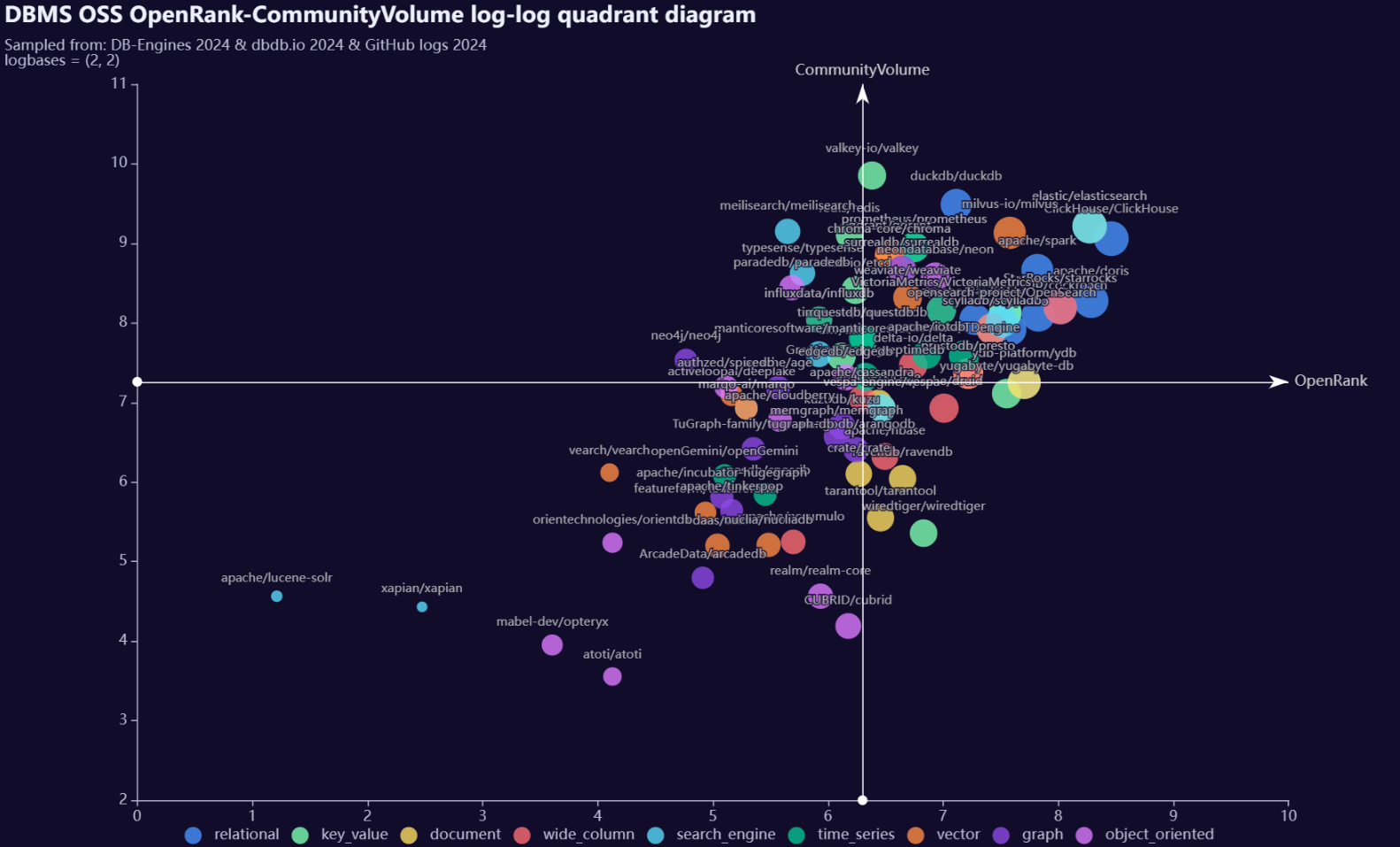

6.3 Database Project Analysis

This section analyzes the growth trend of the database field in terms of OpenRank, Activity and other indicators in the past five years, as well as the concentration trend of the top 10 projects. It also quotes the open source database information disclosed in Database of Databases and DB-Engines Ranking. The focus area is divided into 18 categories according to the database structure and purpose of the database, namely Relational, Key-Value, Document, Wide Column, Search Engine, Time Series, Vector, Graph, Object Oriented, Hierarchical, RDF, Array, Event, Spatial, Columnar, Native XML, and Content. The collaboration log data of the corresponding open source projects on GitHub are collected and analyzed.

6.3.1 Growth Trends in the Database Domain Over the Past Five Years and the Changing Trends in the Concentration of Top 10 Leading Projects

1. Analysis of Concentration Changes in Leading Projects in the Database Domain

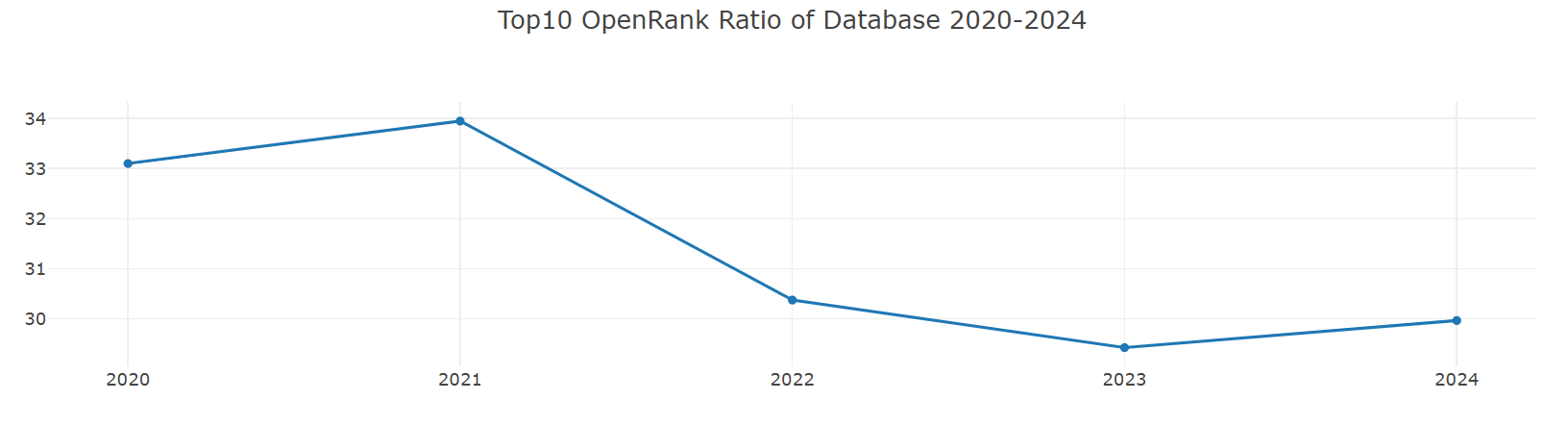

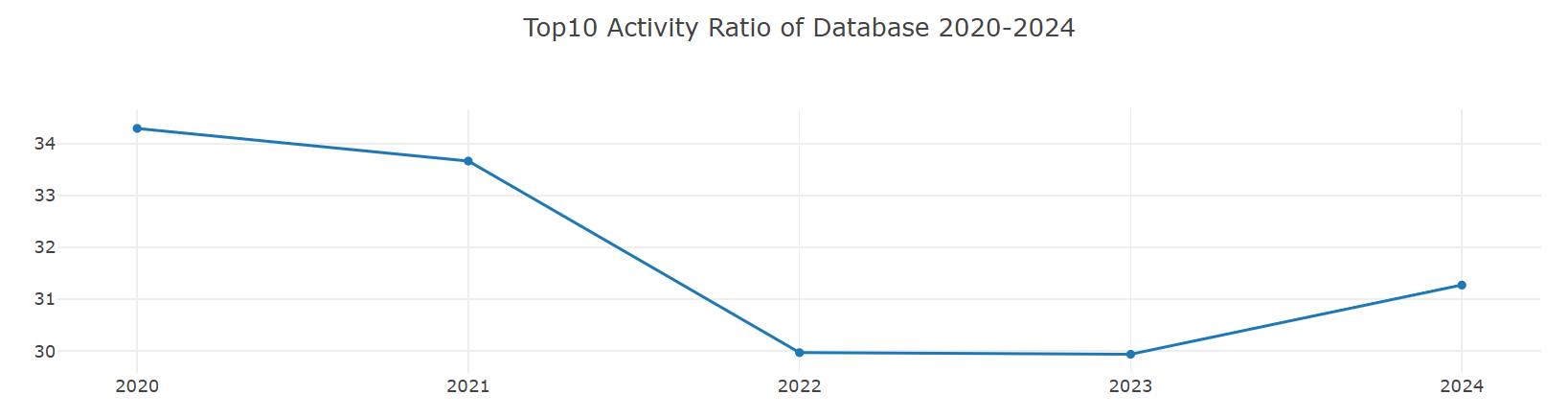

Over the past five years, the concentration of OpenRank and concentration of Activity for the Top 10 leading projects in the database domain have remained within the range of [29%, 35%]. However, in the most recent three years (2022-2024), there has been a decline of approximately 3 percentage points compared to 2020 and 2021, with a slight rebound observed in 2024. Specifically:

- The concentration of OpenRank reached its peak in 2021 at 33.9455%, and dropped to its lowest point in 2023 at 29.42372%.

- The concentration of Activity peaked at 34.29604% in 2020 and fell to its lowest point of 29.96794% in 2022.

This indicates that the concentration of top database projects shows a consistent change in both OpenRank and Activity metrics. Moreover, by comparing the peak and trough years and trends of the two metrics, it can be observed that OpenRank changes lag slightly behind Activity, with the time lag being roughly on a monthly to quarterly scale. This lag reflects the temporal logic between activity and influence in database top projects: changes in activity may occur earlier, while changes in influence gradually follow.

2. The Recovery of Concentration in 2024 and Future Trend Predictions

In 2024, all concentration metrics for leading projects showed an upward trend, and the month-on-month increase in Activity concentration was greater than that of OpenRank concentration. This phenomenon indicates that the resurgence in activity among top database projects will further drive the accumulation of influence. Based on past trends, it can be predicted that the OpenRank concentration in 2025 may accelerate its recovery, and the influence of leading projects over the entire domain will also significantly strengthen as a result.

As the influence of top projects increases, an important challenge they face is how to convert this influence into higher activity levels to further consolidate their position in the field. This dynamic relationship is particularly crucial for top projects to maintain an advantage in the increasingly competitive database sector.

3. Intensified Industry Competition and Resource Allocation Challenges

Looking at the OpenRank and Activity trends over the past five years, although the indicators for top projects have rebounded in 2024, overall growth has slowed. This suggests that competition for resources in the database sector is intensifying, and the pressure among leading projects is increasing. In this context, how to leverage existing advantages and maintain a leading position will be a critical issue for the future development of top projects.

Overall, the changes in concentration among leading projects in the database domain reveal the temporal relationship between activity and the dissemination of influence, while also reflecting the intensification of competition within the field. In the future, leading projects will need to place greater emphasis on resource integration and the conversion of influence to address domain competition and further solidify their central position in the database technology ecosystem.

6.3.2 Growth Trends in Various Subdomains of Databases Over the Past Five Years

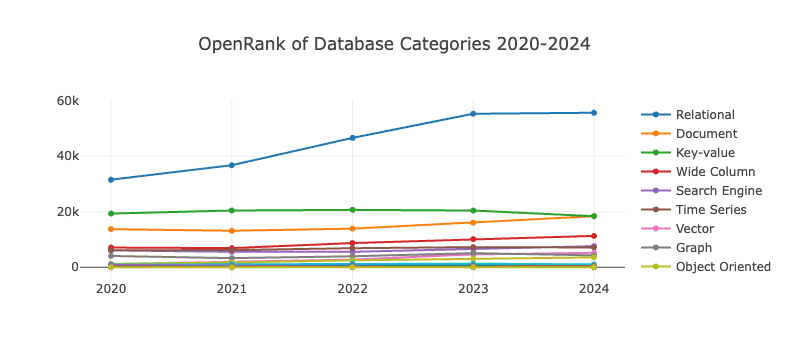

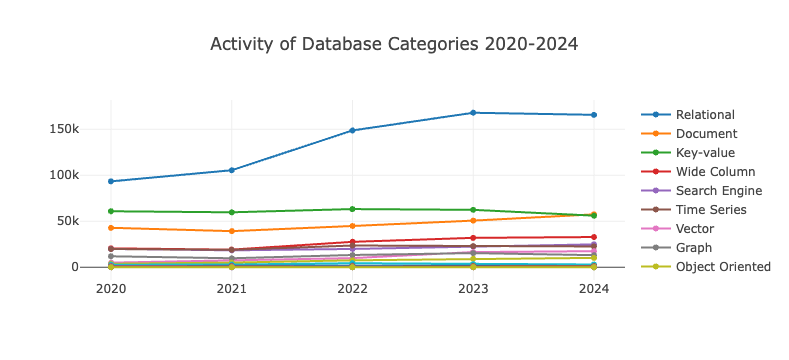

- The development of database categoriess has remained relatively stable over the past five years, with relational databases dominating the field. Although growth slowed in 2024, they still demonstrate strong dominance.

- Key-value databases saw a decline in influence and activity in 2024, with document databases catching up and even surpassing them to some extent.

- Document databases have maintained steady growth over the years. The top three database categories together account for over 70% of the total OpenRank and activity indicators in the database sector.

- As a sector that has existed since the birth of computing, databases have shown a stable development trend over the past five years. It is foreseeable that relational databases will continue to lead the industry, while various types of non-relational databases will serve as important branches in the long-term future.

6.3.3 OpenRank Rankings and Activity Rankings with Proportions in Database Subdomains

| Rank | Category | OpenRank | openrank_ratio(%) |

|---|---|---|---|

| 1 | Relational | 55440.5 | 41.334 |

| 2 | Document | 18780.1 | 14.0016 |

| 3 | Key-value | 18262 | 13.6154 |

| 4 | Wide Column | 11285.4 | 8.41389 |

| 5 | Search Engine | 7575.18 | 5.64772 |

| 6 | Time Series | 7111.37 | 5.30192 |

| 7 | Vector | 5187.47 | 3.86755 |

| 8 | Graph | 4262.87 | 3.17821 |

| 9 | Object Oriented | 3532.3 | 2.63353 |

| 10 | Hierarchical | 1036.42 | 0.772709 |

| 11 | RDF | 430.36 | 0.320857 |

| 12 | Array | 319.34 | 0.238086 |

| 13 | Event | 281.65 | 0.209986 |

| 14 | Spatial | 239.08 | 0.178248 |

| 15 | Columnar | 228.52 | 0.170374 |

| 16 | Native XML | 132.76 | 0.09898 |

| 17 | Content | 22.77 | 0.0169763 |

| Rank | Category | Activity | activity_ratio(%) |

|---|---|---|---|

| 1 | Relational | 166707 | 40.4575 |

| 2 | Document | 58567.1 | 14.2134 |

| 3 | Key-value | 57491.4 | 13.9524 |

| 4 | Wide Column | 32835.4 | 7.96871 |

| 5 | Search Engine | 24881.8 | 6.03848 |

| 6 | Time Series | 22610.5 | 5.48727 |

| 7 | Vector | 17463.4 | 4.23814 |

| 8 | Graph | 13128 | 3.18599 |

| 9 | Object Oriented | 10190.1 | 2.47299 |

| 10 | Hierarchical | 3021.28 | 0.733224 |

| 11 | RDF | 1405.37 | 0.341064 |

| 12 | Array | 1009.34 | 0.244953 |

| 13 | Spatial | 812.11 | 0.197088 |

| 14 | Event | 735.62 | 0.178525 |

| 15 | Columnar | 568.63 | 0.137999 |

| 16 | Native XML | 549.4 | 0.133332 |

| 17 | Content | 77.83 | 0.0188883 |

From the 2024 OpenRank and activity rankings across various categories in the database sector, the following observations can be made:

- Relational, Key-value, and Document databases consistently rank in the top three in both metrics. These top three categories collectively account for over 70% of the total metrics in the database sector.

- Relational databases dominate significantly, with their metrics exceeding the combined totals of the second to fifth places. They represent over 40% of the total metrics in the database sector, making it a super-large category.

- Columnar, as a newly listed database category, is experiencing rapid development momentum.

- Vector databases have also seen notable growth in 2024.

6.3.4 Open Source Quadrant Charts for Projects in Various Subdomains of the Database Field

The Open Source Quadrant Chart evaluates database categories based on three key metrics: Activity, OpenRank, and CommunityVolume. The CommunityVolume metric follows the same formula as the Attention metric in open-digger project, calculated as the weighted sum of stars and forks over a given time period: sum(1*star+2*fork).

Methodology for Quadrant Chart Construction:

- Select the top 10 projects from each database subfield based on Activity.

- Plot a

log(x)-log(y)scatter plot usinglog(openrank)-log(communityvolume), where the base of the logarithm is 2. This represents the number of half-lives required for the spatial influence (openrank) and temporal influence (communityvolume) to decay to 1. - Divide the plot into four quadrants using a vertical line corresponding to the mean of the horizontal coordinates (x-axis) of all points as the vertical axis, and a horizontal line corresponding to the mean of the vertical coordinates (y-axis) of all points as the horizontal axis.

There are 18 database categories in total. For the analysis, we selected 9 categories with an activity proportion greater than 1% in 2023: Relational, Key-value, Document, Wide Column, Search Engine, Time Series, Vector, Graph, and Object Oriented. The Open Source Quadrant Chart based on these categories is shown below:

The Search Engine category exhibits significant polarization, with projects like ElasticSearch having both high OpenRank and CommunityVolume, while others like Lucene-Solr and Xapian have relatively low values in both metrics.

Insights from the First Quadrant: Relational, Document, Search Engine, Vector, and Wide Column databases exhibit strong OpenRank influence as well as high CommunityVolume engagement. In contrast, Object-Oriented and Graph databases show weaker performance in both aspects.

From the vertical distribution in the open-source quadrant chart of the top 9 subcategories by activity, it can be observed that subcategories such as key_value and search_engine, represented by projects like valkey and meilisearch, exhibit higher CommunityVolume relative to their OpenRank, indicating a stronger community presence and faster growth expectations compared to other subcategories. The vector subcategory shows a strong linear correlation between the log-log values of CommunityVolume and OpenRank for its top 10 projects, suggesting a balanced relationship between community presence and collaborative influence.

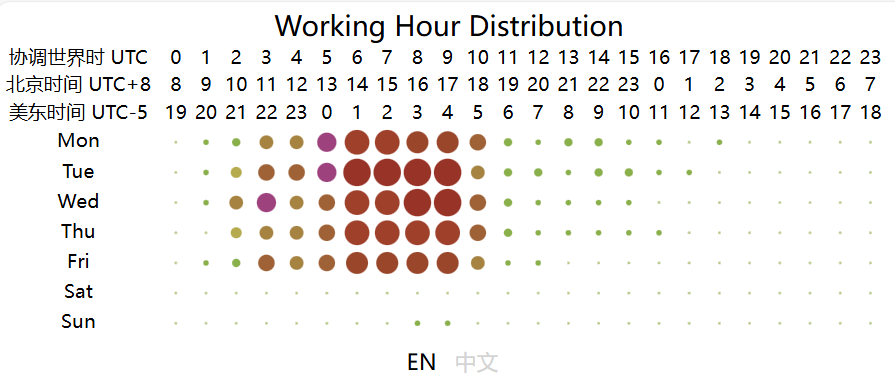

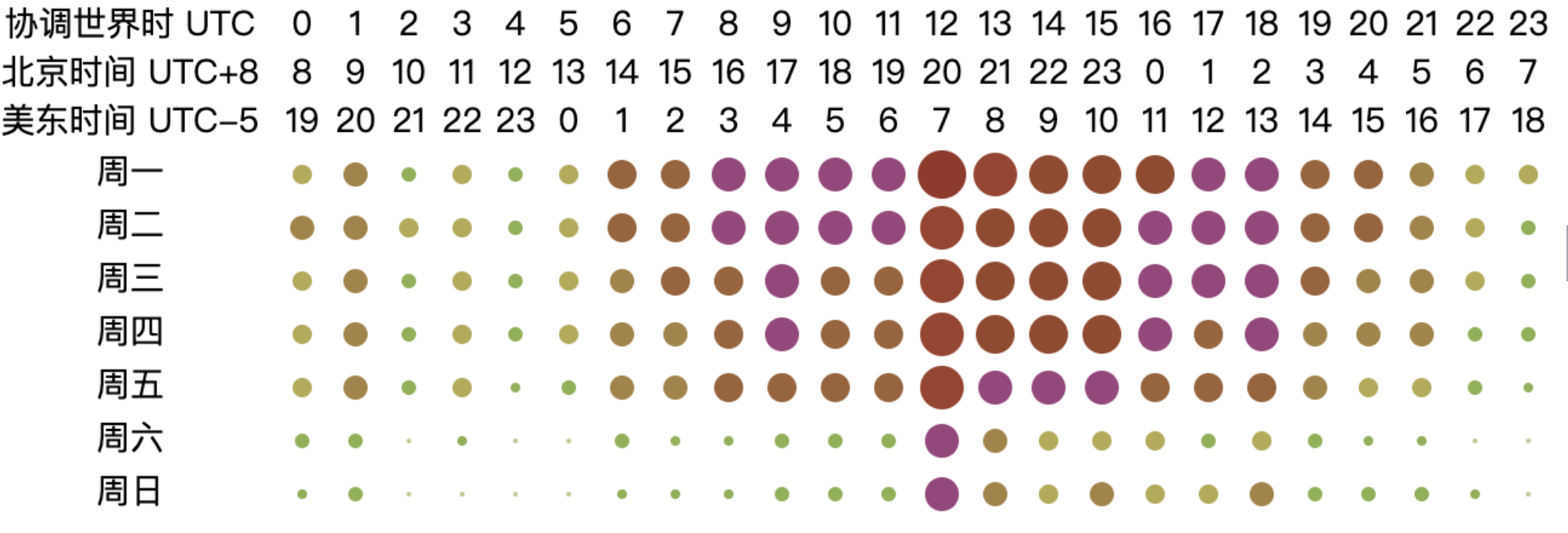

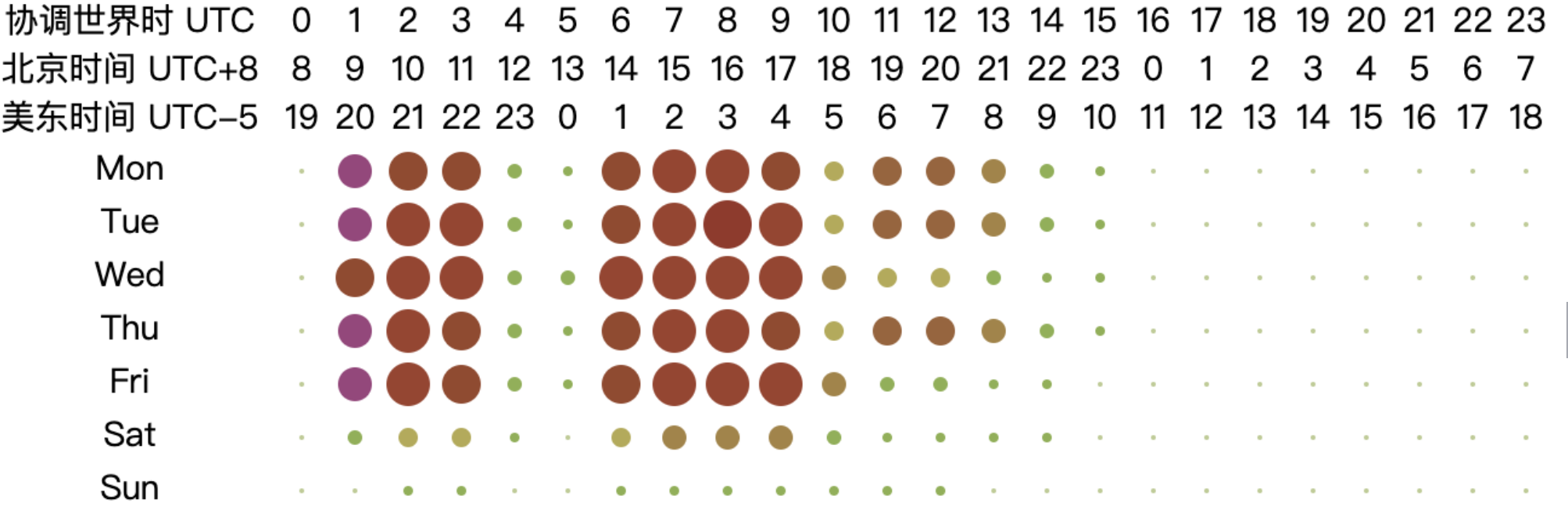

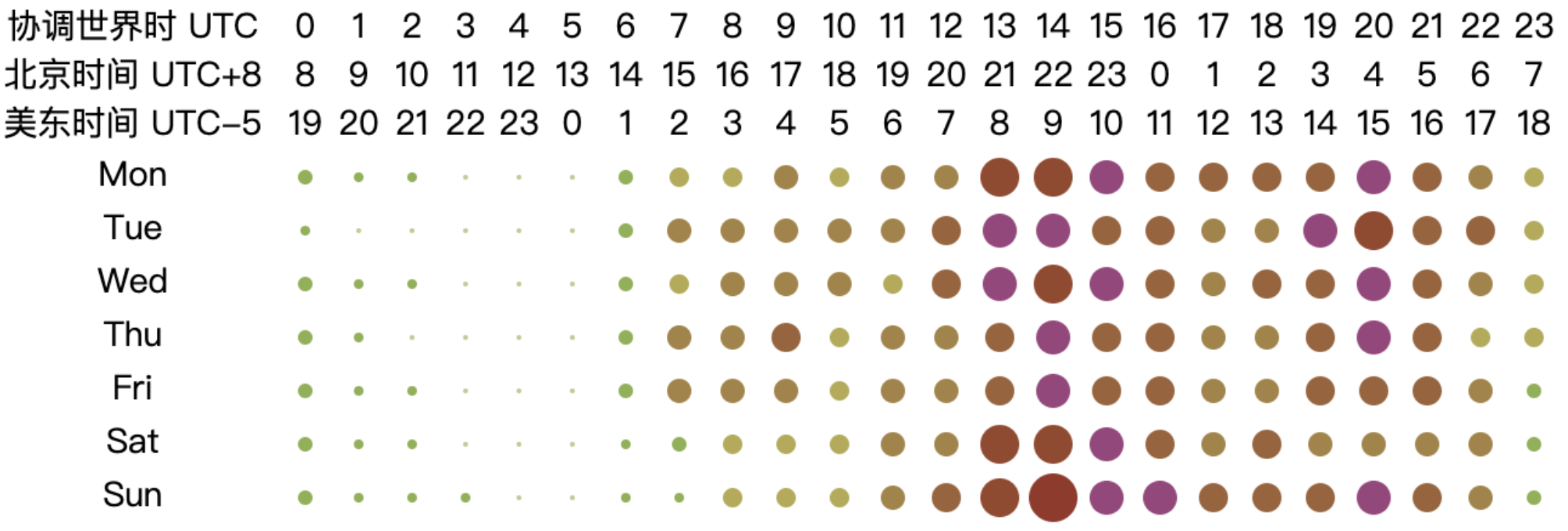

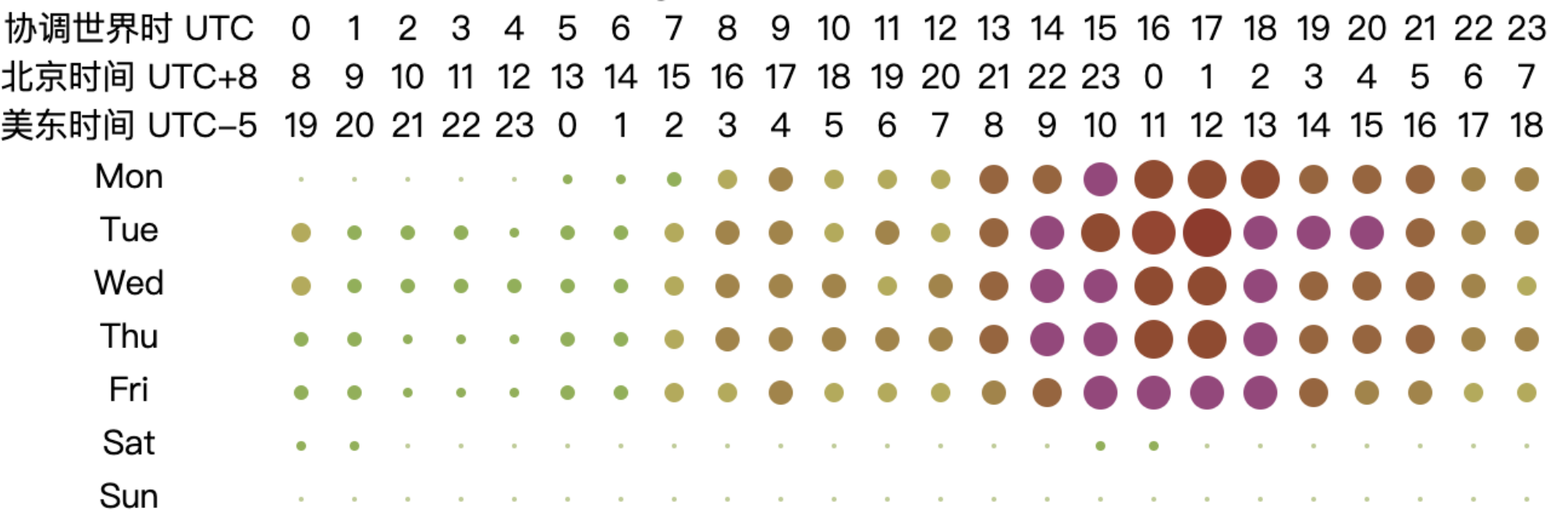

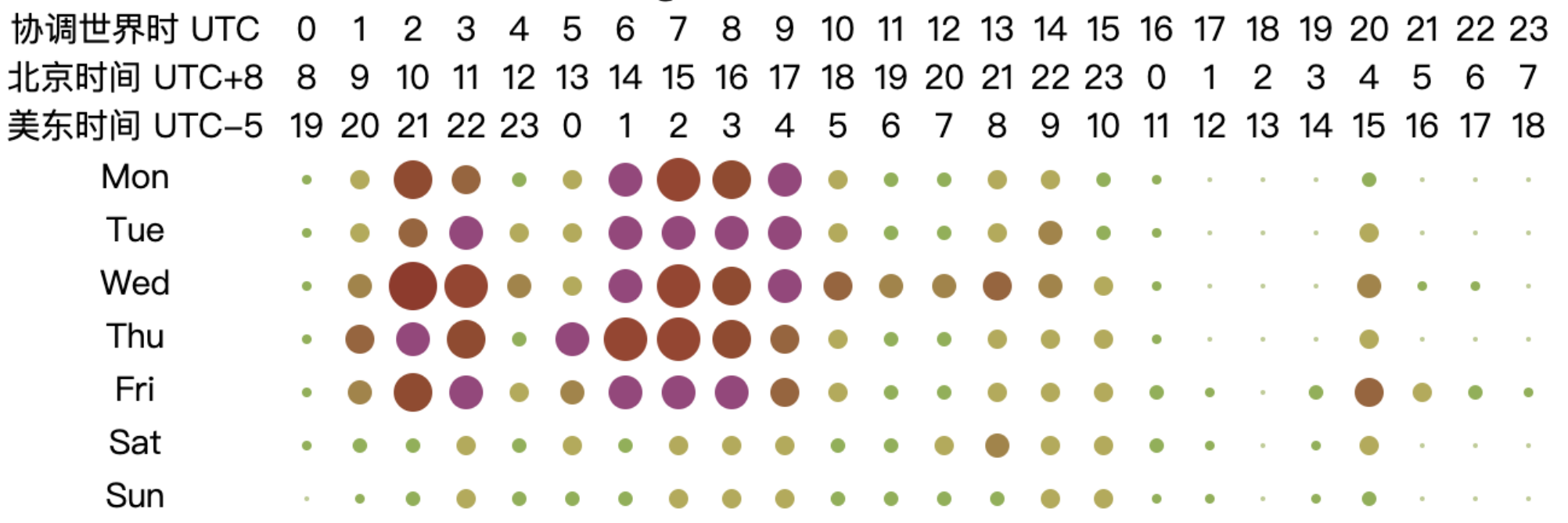

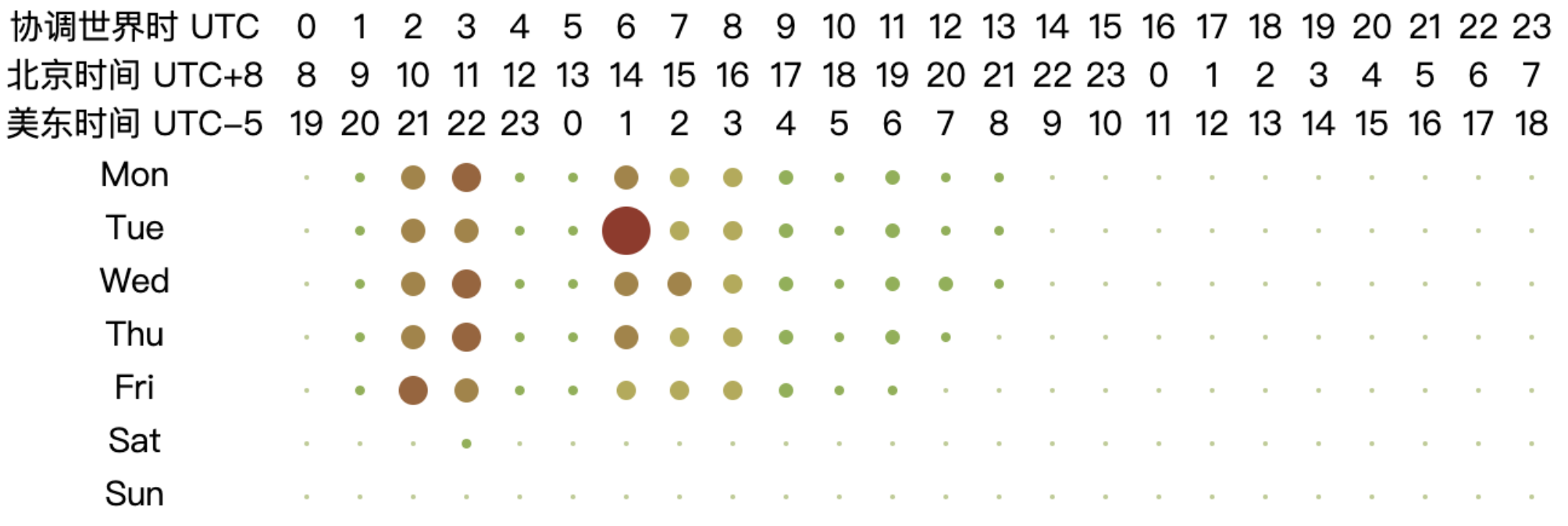

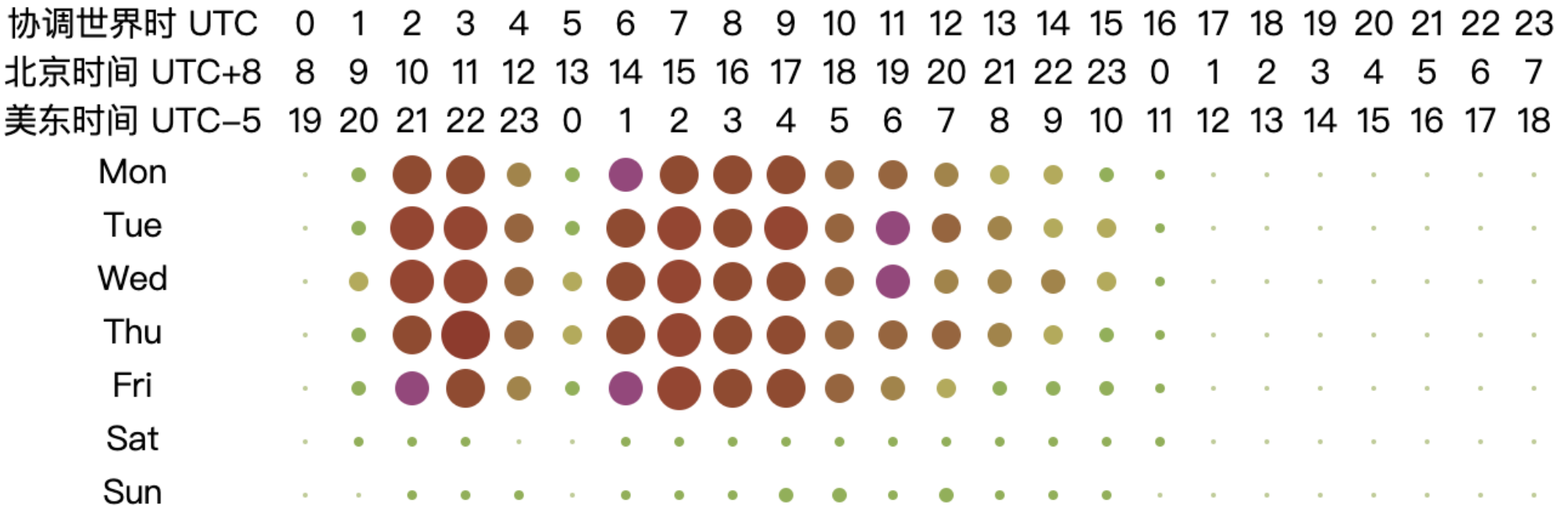

6.3.5 Analysis of Working Hours of Open Source Database Projects

From the chart, it can be observed that the peak working hours for open-source database projects are mainly concentrated between 2:00 to 10:00 UTC from Monday to Friday, while the active hours span from 1:00 to 18:00 UTC from Monday to Friday. This pattern may be related to the fact that most database-related projects have corporate backing. Based on the active UTC time, the chart shows that the active time of the day begins at 2:00 UTC, reaching a peak time at 6:00 UTC and continuing until 10:00 UTC. At 11:00 UTC, activity significantly decreases, and by 18:00 UTC, the projects are no longer active. The two distinct peak time — 2:00 to 6:00 UTC and 6:00 to 10:00 UTC — correspond to the working hours in Asia and Europe, respectively (assuming a typical work start time of 9:00 local time, aligning with UTC+7 to UTC+3 and UTC+3 to UTC-1). As the overlap in working hours gradually decreases afterward, the work peak quickly diminishes. This analysis highlights the critical role of collaboration between Asia and Europe in the open-source database domain, underscoring the importance of their contributions to the field.

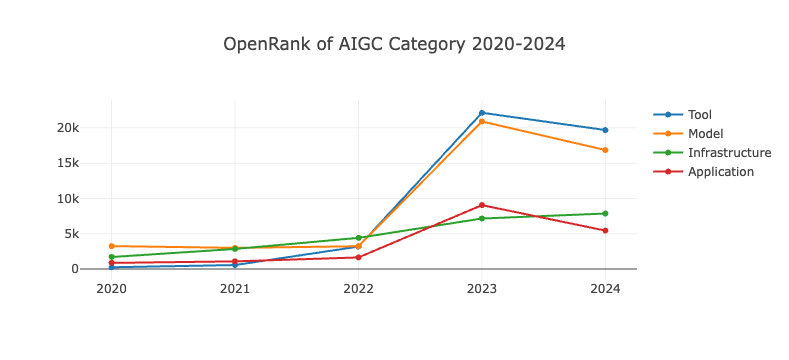

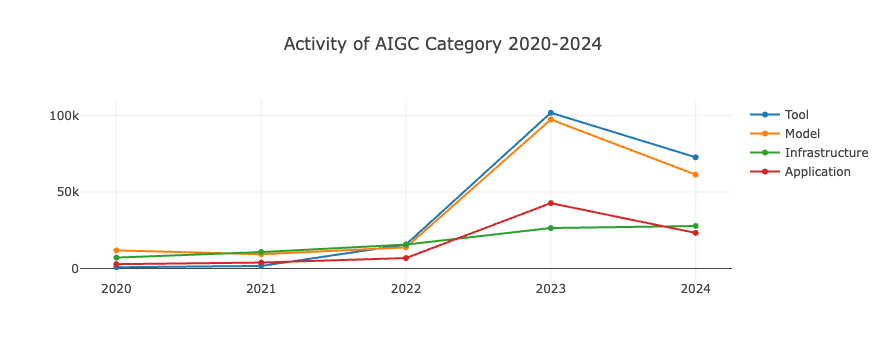

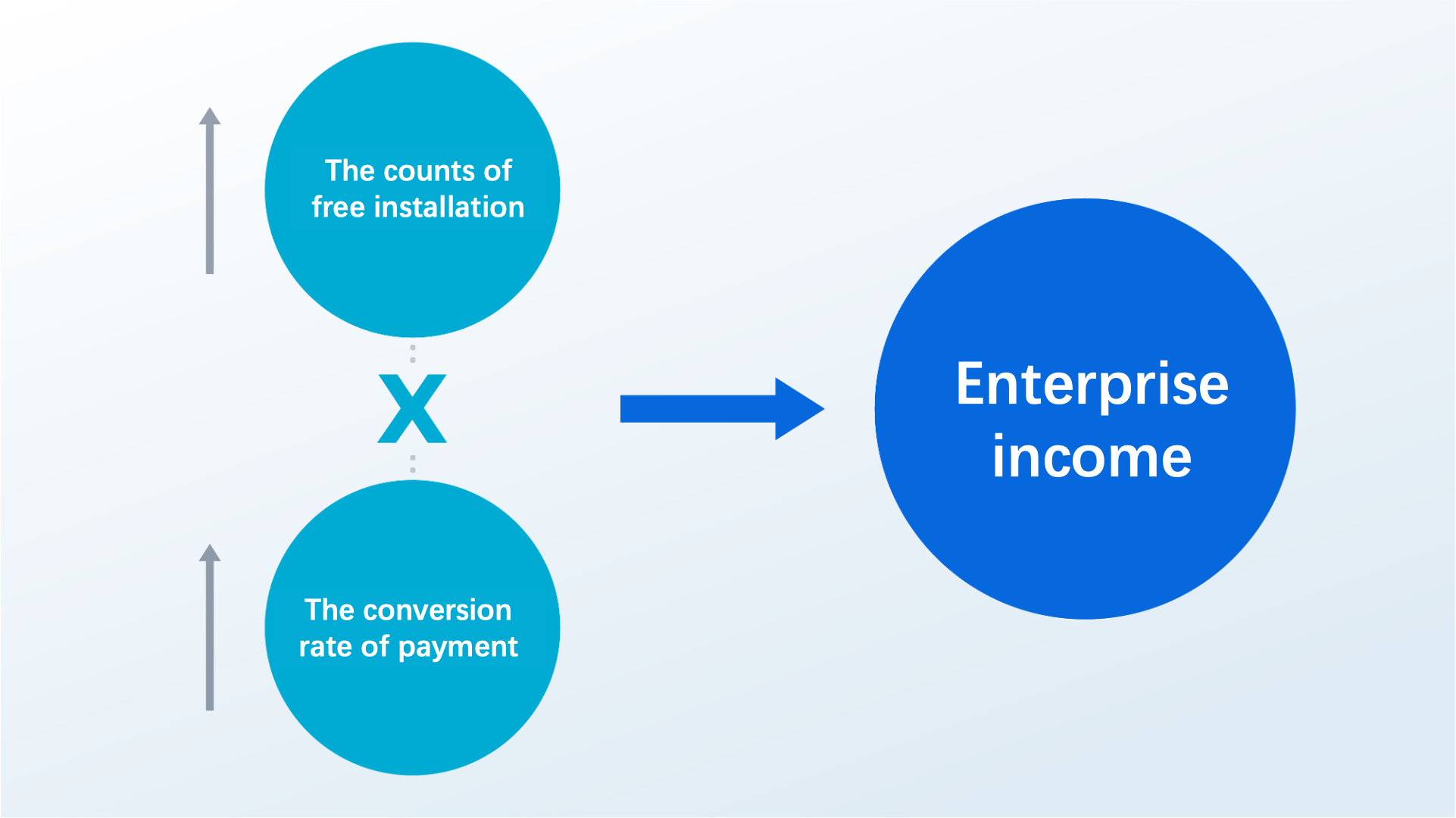

6.4 Project Analysis in the Field of Generative AI

After another year of industry development, generative AI has demonstrated new patterns of growth. Overall, the year 2024 has seen a slowdown in the development of the Generative AI (GenAI) field across the board. This is likely due to the fact that advancements in generative AI, particularly in the domain of large models, require massive investments in funding and computational resources. Following the incremental competition of 2022-2023, the AI industry in 2024 has shifted to competing in a saturated market. With the foundational frameworks of various AI products now largely complete, the focus of development has gradually transitioned from expansion to refining and evolving product forms. Additionally, as leading projects mature and find practical applications, we anticipate that the development of generative AI in 2025 will enter a new phase of equilibrium.

6.4.1 Growth Trends of GenAI Categories in the Past Five Years

- Across different category classifications, the activity and influence of various generative AI projects have declined to some extent.